Continued global momentum delivered all-time high revenue and 15% Underlying EPS growth in FY24

BRUSSELS--BUSINESS WIRE--

Anheuser-Busch InBev (Brussel:ABI) (BMV:ANB) (JSE:ANH) (NYSE:BUD):

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250225267454/en/

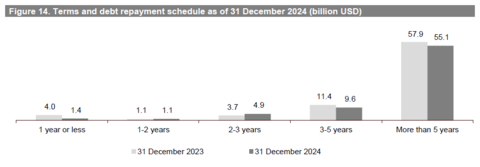

Figure 14. Terms and debt repayment schedule as of 31 December 2024 (billion USD) (Graphic: Business Wire)

Regulated and inside information1

"Beer is a passion point for consumers and a vibrant category globally. The strength of our 2024 results is a testament to the consistent execution of our strategy and the hard work and dedication of our people. We delivered EBITDA growth at the top-end of our outlook and a step change in our free cash flow generation. We are investing for the long-term and are confident in our ability to lead and grow the category." - Michel Doukeris, CEO, AB InBev

Total Revenue 4Q +3.4% | FY +2.7% Revenue increased by 3.4% in 4Q24 with revenue per hl growth of 5.5% and by 2.7% in FY24 with revenue per hl growth of 4.3%. Reported revenue increased by 2.5% in 4Q24 and by 0.7% in FY24 to 14 841 million USD and 59 768 million USD respectively, impacted by unfavorable currency translation. Total Volume 4Q -1.9% | FY -1.4% In 4Q24, total volumes declined by 1.9%, with own beer volumes down by 2.1% and non-beer volumes down by 1.1%. In FY24, total volumes declined by 1.4% with own beer volumes down by 2.0% and non-beer volumes up by 1.5%. Normalized EBITDA 4Q +10.1% | FY +8.2% In 4Q24, normalized EBITDA increased by 10.1% to 5 245 million USD with a normalized EBITDA margin expansion of 216bps to 35.3%. In FY24, normalized EBITDA increased by 8.2% to 20 958 million USD with a normalized EBITDA margin expansion of 179bps to 35.1%. |

Underlying Profit (million USD) 4Q 1 770 | FY 7 061 Underlying Profit (Profit attributable to equity holders of AB InBev excluding non-underlying items and the impact of hyperinflation) was 1 770 million USD in 4Q24 compared to 1 661 million USD in 4Q23 and was 7 061 million USD in FY24 compared to 6 158 million USD in FY23. Reported profit attributable to equity holders of AB InBev was 1 220 million USD in 4Q24 and 5 855 million USD in FY24 versus 1 891 million USD in 4Q23 and 5 341 million USD in FY23, negatively impacted by non-underlying items. Underlying EPS (USD) 4Q 0.88 | FY 3.53 Underlying EPS was 0.88 USD in 4Q24, an increase from 0.82 USD in 4Q23 and was 3.53 USD in FY24, an increase from 3.05 USD in FY23. Net Debt to EBITDA 2.89x Net debt to normalized EBITDA ratio was 2.89x at 31 December 2024, compared to 3.38x at 31 December 2023. |

Capital Allocation Dividend 1.00 EUR The AB InBev Board proposes a full year 2024 dividend of 1.00 EUR per share, subject to shareholder approval at the AGM on 30 April 2025. A timeline showing the ex-dividend, record and payment dates can be found on page 16. Out of the two billion USD share buyback program announced on 31 October 2024, approximately 750 million USD was completed as of 21 February 2025. |

|

The 2024 Full Year Financial Report is available on our website at www.ab-inbev.com

1The enclosed information constitutes inside information as defined in Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse, and regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market. For important disclaimers and notes on the basis of preparation, please refer to page 17. |

Management comments

Consistent execution of our strategy

We made consistent progress across the 3 pillars of our strategy in 2024 and delivered another year of reliable compounding growth. The combination of our megabrands, mega platforms and our focus on innovation to meet consumer trends with both balanced choices and superior value is a winning proposition. While our overall volume performance this year was constrained by the soft consumer environments in China and Argentina, the global beer category remains vibrant with our volumes growing in the majority of our markets and by 0.9% overall when excluding these two countries.

