APEC's path to resilience requires structural reforms, innovation and cooperation for balanced and inclusive growth amid complex economic challenges

As the APEC region faces a shifting global landscape, it contends with a mix of economic challenges, including moderating growth, ageing populations, and the need for just energy transitions. Charting a resilient future requires addressing these challenges through the implementation of structural reforms.

Slowing growth and economic headwinds

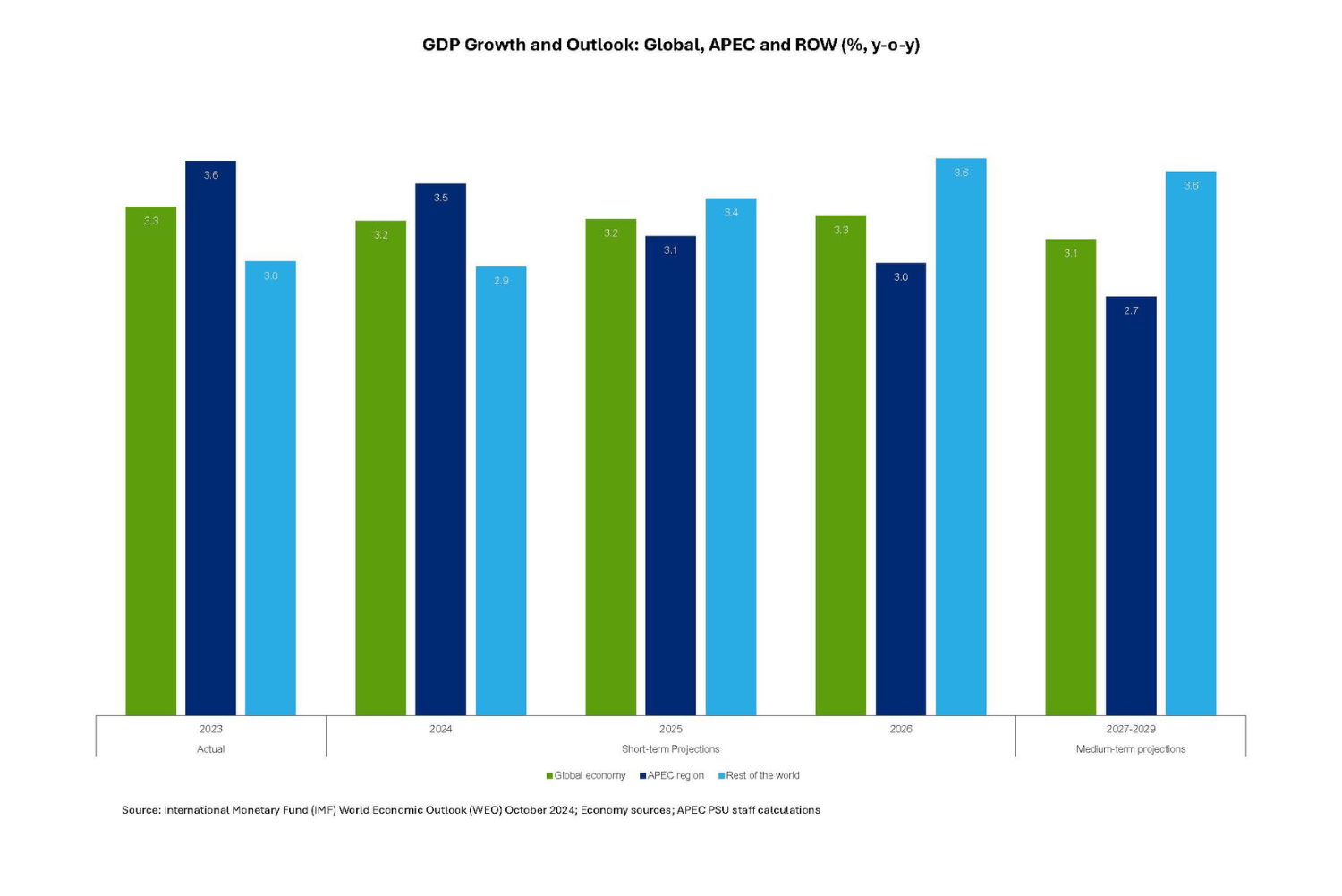

Economic and geopolitical headwinds are slowing growth in the APEC region, which is expected to expand at a moderating pace in the coming years, trailing behind the rest of the world. In particular, APEC growth is projected at 3.5 percent in 2024, declining to 3.1 percent in 2025, and further moderating to 2.7 percent over the medium term.

