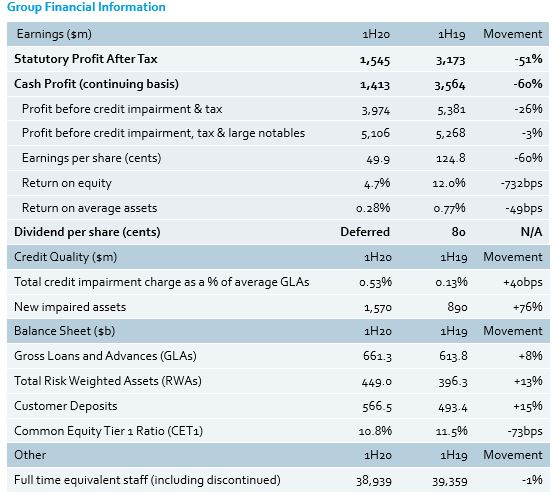

ANZ today announced a Statutory Profit after tax for the Half Year ended 31 March 2020 of $1.55 billion, down 51% on the prior comparable period. This decline was driven primarily by credit impairment charges of $1.674 billion that included increased credit reserves for COVID-19 impacts of $1.031 billion. The valuation of investments in Asian associates was impaired by $815 million, largely due to the impact COVID-19 is having in those markets.

Cash Profit for its continuing operations was $1.41 billion, down 60% from the prior comparable period. Cash Earnings per Share decreased 60% to 50 cents.

Entering the crisis with a strong capital position, ANZ's Common Equity Tier 1 Capital Ratio is 10.8% at 31 March 2020. Return on Equity decreased to 4.7%.

ANZ's Board also determined it will defer its decision on the 2020 Interim Dividend until there is greater clarity regarding the economic impact of COVID-19.

All financials are on a Cash Profit Continuing Basis with growth rates compared to the Half Year ended 31 March 2019 unless otherwise stated.

CEO COMMENTARY

ANZ Chief Executive Officer Shayne Elliott said: "Firstly, our thoughts are with those who have been directly impacted by COVID-19, particularly those who have suffered from the health impacts, as well as the millions of people who are now facing financial uncertainty.

"This is a terrible time for many and I want our customers, employees and shareholders to know we enter this crisis in very good shape to support our communities given the work completed over the past four years to simplify our business and strengthen our balance sheet.

"Our experienced management team has implemented a four-pronged plan focused on protecting the things that matter, adapting for a new world, engaging with key stakeholders, while still preparing for the future.

"From a customer support perspective, we are already assisting 180,000 customers with deferrals on loan payments. We also provided $16 billion in additional lending, mainly to our long-term investment-grade institutional customers to support them through COVID-19. This unparalleled level of customer support is ultimately in the long-term interests of all stakeholders, including investors.

"From an operational perspective, excluding our Australian branch staff, we have more than 95% of our people working from home while still providing the essential banking services required by the community. This move to a new way of working was completed by 17 March, including our offshore delivery centres, and was supported by recent investments in technology and agile work practices.

"While the health implications of this crisis are different, the reality is the financial sector has faced major shocks every seven to 10 years on average. This reinforces our prudent approach to capital and liquidity, as well as the work to simplify our business and focus on productivity. Our conservative approach over recent years, highlighted by our focus on owner-occupier home loans and not offering a retail home loan product to the SMSF sector, are examples of this approach," he said.

Commenting on the Group's most recent financial performance, Mr Elliott said: "This was a reasonable result given the tough trading conditions being experienced before the crisis hit. We maintained our focus on productivity and continued to target balance sheet growth in our preferred segments. Loan losses heading into March were at historically low-levels and we are well positioned to manage the higher credit charges taken as a result of COVID-19.

"COVID-19 has clearly impacted our performance, however the work done over many years to simplify our business, strengthen our balance sheet as well as developing a more agile and resilient workforce meant we were well-prepared to support customers through the crisis and I'm confident we will emerge even stronger," Mr Elliott said.

DIVIDEND

ANZ also today announced its Board will defer a decision on the 2020 interim dividend until there is greater clarity regarding the economic impact of COVID-19. In assessing options, ANZ considered the high level of uncertainty in the economic outlook as well as guidance from the Australian Prudential Regulation Authority (APRA) that all Authorised Deposit Taking Institutions and Insurers should seriously consider deferring decisions on dividends until the outlook is clearer. As part of its regular engagement with APRA, ANZ has also had ongoing discussions regarding both its capital position and various stress testing scenarios.

