Merchandise trade contracted in 2023 due to slower economic growth, economic uncertainty, and restrictive trade policies, resulting in sluggish demand and spending decisions.

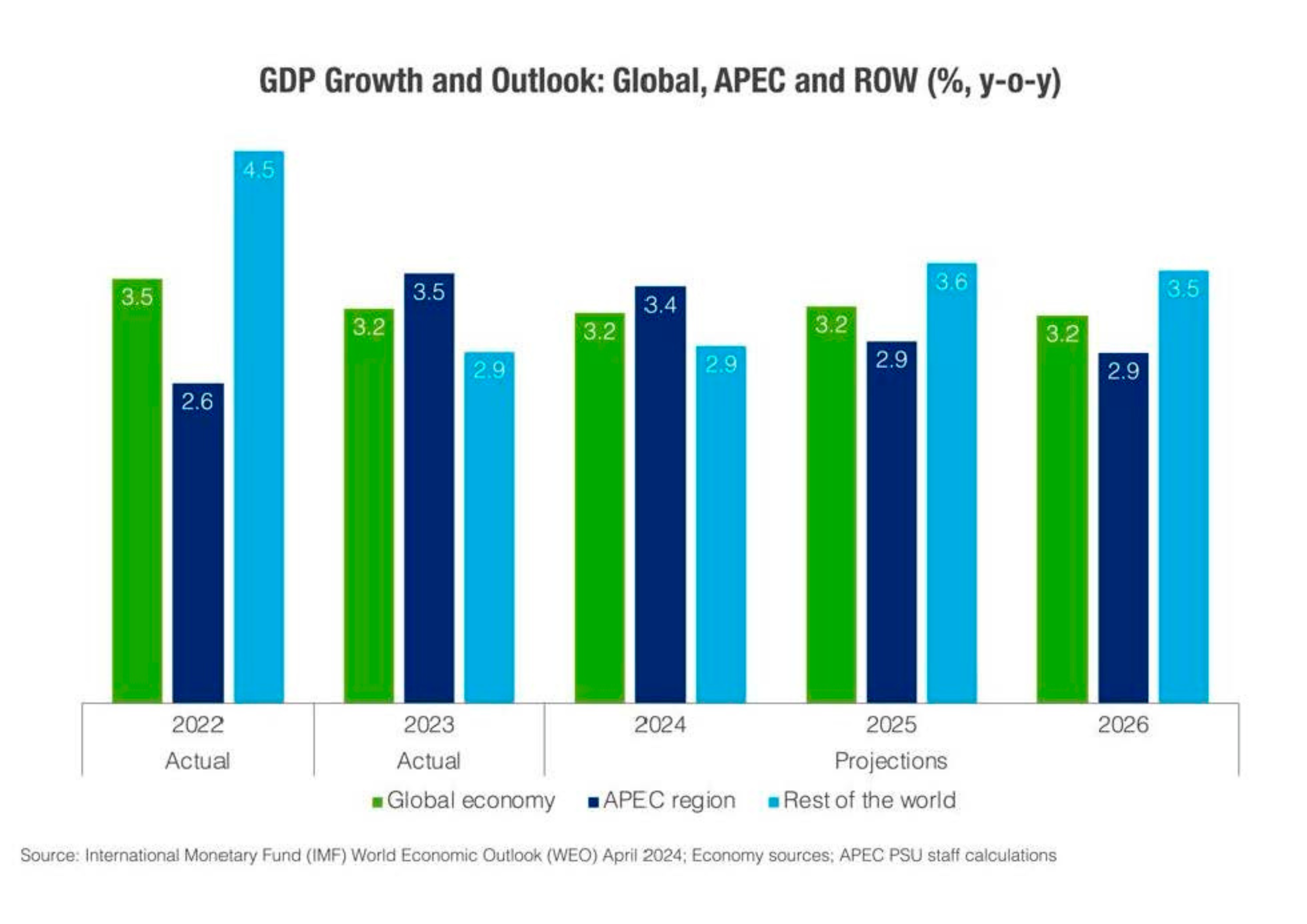

In 2023, APEC's GDP accelerated to 3.5 percent, outpacing both the global GDP growth and the year-ago APEC growth of 2.6 percent, driven primarily by robust household spending as consumer confidence strengthened amid declining inflation. The resilience of the services sector combined with government spending further bolstered economic growth.