Economic and geopolitical headwinds are slowing growth in the APEC region, which is expected to expand at a moderating pace in the coming years, trailing behind the rest of the world. In particular, APEC growth is projected at 3.5 percent in 2024, declining to 3.1 percent in 2025, and further moderating to 2.7 percent over the medium term.

Significant risks from soaring debt, and geopolitical issues coupled with heightened uncertainty could limit growth potential well into the medium term. Upside opportunities could come from harnessing innovative technologies to boost productivity, moderating inflation that could translate into stronger consumption and investment activity and implementing structural reforms to address challenges in the short and medium term.

Monetary policy shifts and inflation trends

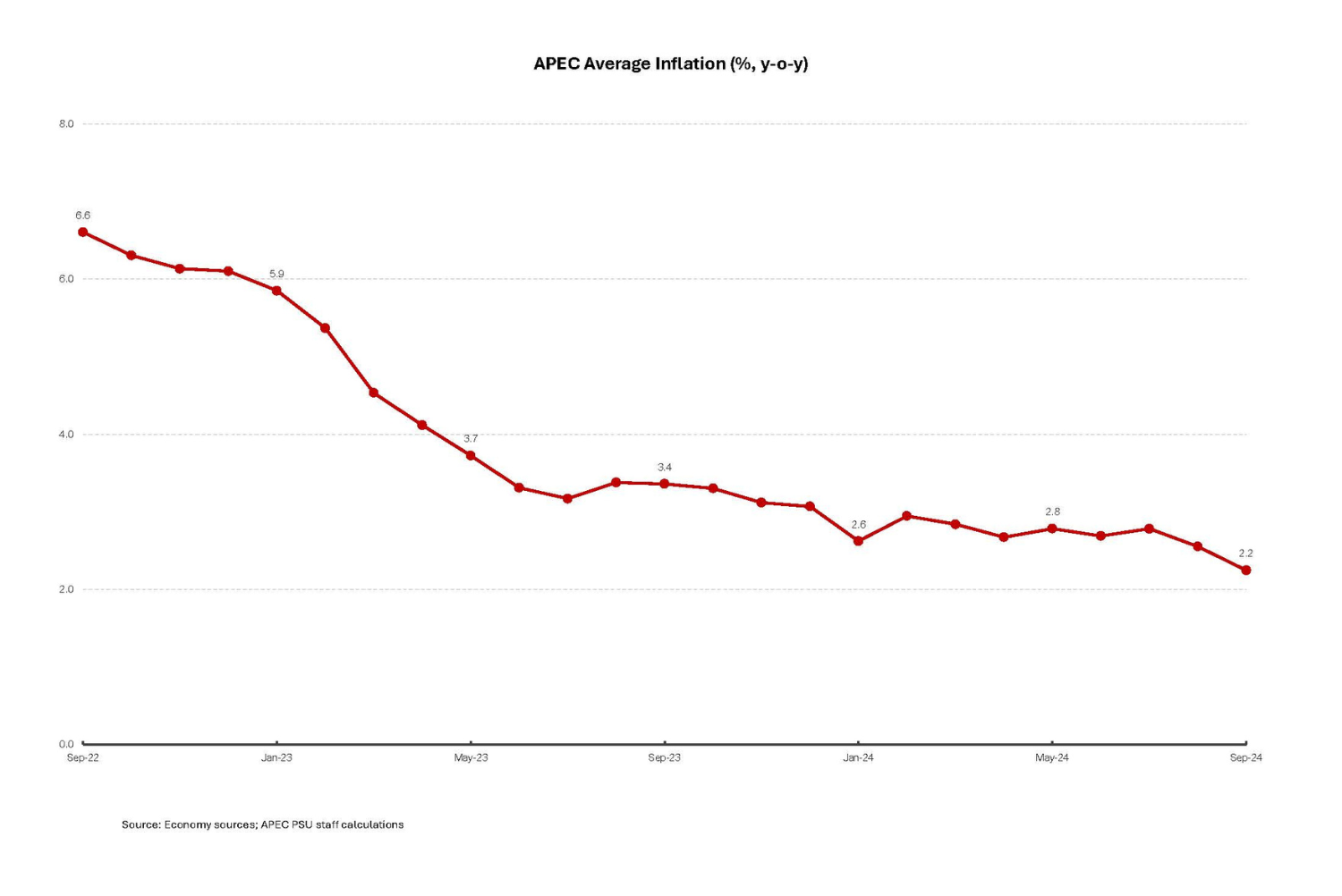

Monetary tightening has reduced inflation, but as policy rates adjust to a lower inflation environment, vigilance is necessary to manage exchange rate volatility and preserve macroeconomic stability. As APEC growth moderates, authorities will have to be cautious about reducing interest rates drastically, as it may result in significant depreciations in local currencies vis-à-vis the US dollar, which in turn could give rise to inflationary pressures.