ANZ Chairman David Gonski said: "This decision is not about our current financial position and ANZ has not received any concerns from APRA regarding our level of capital. The Board agrees with the regulator's guidance that deferring a decision on the 2020 interim dividend is prudent given the present economic uncertainty and that making a decision at this time would not have been appropriate.

"This was a very difficult decision and the Board considered all options available as we understand the impact this will have on those shareholders who rely on dividends," Mr Gonski said.

The Board will carefully consider all factors over the coming months and continue to assess the evolving situation, including the severity of community lock-downs, before determining a final position on the interim dividend. ANZ will provide an update as part of a trading update in August in conjunction with the release of its Pillar 3.

COVID-19 CUSTOMER SUPPORT

ANZ launched support packages for retail and commercial customers in Australia and New Zealand that included the option of an up to six-month loan payment deferral. ANZ also reduced a range of variable and fixed rates for home and business customers, including being the only Australian bank to reduce mortgage rates after the most recent Reserve Bank decision.

Australia Retail and Commercial

- Received ~105,000 requests for assistance on $36 billion worth of home loans. This represents 14% of ANZ's home loan portfolio.

- Repayment deferrals have been provided on $7.5 billion of lending to commercial customers, with assistance provided to ~15% of commercial lending customers.

- Pre-approved more than $4 billion in lending to 35,000 small business customers with existing transactional accounts (average of $140,000 each); provided temporary overdraft increases for ~5,500 commercial accounts.

- Reallocated and retrained staff to support key areas with more than 500 branch staff assisting with clearing call centre back-logs; trained an additional 300 people to assist customers contacting via digital channels. Responded to more than 6,000 social media posts.

New Zealand

- Provided financial support to more than 30,000 personal, home and business loan customers through loan deferrals or adjustments with lending of around ~NZ$12 billion.

- Deferred 19,600 home loan repayments and moved 20,900 to interest only.

- Granted 1,345 temporary overdraft facilities to businesses needing more working capital, worth nearly NZ$25 million; received ~820 requests regarding the Business Finance Guarantee Scheme.

Institutional

- Increased core lending by 12%, or $16 billion, during the half, with the majority extended in March to support customers in our priority sectors with their balance sheet needs.

- Joint Lead Manager on $13 billion Treasury bond for the Australian Office of Financial Management, helping fund the Australian Government's COVID-19 support package.

- Maintained customer service standards despite a 35-45% increase in transaction volumes of trade and lending processes. This was achieved with 100% of staff in operations hubs and 85% of global operations teams working from home.

CREDIT QUALITY

The total provision charge for the half was $1.7 billion, up from $402 million in the previous half. This includes a collective provision charge of $1.0 billion, taking the collective provision (CP) balance to $4.5 billion, which compares to $2.5 billion before the adoption of AASB 9 in September 2018. The increase in CP has been driven by a deterioration in economic forecasts as a result of COVID-19, not by customer downgrades or increased delinquencies. The individually assessed provision charge of $626 million, increased $228 million compared to 2H19.

PRODUCTIVITY

ANZ will maintain its focus on productivity given the impact of COVID-19 on its operations. Actions taken include having staff draw down leave balances, with budgets for salary increases in 2020/21 to be significantly reduced and focused only on those below senior management. While final assessments will be made as part of the Full Year results, variable remuneration is expected to be materially reduced given the impact COVID-19 has had on shareholders and focused primarily on rewarding those such as branch and call centre staff who have been working hard to provide essential services to customers.

CLOSING REMARKS

Commenting on the outlook Mr Elliott said: "The coming months will be difficult. The COVID-19 crisis has already evolved at such a pace it is difficult to predict how deep the economic crisis will be or how long the recovery will take.

"However, the swift action from Governments in Australia and New Zealand, as well as the healthy state of corporate balance sheets going into the crisis, has both countries well placed to not only manage the health aspects but also lessen the economic impact.

"While dealing with the immediacy of the current crisis as well as protecting our customers and staff remains our top priority, we are not sitting idle waiting for changes to happen to us. We are analysing customer behaviour and fast tracking digital investments given we know there will be opportunities for banks that focus on their customers, stay prudent, read changing customer needs and have the resources to invest for the long-term.

"Finally, I'd like to acknowledge the hard work of the ANZ team who demonstrated resilience, agility, customer focus and accountability and I have never been prouder to lead a team that so genuinely cares about their customers, colleagues and communities, " Mr Elliott said.