Looking ahead, our view is that growth in APEC will reach 3.4 percent in 2024 and slow to 2.9 percent in 2025-2026. This projected economic moderation reflects uncertainties stemming from trade protectionism, persistent inflationary pressures and geopolitical tensions. Indeed, investors are hedging against intensifying global uncertainties by demanding more gold, reflected in prices that have soared by 17 percent, from around 2,050 USD per troy ounce in January 2024 to about 2,400 USD per troy ounce in April 2024.

Looking ahead, our view is that growth in APEC will reach 3.4 percent in 2024 and slow to 2.9 percent in 2025-2026. This projected economic moderation reflects uncertainties stemming from trade protectionism, persistent inflationary pressures and geopolitical tensions. Indeed, investors are hedging against intensifying global uncertainties by demanding more gold, reflected in prices that have soared by 17 percent, from around 2,050 USD per troy ounce in January 2024 to about 2,400 USD per troy ounce in April 2024.

In addition, high debt levels continue to be a concern. The general government gross debt-to-GDP ratio surged during the pandemic and remains persistently high post-pandemic. A confluence of factors, including extensive stimulus initiatives and ongoing fiscal support amid economic challenges, have contributed to the elevated debt levels. In the APEC region, the ratio has increased significantly to 104.5 percent of GDP in 2023 from below 100 percent pre-pandemic. APEC's public debt could go up to 110 percent of GDP in the near term due to the combined impact of the pandemic aftermath and fiscal support packages aimed at assisting vulnerable groups. Besides, interest payments have also increased. Ongoing uncertainties make it more challenging for economies to fully offset the debt incurred during those episodes of health and economic crises and return to the pre-pandemic level.

Despite these challenges, there exists considerable upside potential driven by the resurgence of consumption, increased investment, revitalized tourism and the expected rebound in trade. These factors could help sustain economic growth in the region.