Latest available data show that more than half of APEC member economies decided to reduce their monetary policy rates as of October 2024 compared to the levels reported in the ARTA August 2024, while some maintained a neutral policy stance and a few raised their benchmark rates to counter inflationary risks.

Moderating energy prices have also helped ease inflation, but food prices are showing signs of an uptick, mainly due to supply concerns in vegetable oil and dairy industries.

Moderating energy prices have also helped ease inflation, but food prices are showing signs of an uptick, mainly due to supply concerns in vegetable oil and dairy industries.

The inflation outlook for the APEC region suggests a significant tapering to 2.9 percent for all of 2024 from 3.8 percent a year ago, further slowing to 2.6 percent in 2025. Barring any shocks, inflation in APEC is seen to average 2.4 percent in the medium term. However, price pressures could come from an increase in tariffs, which act as a tax on consumers purchasing imported goods.

Fragile trade amid increased protectionism

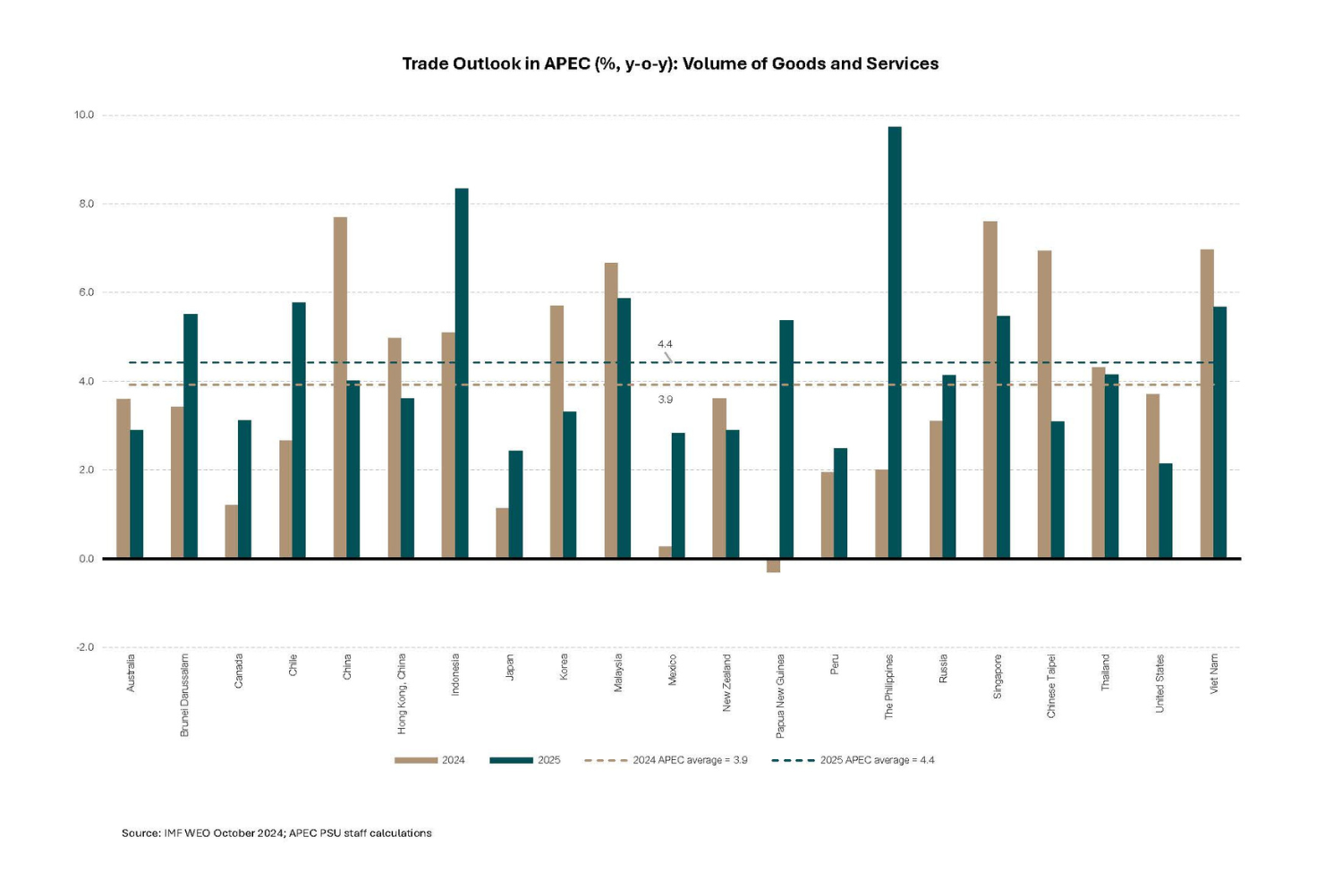

Trade in the APEC region has shown signs of recovery, although protectionist measures and uncertainties could reverse this positive development.

Merchandise trade has rebounded in the first half of 2024 after contracting in the same period in 2023, as lower inflation and interest rates boost consumption and investment. The value and volume of merchandise exports recovered to a modest growth of 3.1 percent and 3.0 percent, respectively, with merchandise imports mirroring export performance.

In addition, commercial services in the first half of 2024 reflected continued export growth at 9 percent, buoyed by double-digit growth in travel services at 23 percent and transport services at 10 percent.

While trade growth forecasts for APEC economies indicate uneven trajectories, the APEC region could expand by 4.4 percent in trade volume next year, in the absence of negative shocks. However, trade activity in the region remains fragile, vulnerable to a host of factors affecting global demand, including trade-restrictive measures, ongoing geopolitical tensions, and economic growth prospects.

Protectionism, in particular, is a threat to the current trade outlook and harms economic relations among APEC members. As of end-October 2024, trade restrictions and trade remedies reached 345 and 944 measures, respectively, a significant increase from pre-pandemic levels.

Embracing innovation and sustainability

Embracing innovation and sustainability

Innovative technologies have the potential to vastly enhance efficiency and productivity. Maximizing the transformative benefits from digitalization and green transition requires investing in upgraded physical and digital infrastructure and skills while also allocating resources to compensate those facing adjustment challenges.

