Key points:

- Cattle prices continue breaking records as slaughter hits historical low

- Greater volumes of cattle cross borders in 2020

- Export demand subdued due to COVID-19

For the Australian cattle market, trying to capture how 2020 unfolded is a difficult task, as pandemic-induced disruptions and changing seasons resulted in unpredictable situations unfolding. These unforeseen circumstances will carry impacts over into 2021 as the industry enters uncharted territory. Despite these challenges, Australian cattle have performed well this year, highlighting the strength of the industry to adapt, and the quality of the product being produced.

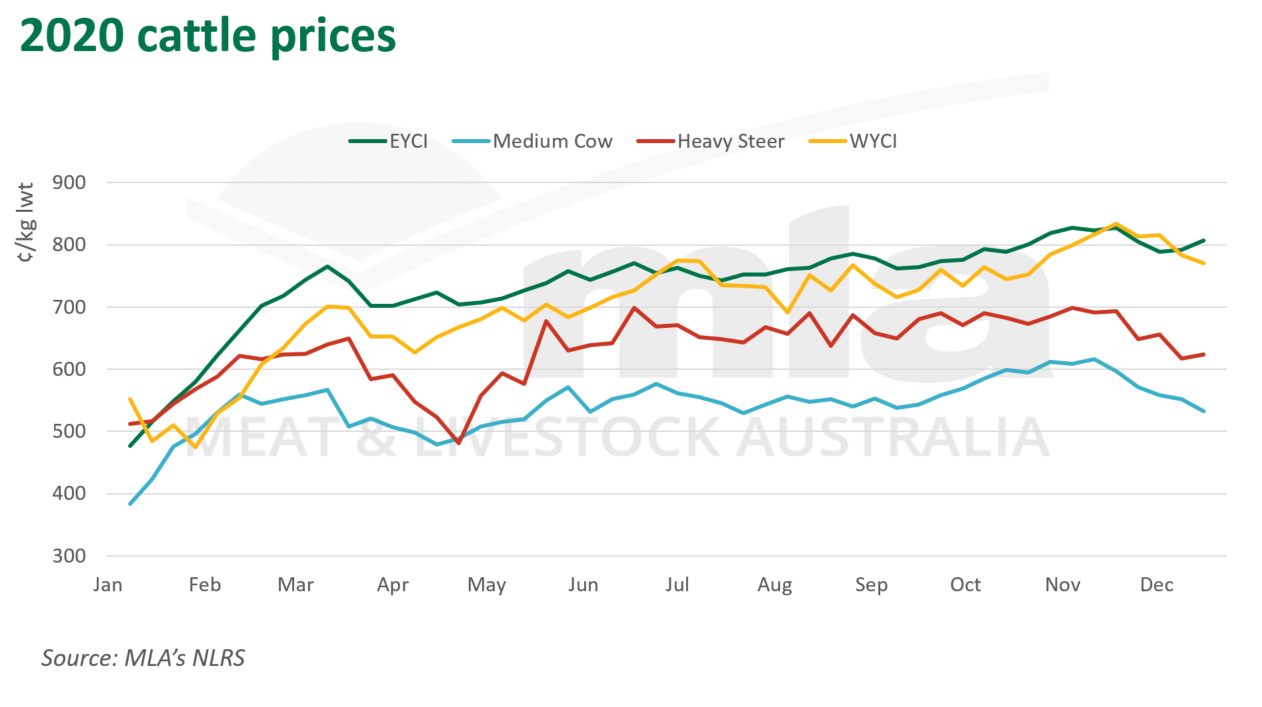

Restockers continued to make their presence known in the market, with a change of season in key southern regions offering an incentive to rebuild herds. The bounce back was immense, with the largest continuous climb ever seen in young cattle prices – the Eastern Young Cattle Indicator (EYCI) sat at 477¢/kg cwt at the start of the year, rising 289¢ by March 11, as rain came.

The scene was set for a booming year for domestic cattle prices before COVID-19 hit. The impact of the pandemic was profound, disrupting logistical supply chains, reducing foodservice demand, triggering trade tension and undermining the confidence of the Australian cattle market. Border closures and plant suspensions also took a toll on the processing sector.

