While a second airline is valuable to provide competition for Qantas, a government bailout of Virgin is not desirable.

Virgin Australia has entered voluntary administration and has appointed Deloitte as administrators. Despite Virgin Australia (VA) and its major shareholders asking for a government bailout, the federal government has repeatedly rebuffed these requests. The Queensland government offered $200 million for VA to keep its headquarters in Brisbane. Unsurprisingly, no other state government is likely to match Queensland's offer.

This begs the question: should Virgin Australia be bailed out?

To answer this, we need to observe a rigorous set of criteria by which to judge whether a bailout is justified. Taxpayers can only fork out so much money and the government must decide how to ration it.

A government bailout isn't economically viable because VA doesn't satisfy the following conditions:

Exogenous shock

There must be an exogenous shock to the company's finances to validate a government bailout. This should be due to something that is beyond the company's control - just like what happened to financial institutions during the Great Recession. In theory, companies should maintain cash stockpiles in the event of a once-in-a-century pandemic. But many companies have not. In this instance, COVID-19 is beyond VA's control and the company does not have enough cash reserves to survive the pandemic.

Profits do matter

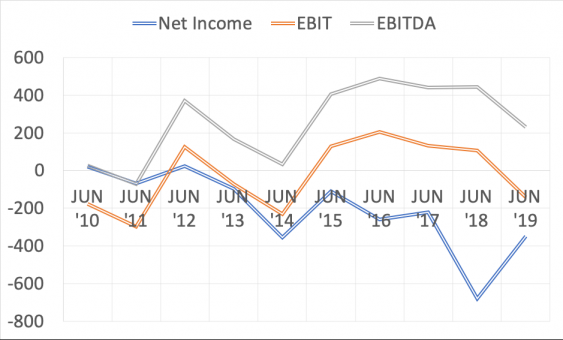

The second condition is that the company must have been well-run. If a company is bleeding money into oblivion, taxpayers should not keep it on life support. It is not the government's role to play turnaround specialist and pick companies to attempt to reform and/or subsidise unproductive operations. VA dismally fails this criterion as the company has not made a profit since 2012. Net income has been negative for eight years. Income before tax has been underwhelming. In contrast, Qantas has been profitable for at least five years.

Figure 1: Virgin Australia's net income, EBIT and EBITDA over ten years.

The company is not of systemic importance

Unfortunately, many companies will fall victim to COVID-19. The government has done an admirable job in supporting companies with the limited funds any government can muster. But funds are limited, and the government cannot subsidise all companies. Thus, when choosing which companies to save, the government would devote its attention to systemically important companies that have contributed to the economy.

VA does employ many people across different areas. However, so do many other restaurants, hotels, universities that employ thousands of people. And, the government has not bailed out individual restaurants or provided cash to universities. Therefore, merely employing people cannot be the sole condition on which to base a bailout. Hopefully, many of these jobs will survive VA's restructure.

What do taxpayers get out of it?

Taxpayers should get something out of any bailout. Otherwise, it creates a perverse incentive for shareholders to simply shift risk to the government on the assumption they will be bailed out. This creates a significant problem.

First, the government would not want to lend money to VA as it is not a viable investment - the company has not been profitable for over five years. It therefore has little prospect of repaying that debt. The government also cannot impose collateral requirements on VA because it has few assets that would make good collateral. Its aircraft are mainly on lease. And, while it could sell aircraft and airport slots, these are not liquid. The government cannot force shareholders to provide collateral either, because 90 per cent of the shares are owned by overseas corporations and enforcing collateral against them would be a fraught prospect.

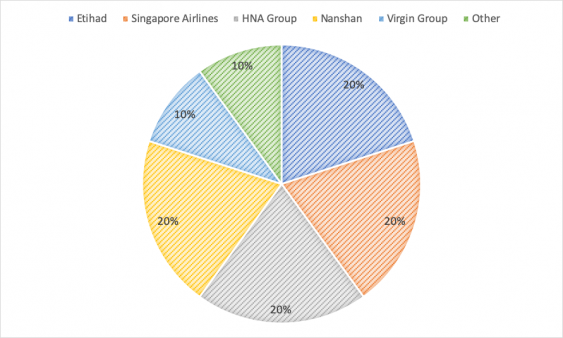

Second, equity is problematic. Governments should not nationalise corporations. But a government could hold equity and place it into a sovereign wealth fund - potentially for sale later. In VA's case, the shareholding base is highly concentrated. Four shareholders own 20 per cent of the shares each, and one shareholder owns 10 per cent. This could induce principal-principal conflicts where the government runs the risk of being trampled over. To prevent this issue, the government would need 51 per cent of the equity. While it is not certain, it appears unlikely that the shareholders would accept this amount of dilution rather than go into administration.

Figure 2: Virgin Australia's cap table

Should shareholders bail out VA?

A necessary condition should be that shareholders cannot be expected to make the bailout. In a normal listed company with dispersed shareholdings, this is often the case. Companies can show good faith by attempting to raise equity. However, as VA is 90 per cent owned by overseas corporations, Treasurer Josh Frydenberg has highlighted that it would be disingenuous for the government to effectively bailout those organisations.

For a bailout to be justified, the shareholders should - at the very least - demonstrate that they cannot reasonably provide the funding in question. It is quite possible that only some shareholders have capital. In which case, those shareholders could justifiably seek more shares in return for propping up the company.

Is it the best use of money and what precedent does it set?

The government must also consider whether the bailout is the best use of taxpayers' money. A bailout is undesirable if the government could have spent the bailout money better and/or it would set a precedent for other bailouts.

The government has competing priorities. It must consider whether other companies' request for a bailout is more justified - especially if those companies or organisations have generated significant value for the country. For example, if the government were to spend $1.4 billion on a company that has been making consecutive losses, it would raise the question of whether it would be better to invest that money in a successful industry that has generated significant social returns on capital and is a major exporter instead - such as the tertiary education sector.

Is bailing out VA unfair to other companies?

Qantas has argued that if VA received the requested $1.4 billion bailout, then Qantas should receive $4.2 billion. There is some basis for this. Providing funding to failing companies creates inherent perverse incentives. It penalises Qantas for exercising discipline to remain profitable. It does this implicitly by significantly altering the competitive position of Qantas vis-à-vis VA and would render Qantas' relative discipline irrelevant.

Proponents of a bailout make at least two arguments: first, Australia needs a second airline; second, VA is a major employer and its collapse will destroy many jobs and harm many suppliers. Both arguments are true to an extent.

Competition brings along many benefits to consumers - it encourages suppliers to maintain or improve the quality of their products or services at competitive prices. It helps shareholders by disciplining managers and punishing complacency. On these grounds, a second airline is desirable in Australia's aviation sector. But it is not essential. Regulation is a blunt instrument to deal with near-monopoly power and in this case, the ACCC has powers to punish the misuse of market powers.

What can be done to save VA?

After assessing the above conditions, VA is not a good candidate for a bailout. It has been persistently unprofitable and has had negative free cash flow in all but one of the past 10 years. The bailout would also effectively mean that the Australian government will be supporting five major overseas corporations and will be allocating scarce resources to a company that might be in need of more capital in the near future.

In essence, the only way a bailout could work is if the government treated it as a turnaround project - much like a leveraged buyout - in an attempt to reverse VA's financial affairs.

Mark Humphery-Jenner is an Associate Professor and AGSM Scholar at the School of Banking & Finance, UNSW Business School.