Foreign direct investment (FDI) in Latin America and the Caribbean remained stable in 2023, totalling $193 billion, according to the latest World Investment Report published today.

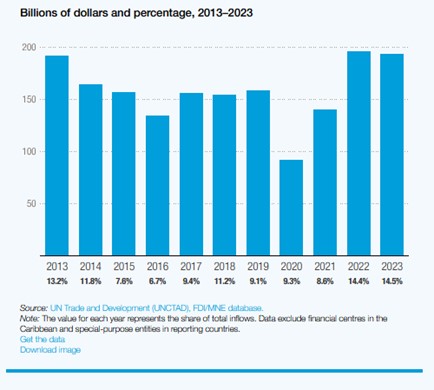

Figure 1: Latin America and the Caribbean: Foreign direct investment inflows and share in world inflows

Data visualization: https://www.datawrapper.de/_/gSbAI/

Greenfield FDI, where a company sets up new operations abroad, saw increased announcement values in the region - driven by large projects in Brazil and Chile.

With global demand growing, commodities and minerals critical for clean energy technologies were the top sector accounting for 23% of the region's greenfield project value over the past two years. The share is more than twice higher than in other developing regions.

Investment in renewable energy was also prominent, with four of the top ten announced projects (by value) relating to the production of green hydrogen or green ammonia.

In 2023, Latin American and the Caribbean attracted 19 megaprojects valued at more than $1 billion each, with 17 of them undertaken by investors outside of the region.

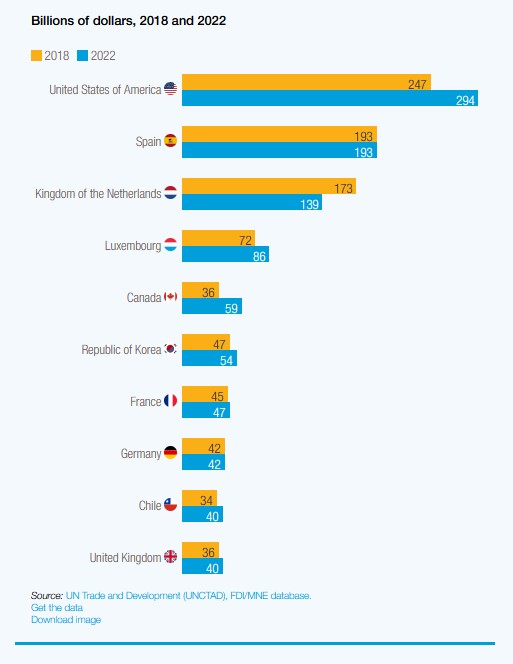

By FDI stock, the United States, Spain, the Kingdom of the Netherlands, and Luxembourg were the top investors.

Figure 2: Latin America and the Caribbean: Top 10 investor economies by foreign direct investment stock

Data visualization: https://www.datawrapper.de/_/bpn3T/

Trends by sector and industry

As in other regions, the number and value of international project finance deals - which is crucial to channelling investment into infrastructure and public services - in Latin America and the Caribbean declined by 30% and 23%, respectively.

The renewable energy sector was hit the hardest, with 40% fewer deals and $16 billion less in value compared to 2022.

Cross-border mergers and acquisitions, which typically account for a smaller share of FDI in the region, saw their overall value fall by 26% to $11 billion. The information and communications technology and chemicals sectors recorded the highest decrease in transactions, while there was an increase in the basic metals and metal products industry.

Countries posted varying results

In South America, foreign investments fell by 2% to $143 billion. Accelerated flows to Argentina, Chile, and Guyana offset lower values in Brazil and Peru, with Brazil remaining the largest FDI recipient in this subregion.

In Central America, Mexico accounted for the bulk of foreign investment, showing stable numbers despite lower project values.

In the Caribbean (excluding offshore financial centres), overall FDI was up by 6%, with most countries experiencing growth. The Dominican Republic saw a 7% increase in inflows year-on-year.

Over the past five years, foreign investments have expanded across the region's main economic groupings, with flows to the Caribbean Community tripling compared to 2018.

To access country fact sheets, please click here https://unctad.org/wir