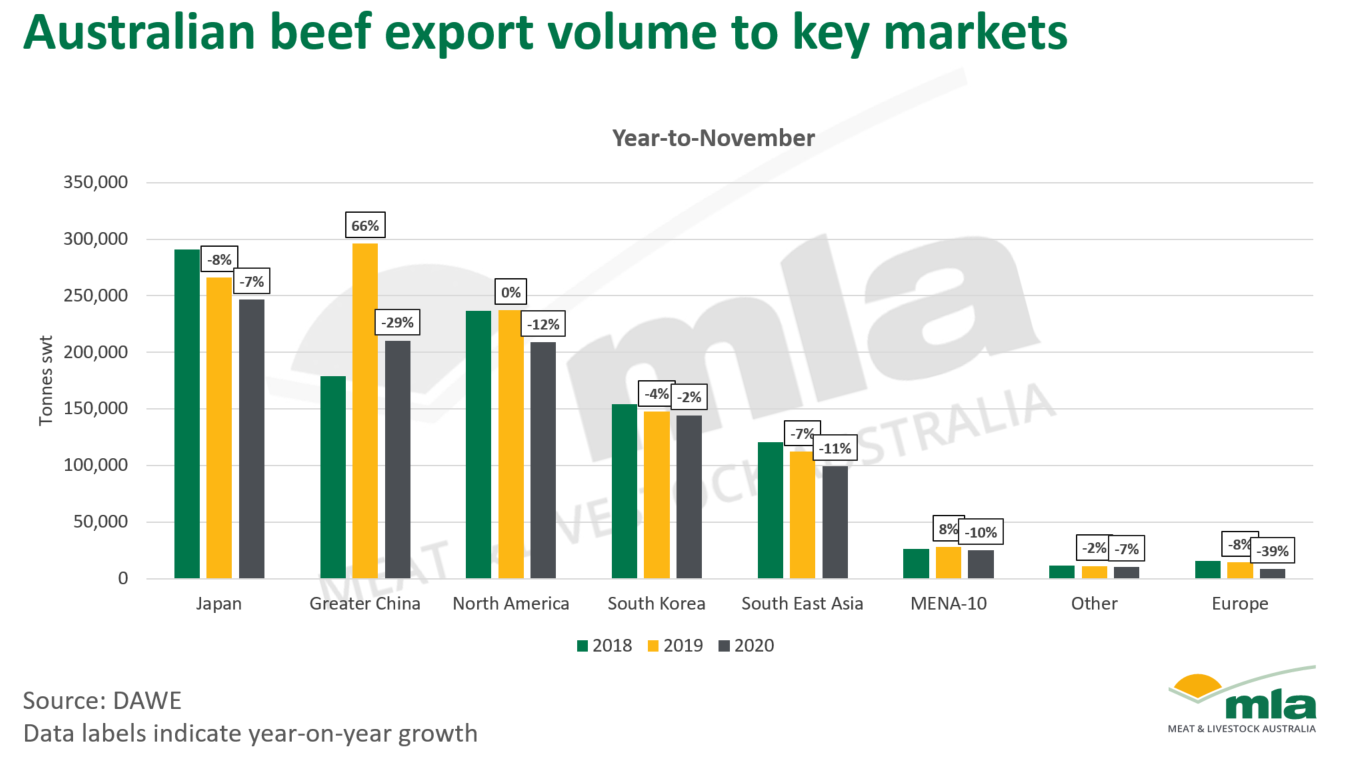

Retail volumes, however, surged on the back of panic buying and increased cooking from home, with the desire for quality red meat at the forefront of consumers' minds as they endured the pandemic. Export volumes continued to dwindle however, down 14% year-on-year, with a slow recovery expected for many key export markets.

Beef processors were forced to remain agile throughout 2020 on the back of reduced export and foodservice demand and low supply, maximising carcase value through altering cuts and pivoting to focus on retail markets.

While medium and heavy categories took a hit due to the decline in foodservice demand, young cattle prices were able to rally. Solid rainfall across the eastern states throughout the Easter period spurred on restocker activity, climbing for the remainder of the year.