Taming inflation: Do not let your guard down

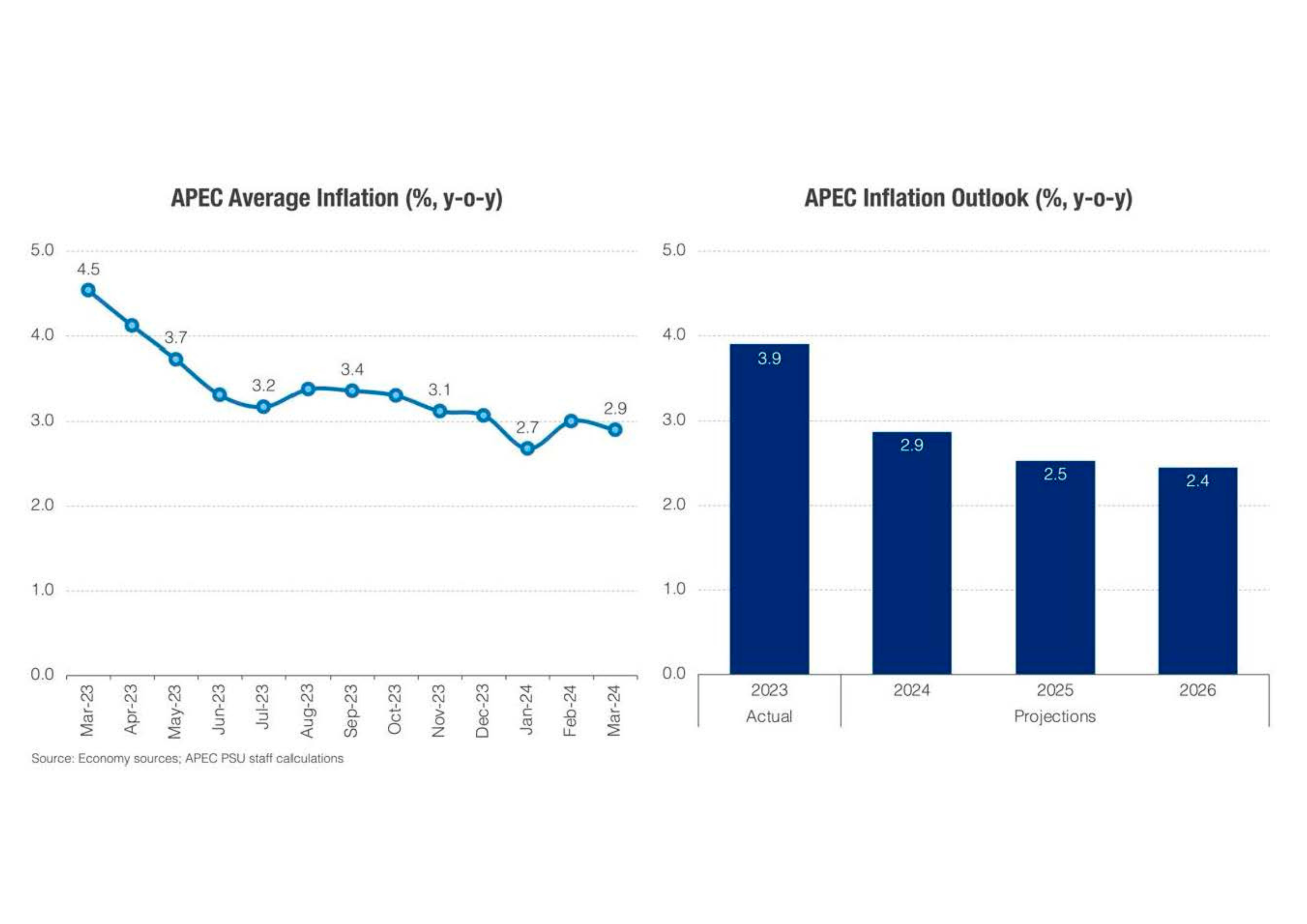

Inflation across APEC economies averaged lower at 3.9 percent in 2023 from 5.9 percent in 2022. Latest data in March 2024 saw APEC average inflation declining anew to 2.9 percent year-on-year. The steady reduction in inflation reflects in large part the synchronized and successive monetary policy tightening efforts by APEC economies. Barring any shocks, inflation in APEC is expected to gradually ease over the short term, to 2.9 percent in 2024, followed by further reductions to 2.5 percent in 2025 and 2.4 percent by 2026.

With inflation showing signs of moderation, the majority of APEC economies have opted to keep their key policy rates unchanged, aligning with the US Federal Reserve's decision to hold interest rates steady. However, economies need to be on guard to dampen inflationary pressures through the exchange rate. In the last 12 months, 17 currencies in the APEC region have depreciated against the US dollar, ranging from -2.1 percent to -16.7 percent as of April 2024.

Other potential risks on inflation could come from supply disruptions, such as reduced crude stock in key oil-producing economies, alongside ongoing geopolitical issues, which have fueled a substantial surge in oil prices, increasing by 10 percent in March 2024. Likewise, food prices experienced notable upward pressure, driven by shortages in vegetable oils due to crop failures coupled with intensified demand for biodiesel.

