Key points:

Beef producer confidence is higher than expected according to recent survey results.

Herd growth is expected to increase by 6% in 2025.

Producers intend to retain more heifers and purchase more steers compared to last year.

The November 2024 Beef Producers Intentions Survey results highlight positive trends for Australia's beef cattle industry for 2025, with forecasts showing growth and stability.

Confidence is strong

Producer sentiment has significantly improved compared to 2023. Over half of producers (56%) feel positive about the industry's future. Confidence is shared nationwide, with better weather and stable prices boosting optimism, particularly in NSW (nett sentiment +51) and Queensland (nett sentiment +59).

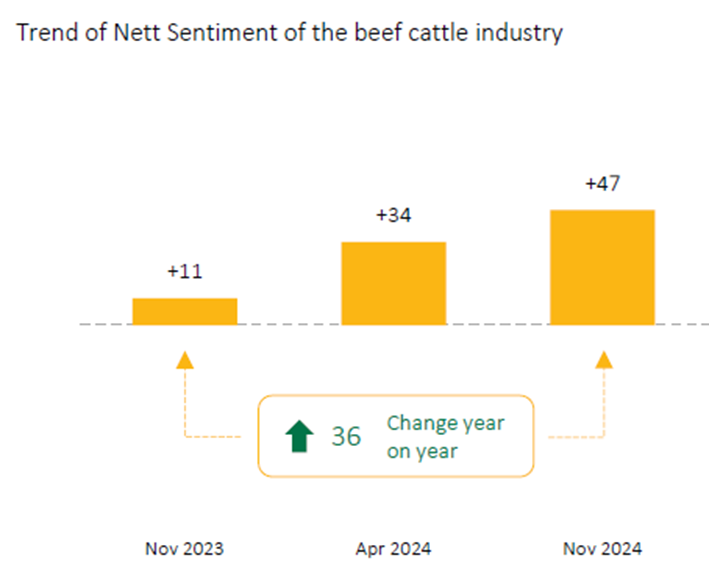

Producers reported a much more positive outlook for the cattle industry in the next 12 months. Nett sentiment has improved some 36 points over the same measure in the November 2023 survey (now +47 compared to +11 in 2023)

Breeding and selling

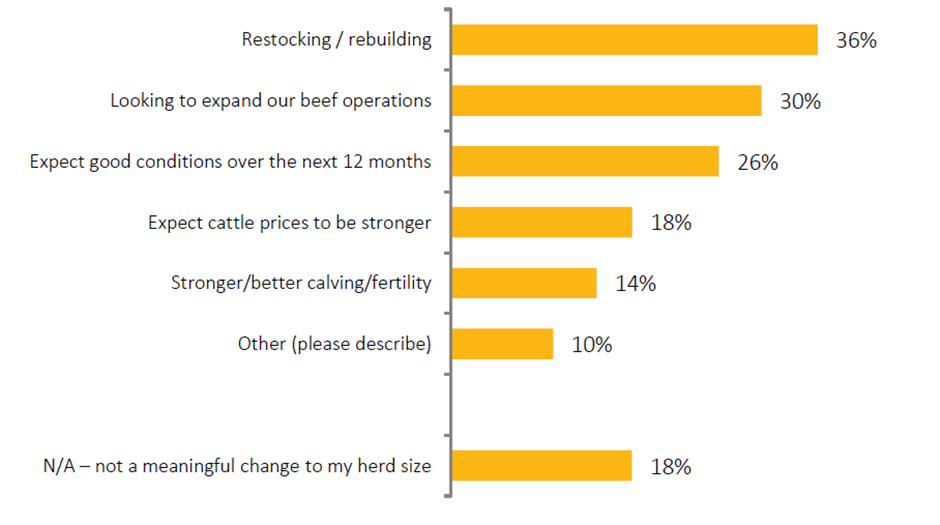

plans Overall, 45% of producers are looking to increase their beef cattle herd, with northern producers (50%) taking the lead. Out of these producers, 36% of them intend to rebuild their herd, with their intended methods being

- retaining more heifers (53%)

- purchasing more steers (19%).

Australian grassfed cattle producers are optimistic about 2025, focusing on rebuilding and improving the quality of the cattle herd.

Herd growth

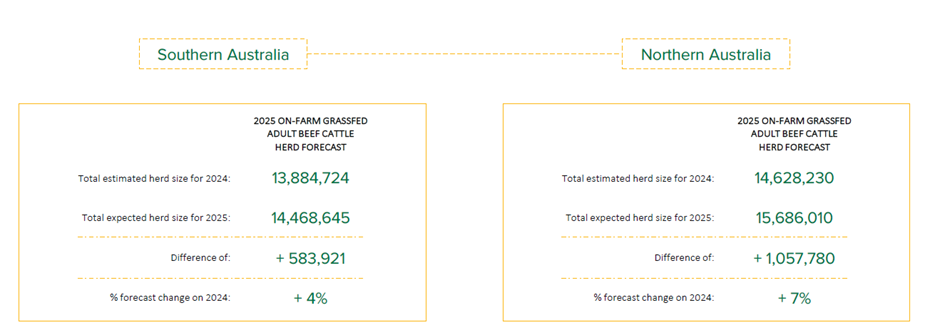

expected Cattle producers across Australia plan to increase their grassfed beef herds by 6% next year. This will be an increase from 28.5 million cattle in 2024 to 30.2 million in 2025. Stronger growth is forecast for northern producers (7%) compared to southern producers (4%). Drivers include restocking after recent challenges, expanding operations and confidence in good seasonal conditions.

View the full results of the latest Beef Producer Intentions Survey here.

Attribute content: Emily Tan MLA Market Information Analyst

MLA makes no representations as to the accuracy, completeness or currency of any information contained in this publication. Your use of, or reliance on, any content is entirely at your own risk and MLA accepts no liability for any losses or damages incurred by you as a result of that use or reliance. No part of this publication may be reproduced without the prior written consent of MLA. All use of MLA publications, reports and information is subject to MLA's Market Report and Information Terms of Use.