We advanced our digital transformation, with 75% of our revenue now transacted through B2B digital platforms. The momentum of BEES marketplace accelerated, with the gross merchandise value (GMV) growing by 57% versus FY23 to reach 2.5 billion USD.

As we continue to optimize our business we delivered a high-quality set of financial results. USD revenues increased to an all-time high, EBITDA grew at the top-end of our outlook, Underlying EPS increased by 15.4% in USD and free cash flow generation increased by 2.5 billion USD. We enhanced the efficiency of our resource allocation and delivered an important milestone in our capital allocation journey with our net debt to EBITDA ratio reaching 2.89x as of 31 December 2024, below 3x for the first time since 2015.

The beer category is large and profitable, continues to gain share of alcohol globally and our footprint has structural tailwinds for long-term volume growth with favorable demographics, economic growth and opportunities to increase category participation.

Continued global momentum

Our top-line increased by 2.7% in FY24, with revenue growth in 75% of our markets. Revenue per hl increased by 4.3%, accelerating sequentially through the year, as we continued to make disciplined revenue management choices and drive premiumization, while investing in our brands to provide value to our consumers. Excluding China and Argentina our volumes globally grew by 0.9% but overall performance was significantly constrained by these two countries, resulting in a total volume decline of 1.4%.

EBITDA increased by 8.2% with production cost efficiencies and disciplined overhead management driving EBITDA margin expansion of 179bps. Underlying EPS was 3.53 USD, a 15.4% increase versus FY23, driven primarily by USD EBIT growth and optimization of our net finance costs.

Progressing our strategic priorities

- Lead and grow the category In FY24, we invested 7.2 billion USD in sales and marketing behind our megabrands, mega platforms and brand building capabilities to lead the long-term growth of the global beer category. The beer and Beyond Beer category continued to gain share of total alcohol globally with further growth projected over the next 5 years, according to IWSR. We estimate that we gained or maintained share in two thirds of our markets, with our megabrands, which represent 57% of our revenue, leading our growth with a 4.6% revenue increase. Our unparalleled portfolio holds 20 iconic billion-dollar revenue beer brands and 8 out of the top 10 most valuable beer brands in the world, with Corona and Budweiser the #1 and #2, according to Kantar BrandZ. We successfully activated our portfolio in some of the largest consumer moments such as the Olympics, NBA, Copa America, Lollapalooza, Wimbledon and the Super Bowl, driving an increase in our overall portfolio brand power. Our marketing effectiveness and creativity was recognized by again being named the most effective marketer in the world by both Effies and the World Advertising Research Center and being the most awarded beverage company at the 2024 Cannes Lions International Festival of Creativity.

- Category Participation: Investments in our megabrands and innovations drove an estimated increase in the percentage of beer consumers purchasing our portfolio globally of approximately 90 basis points. Participation increases were driven by improvements with all consumer groups in the US and with new legal drinking age consumers (LDA-24 years old) in 65% of our markets.

- Core Superiority:Our mainstream beer portfolio represented approximately 50% of our FY24 revenue and delivered low-single digit revenue growth, with increases in 60% of our markets, including high-single digit growth in South Africa and Colombia.

- Occasions Development: We continue to focus on innovating to expand occasions and meet consumer trends. Our portfolio includes options for consumers seeking balanced choices such as low carb, organic, sugar free, gluten free and no-alcohol brands. In no-alcohol beer, our portfolio delivered a low-twenties revenue increase in FY24 and is estimated to have gained share globally, led by Corona Cero which delivered triple-digit volume growth. We are the leader in no-alcohol beer in many of our key markets, including the US, Brazil and Belgium, and see significant headroom for future growth.