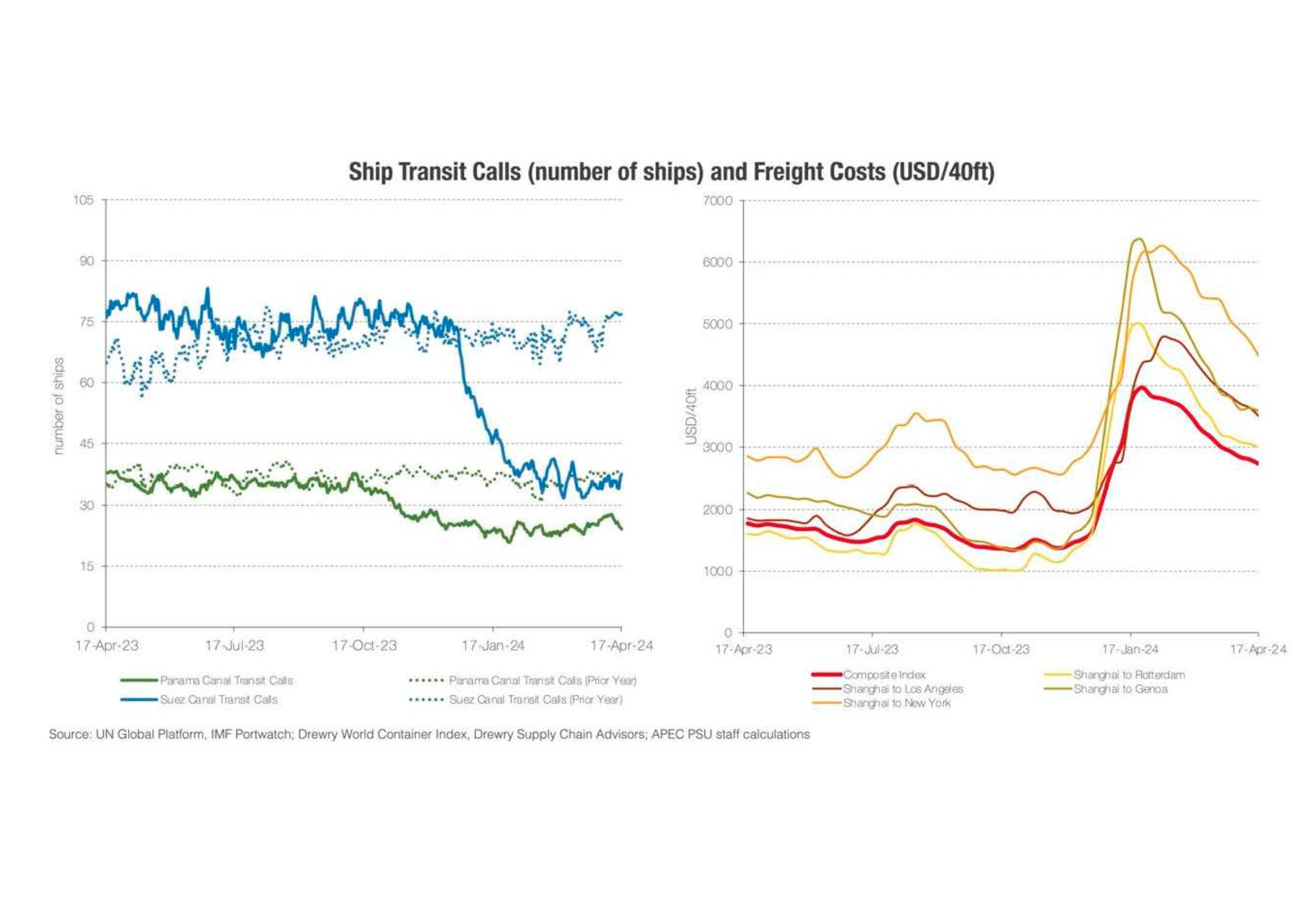

Adding to these adverse price developments are the extended drought conditions and increased maritime risks observed at the Panama and Suez Canals, respectively. These factors have led to a significant escalation in freight costs, reaching their peak in late January 2024 and persisting at levels 50 percent higher as of April 2024 compared to a year ago.

