Dr Wei Li

The report surveyed more than 1,000 Australian business leaders to understand their adoption of and attitude toward digital payments, which include tap to pay, buy now pay later services, and digital wallets such as Google Pay and Apple Pay.

It found 46 percent of businesses surveyed are now accepting four or more payment methods, and 45 percent want to improve their current payment systems.

"Our research shows the adoption rate of digital payments remains uneven across states, industries and different sizes of businesses," said co-author Dr Wei Li, lecturer in International Business at The University of Sydney Business School.

"While the progression may manifest incrementally and there are barriers to overcome, the findings show businesses are gravitating towards a more sophisticated and inclusive digital payment framework, paving the way for a transformed and resilient economic future."

Among emerging digital payment technologies, digital wallets are the most common methods adopted by Australian businesses, reportedly accepted by 34 percent of surveyed businesses.

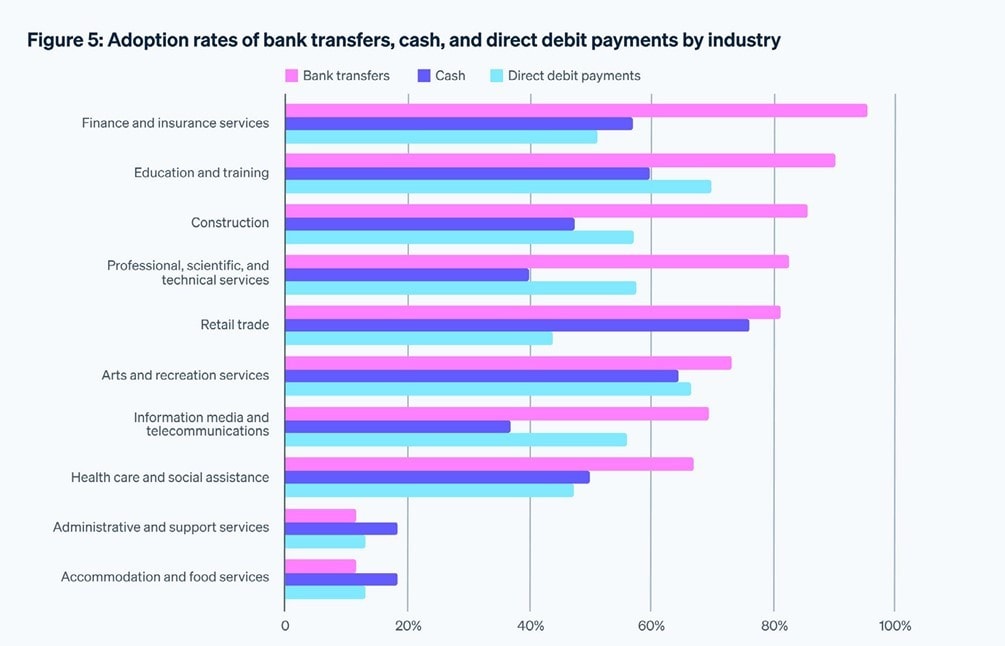

Digital payment adoption varies widely across industries for Australian businesses.

Victorian businesses are at the forefront of digital wallet adoption, with 38 percent accepting this payment method, followed by businesses in NSW and Queensland at 34 percent.

At an industry level, 57 percent of businesses in retail and 49 percent in the finance and insurance services sector are adopting digital wallets.

Report co-author Dr Luke Deer, lecturer in Finance at the University of Sydney Business School, said security concerns, along with cost and reliability, are the main factors preventing businesses from investing in digital payments.

"54 percent of businesses identified fraud and scams as their primary concern when it comes to adopting new payment technology, which is understandable given the potential for financial and reputational damage if a data breach occurs," Dr Deer said.

"This also helps explain why digital wallets provided by established, reputable companies such as Google and Apple are the most popular choice. Businesses want reassurance that payment service providers have robust security and fraud prevention strategies in place to protect them and their customers."

Declaration

This research was co-funded by global financial infrastructure platform for businesses, Stripe and The University of Sydney Business School.