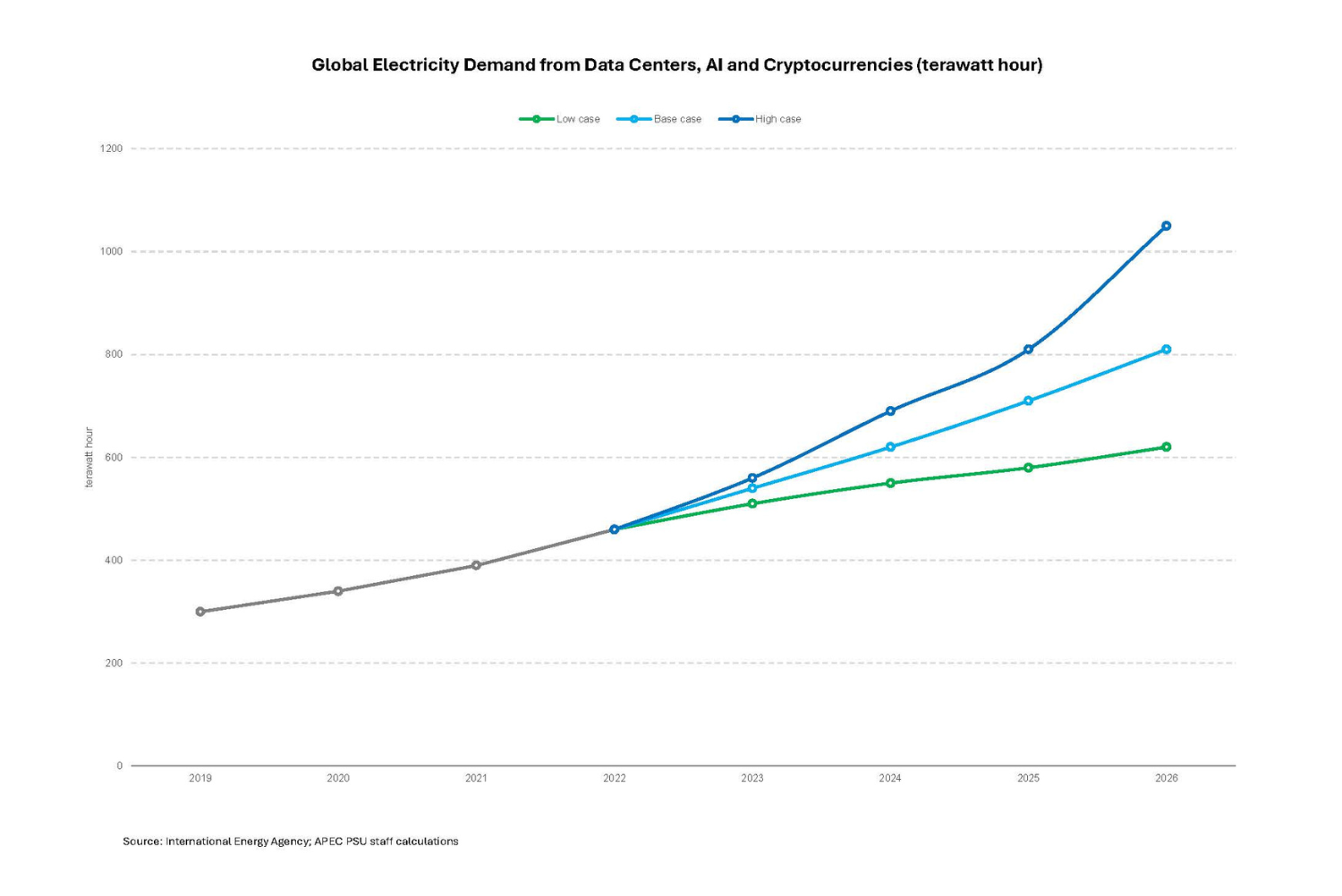

However, energy demand from innovative technologies is expected to more than double in the medium term, presenting a sustainability challenge as much of energy is still derived from non-renewable sources. To balance higher energy demand with environmental concerns, APEC economies need investments in renewable energy, along with policies that support the green transition.

The amplified demand from AI, low-emission and other innovative technologies has also translated into higher metal prices, with gold, silver and copper prices remaining elevated as of September 2024. Gold prices, in particular, are facing higher prices as investors are buying gold to hedge against global uncertainties. This view is supported by the slight decline in manufacturing managers' outlook on business conditions, indicating renewed cautiousness amid ongoing complex challenges.

The amplified demand from AI, low-emission and other innovative technologies has also translated into higher metal prices, with gold, silver and copper prices remaining elevated as of September 2024. Gold prices, in particular, are facing higher prices as investors are buying gold to hedge against global uncertainties. This view is supported by the slight decline in manufacturing managers' outlook on business conditions, indicating renewed cautiousness amid ongoing complex challenges.