Trade trends: Contraction but rebound in the horizon

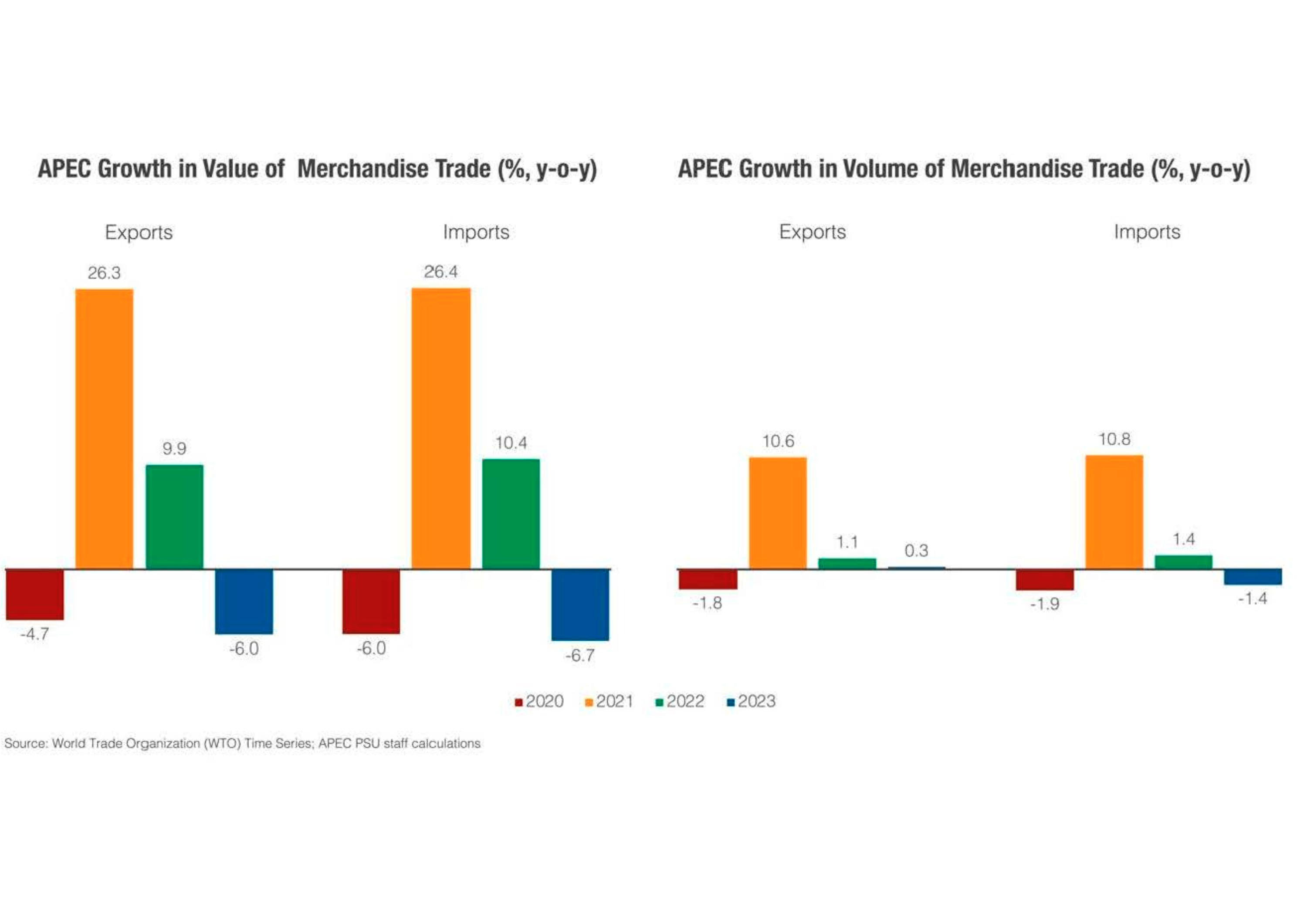

APEC merchandise trade contracted in 2023 as a slower economic growth gave rise to economic uncertainty, in turn affecting spending decisions and translating into sluggish demand. Additionally, the accumulation of restrictive and unpredictable trade policies such as anti-dumping measures and countervailing duties continued their upward trend, further exacerbating trade activity.

The value of APEC merchandise exports and imports in 2023 reversed by -6.0 percent and -6.7 percent respectively, after expanding in 2021-2022. The volume of merchandise trade followed the same declining trend, with exports growing marginally by 0.3 percent while imports contracted by 1.4 percent during the same period.