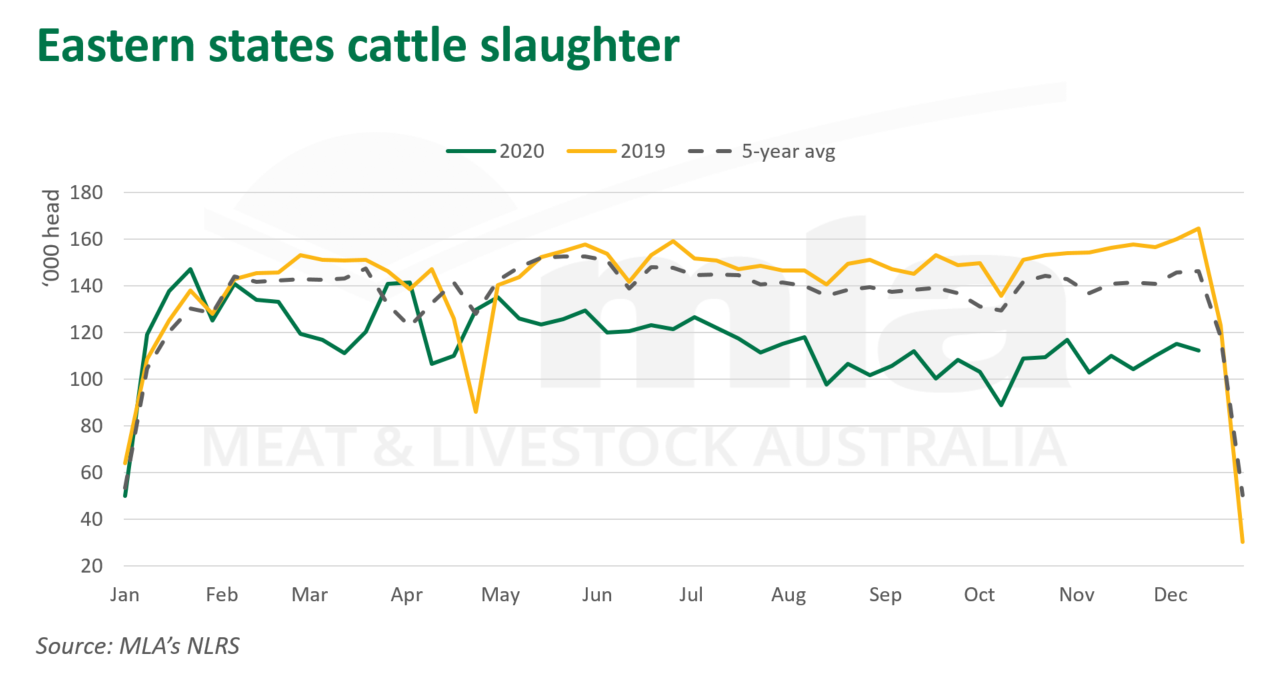

Slaughter volumes continued to decline following mass drought-induced turnoff in 2019 and heightened restocker activity in 2020 primarily out of NSW as supply continued to tighten. The continual rise of Australian domestic prices, along with a rise in the AUD, reduced the competitiveness of Australian exports. Nevertheless, Australia remained resilient with the high value of Australian meat able to offset the lower volumes exported in 2020.

New South Wales sought large amounts of cattle out of Queensland and the Northern Territory, helping to drive herd rebuild momentum. However, significant volumes on feed, high female slaughter and an underwhelming season across large parts of Queensland, the Northern Territory and Western Australia stalled the pace this rebuild, even with a La Niña still predicted throughout summer.

Price premiums at saleyards migrated from New South Wales to major Queensland selling centres, driven by tight supply and greater feed availability, as increased southern demand for northern light cattle lifted prices to maximise declining margins, with the finished end struggling to keep up.

Increased supply and record prices in Queensland allowed the EYCI to experience large rises week-on-week to consistently break new ground. Western Australia prices also gained momentum on the back of increased interstate demand and strong trade, with the Western Young Cattle Indicator (WYCI) achieving a record of 833.75¢/kg cwt on November 19, overtaking the EYCI record of 829.50¢/kg cwt.

Prices have since softened slightly as the selling year wraps up, but tightening supply and strong demand sentiment is expected to flow into the new year, underpinning high prices in 2021.

© Meat & Livestock Australia Limited, 2020

To build your own custom report with MLA's market information tool click here.

To view the specification of the indicators reported by MLA's National Livestock Reporting Service click here.