Ageing populations and economic consequences

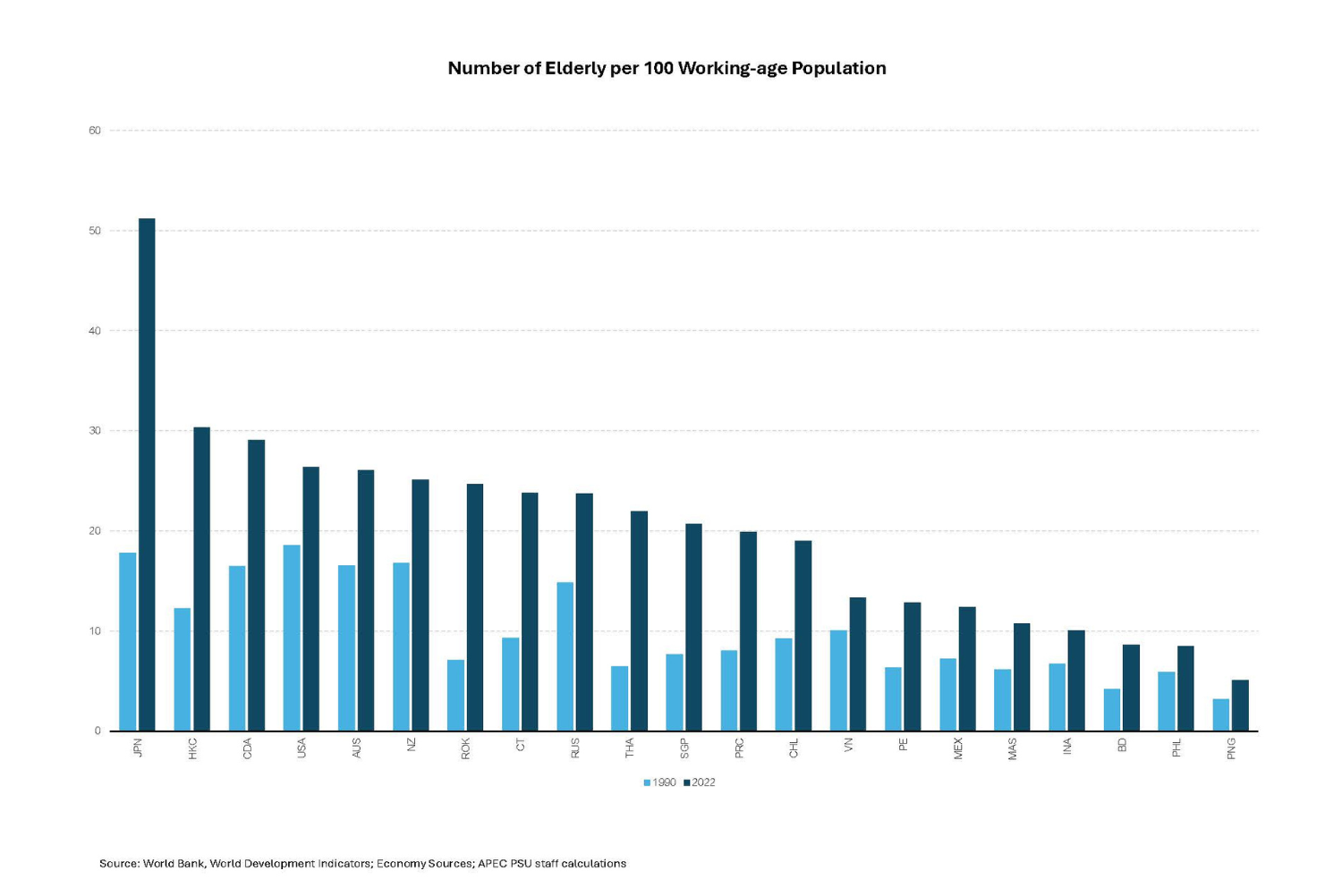

In APEC, at least half of the membership are facing rapidly ageing populations although at varying speeds. In 2022, over half of APEC economies reported an old-age dependency ratio ranging from 20 elderly to 51 elderly per 100 working-age individuals-a striking increase compared to 1990 when the highest ratio in the region was just 19 elderly per 100 working-age individuals. This underscores growing concerns about the pressures of an ageing population on economic stability and workforce sustainability, demanding tailored policy responses in the near term.

Labor force shrinkage, higher healthcare and pension costs, tax base decline, and slower economic growth are just some of the considerable adverse impacts of ageing populations. Economies could consider the following policy suggestions, as appropriate, given economy-specific conditions and priorities:

- encourage older individuals to remain in the workforce longer by offering flexible working arrangements, reducing early retirement incentives, and providing lifelong learning opportunities;

- make pension and healthcare systems more sustainable by raising retirement ages, adjusting benefits, and promoting private savings plans;

- support controlled immigration of young, skilled workers to offset the declining working-age population;

- invest in automation, AI, and other technologies to enhance labor productivity and reduce dependency on human labor as this can compensate for a shrinking workforce;

- promote higher birth rates by offering better support for families, including affordable childcare and parental leave; and

- increase female participation in the workforce to boost labor supply, through policies that advance gender equality in the workplace, including bridging the gender wage gap and eliminating sex-based discrimination in hiring and career advancements.