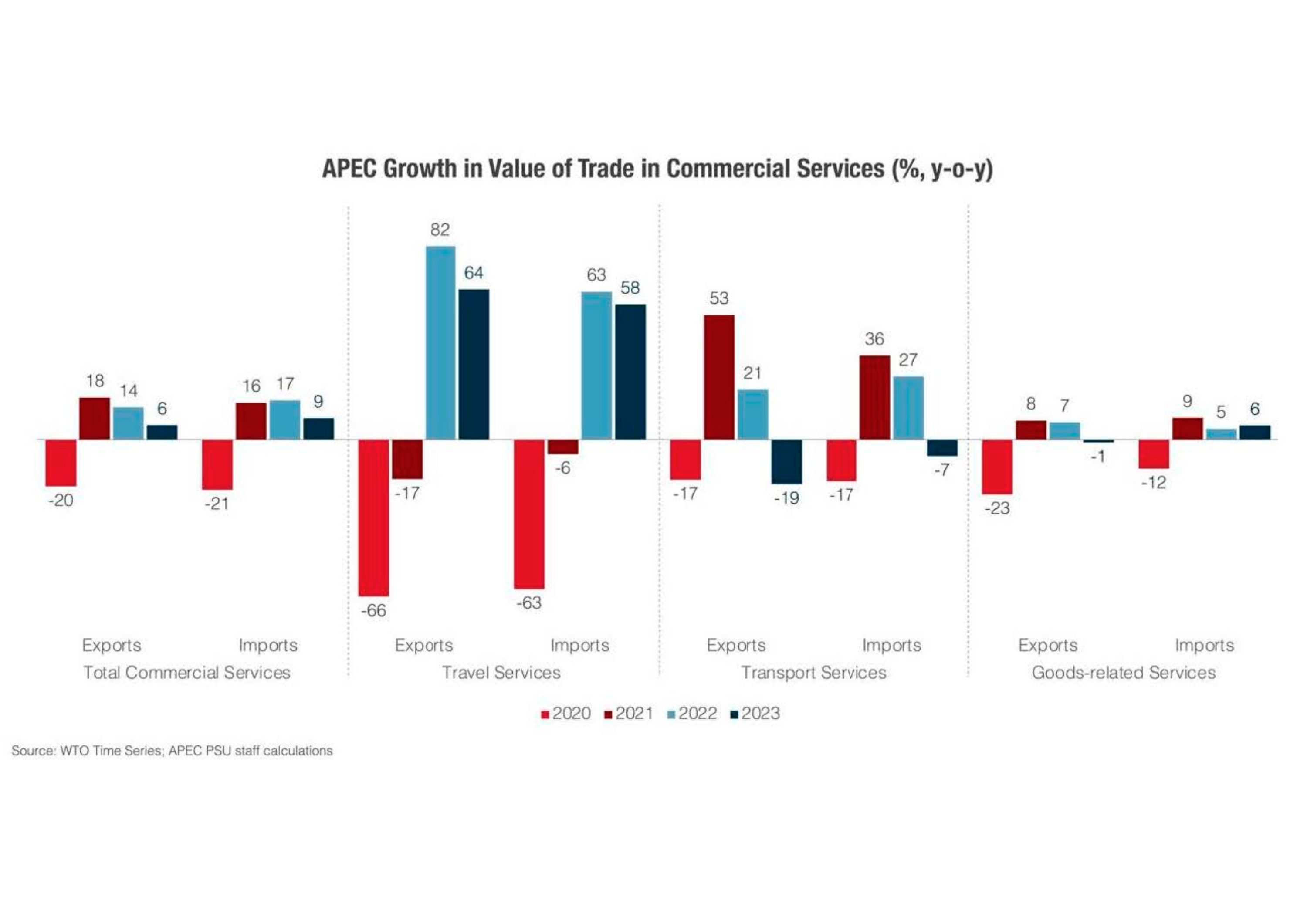

Commercial services trade has decelerated but showed more resilience than goods trade in 2023. The recovery of travel and tourism services continues, increasing by 64 percent year-on-year for exports and 58 percent for imports, emerging as a significant contributor to commercial services trade growth.

Commercial services trade has decelerated but showed more resilience than goods trade in 2023. The recovery of travel and tourism services continues, increasing by 64 percent year-on-year for exports and 58 percent for imports, emerging as a significant contributor to commercial services trade growth.

A glimmer of hope emerges through trade facilitation. Recent data indicate that the region is actively implementing 551 trade-facilitating measures, providing promising avenues to counter the adverse effects of trade constraints.

There are bright prospects for trade in the APEC region in the near term. Projections paint a picture of robust recovery in 2024, with growth estimates spanning from 0.6 percent to 12.6 percent across APEC economies. The regional average is estimated to reach 4.0 percent, higher than forecasts for global trade. This favorable trend is expected to continue in 2025, underpinned by resilient supply chains and a more stable economic growth.

Looking ahead: Cooperate to counter complex challenges

In the face of global uncertainties and volatile commodity markets, prioritizing enhanced multilateral cooperation stands as an imperative. The latest APEC Perception Survey reveals that people in the region support multilateralism, emphasizing its crucial role in advancing an interconnected global economy. This underscores the importance of multilateral approaches in promoting free and fair trade and investment across the Asia-Pacific. Indeed, fostering collective action to keep trade open, ensure global stability, and address complex and multiple challenges will fortify APEC economies against prevailing headwinds that threaten to diminish the gains made post-pandemic.

At the same time, and especially in the short term, monetary policy must remain on guard against new price pressures while supporting growth, ready to adjust policy rates accordingly. On the other hand, fiscal policy needs to prioritize fiscal consolidation and debt sustainability while rebuilding buffers to safeguard against future shocks. Easing debt burdens will also open up fiscal room and enable new investments. Flexible and prudent policy approaches are indispensable tools to navigate and respond to challenges while cultivating sustainable growth.

Equally important, economies should steer toward implementing structural reforms that boost potential, productivity and prospects. For example, the Enhanced APEC Agenda for Structural Reform (EAASR) sets out a fresh trajectory for growth-oriented structural reform, focusing on fostering open, transparent, and competitive markets; enhancing business recovery and resilience to withstand future shocks; promoting equal access to opportunities across society for inclusive and sustainable growth; and leveraging innovation, technology, and skill development to drive productivity gains and facilitate digitalization. Another area for reform is the APEC services sector through the APEC Services Competitiveness Roadmap (ASCR). Among other objectives, the roadmap encourages APEC member economies to establish an open and predictable environment by reducing trade and investment restrictions. Implementing reforms fosters more resilient economies.

By remaining vigilant, reducing debt and rebuilding buffers, implementing productivity-enhancing structural reforms, and deepening cooperation, APEC economies can effectively navigate the complexities of the current landscape, strengthening economic fundamentals and regional ties for a future that is inclusive, sustainable and prosperous.