- Premiumization:We are the global leader in premium and super premium beer. Our above core beer portfolio represented 35% of our FY24 revenue and grew revenue by low-single digits. Corona led our performance, increasing revenue by low-teens outside of Mexico with double-digit volume growth in more than 30 markets. In the US, Michelob Ultra led our growth and was the #1 volume share gaining brand in the industry in 2H24. In Brazil, Budweiser was the #1 volume share gaining brand in the industry with volumes increasing by nearly 50%.

- Beyond Beer:In FY24,our Beyond Beer business represented 2% of our revenue and grew revenue by low-single digits led by double-digit growth in key brands such as Cutwater, Nütrl and Brutal Fruit.

- Digitize and monetize our ecosystem We continued to progress our digital transformation by expanding the availability and usage of BEES, accelerating the growth of BEES Marketplace and scaling our digital DTC megabrands.

- Digitizing our relationships with our more than six million customers globally: As of 31 December 2024, BEES was live in 28 markets, with 75% of our revenues captured through B2B digital platforms. In FY24, BEES captured 49 billion USD in GMV, growth of 19% versus FY23.

- Monetizing our route-to-market: BEES Marketplace generated 36 million orders and captured 2.5 billion USD in GMV from sales of third-party products this year, growth of 31% and 57% versus FY23 respectively.

- Leading the way in DTC solutions: Our omnichannel DTC ecosystem of digital and physical products generated revenue of 1.4 billion USD this year. Our DTC megabrands, Zé Delivery, TaDa Delivery and PerfectDraft are available in 21 markets, generated over 76 million e-commerce orders and delivered 560 million USD of revenue in FY24, growth of 9% versus FY23.

- Optimize our business

- Maximizing value creation: We enhanced our resource allocation efficiency this year, optimizing our net capex from 4.5 billion USD in FY23 to 3.7 billion USD in FY24 while continuing to invest in our facilities, digital transformation and growth priorities. Increased capex efficiency, USD EBITDA growth and the optimization of our net working capital and finance costs drove strong growth in our free cash flow generation, reaching 11.3 billion USD in FY24, a 2.5 billion USD increase versus FY23. We continued to proactively manage our debt portfolio in FY24 with bond repurchases of 9 billion USD and issuances of 5 billion USD strengthening our debt maturity profile while maintaining our average coupon. We reduced net debt by 6.9 billion USD to reach 60.6 billion USD, resulting in a net debt to EBITDA ratio of 2.89x as of 31 December 2024, below 3.0x for the first time since 2015. The AB InBev Board of Directors has proposed a full year dividend of 1.00 EUR per share, a 22% increase versus FY23, with the ambition to continue a progressive dividend over time. In addition, as of 21 February 2025 we have completed 750 million USD of our 2 billion USD share buyback program announced on 31 October 2024.

- Advancing our sustainability priorities: In FY24, we contracted the equivalent of 100% of our global purchased electricity volume from renewable sources with 81.2% operational. Since 2017, we reduced our absolute GHG emissions across Scopes 1 and 2 by 42% and GHG emissions intensity across Scopes 1, 2 and 3 by 29.5%. In sustainable agriculture, 100% of our direct farmers met our criteria for skilled, connected and financially empowered. In water stewardship, 89% of sites in scope for our 2025 goal are already seeing improvement in watershed health. Our water use efficiency ratio improved to 2.47 hl per hl, an improvement of 20% versus a 2017 baseline. For circular packaging, 89.8% of our products were in packaging that was returnable or made from majority recycled content. We have supported responsible drinking for decades and have invested over 1 billion USD in responsibility programs across the globe since 2016. We continue to promote beer as the beverage for moderation and provide choices for consumers, including no alcohol and low alcohol beers. Please refer to our Sustainability Statements in our 2024 annual report here for