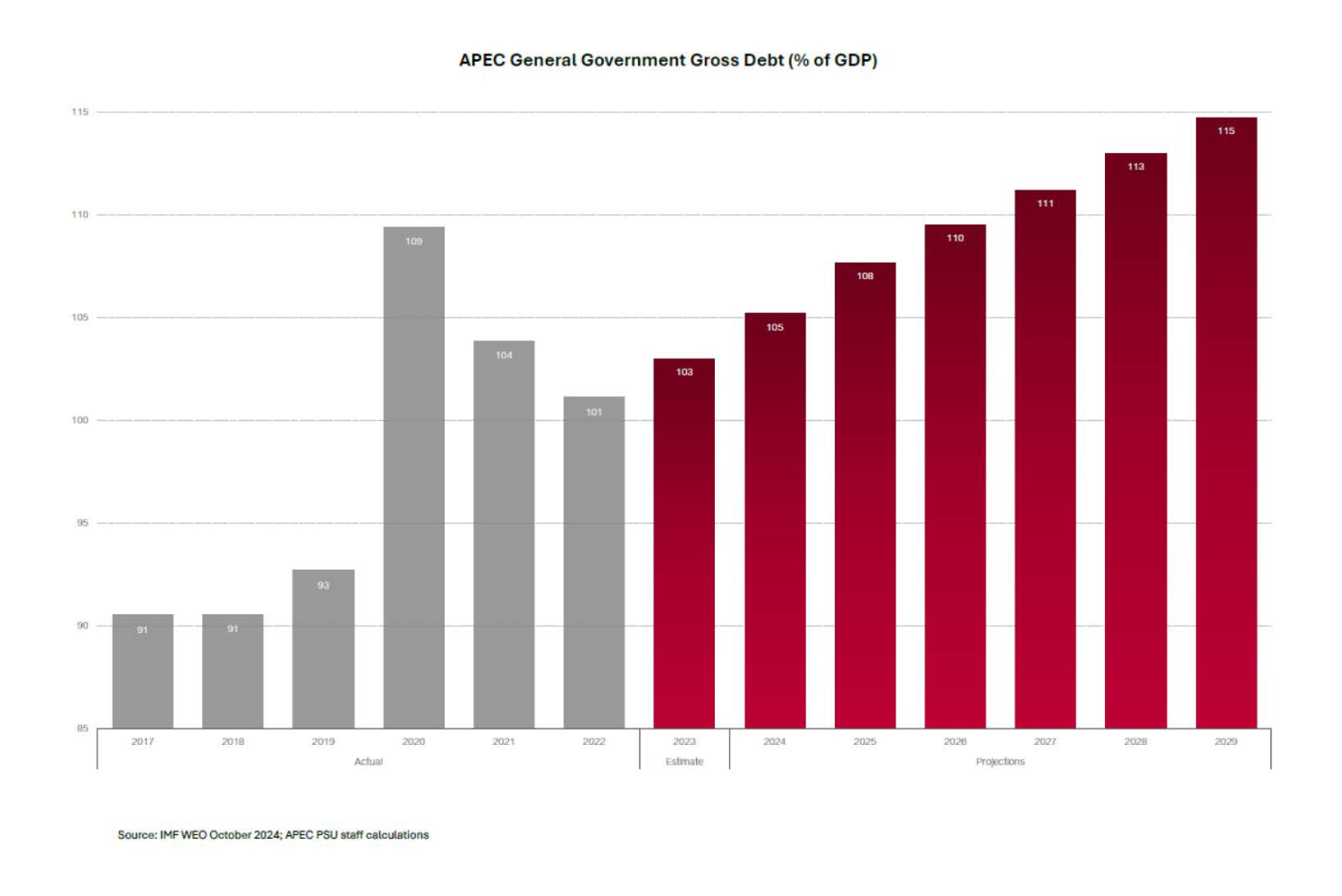

Ageing populations are expected to exert fiscal pressures, compounding the already elevated government debt. The average general gross government debt among APEC economies is estimated to have reached 103 percent of GDP in 2023 and is expected to exceed pandemic response levels at 110 percent of GDP by 2026, widening anew to 115 percent of GDP in the medium term if left unaddressed. This upward trend in government debt requires gradual but urgent fiscal consolidation alongside targeted fiscal support to protect vulnerable groups.

The way forward: policies, reforms and cooperation

APEC economies need a balanced mix of monetary and fiscal policies, alongside structural reforms to tackle challenges and enhance growth prospects. In the immediate term, APEC economies should consider gradually adjusting monetary policy rates to support economic growth while remaining flexible to address inflationary risks. In parallel, a focus on fiscal consolidation is warranted by directing resources toward social programs that uplift lives and sectors that contribute to growth.

Implementing structural reforms now is critical to address the great demographic shift and its looming impacts, embrace innovative technologies and support the green transition, while also tackling skills mismatches as well as sustainability and inclusivity issues.

In the face of complex economic challenges, APEC economies can benefit from a cooperative, multilateral approach to shared challenges, particularly by implementing policies toward a balanced growth that benefits all.