Key points:

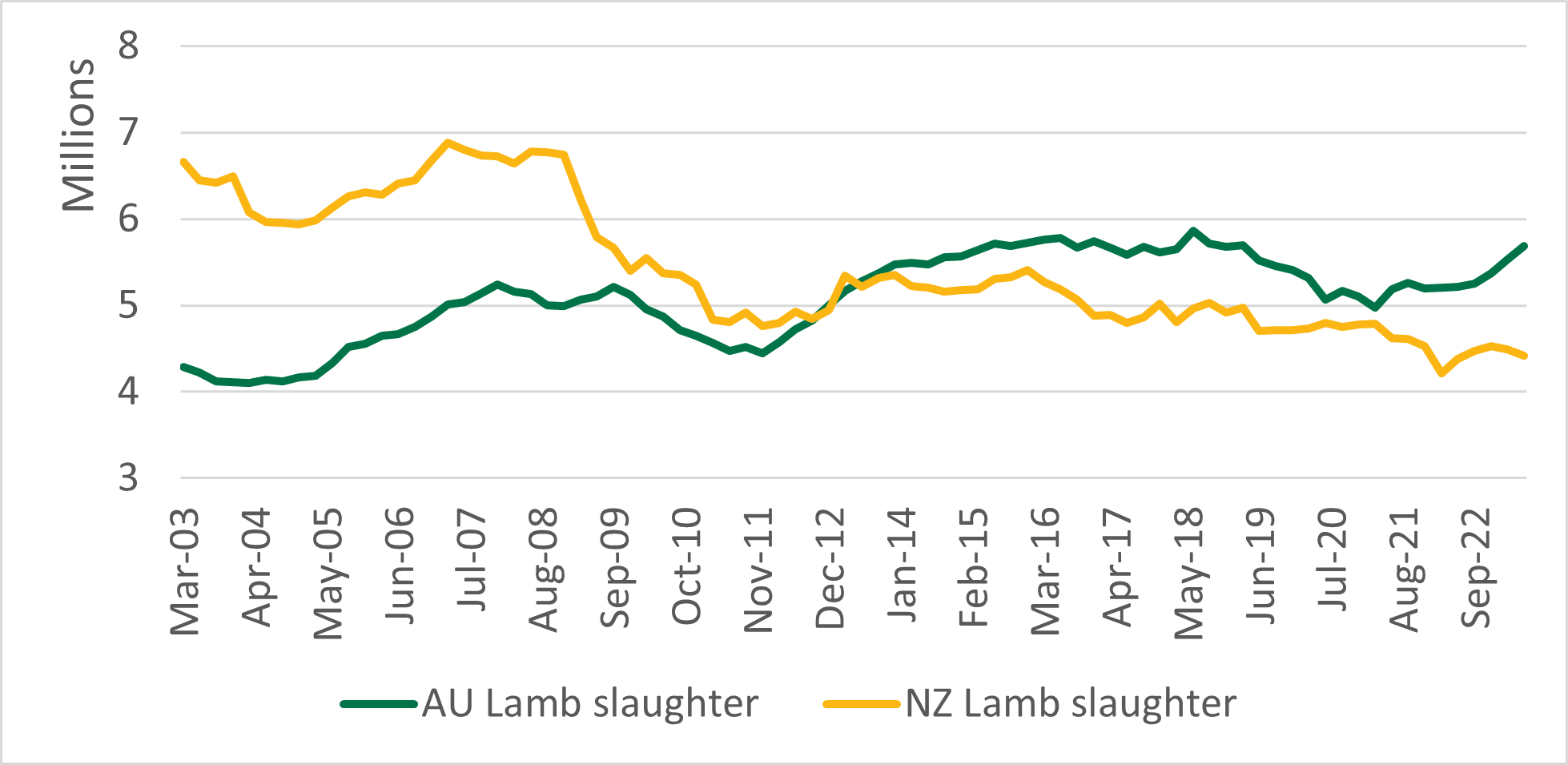

- Australia sits above New Zealand in lamb slaughter, growing 14% in the past decade.

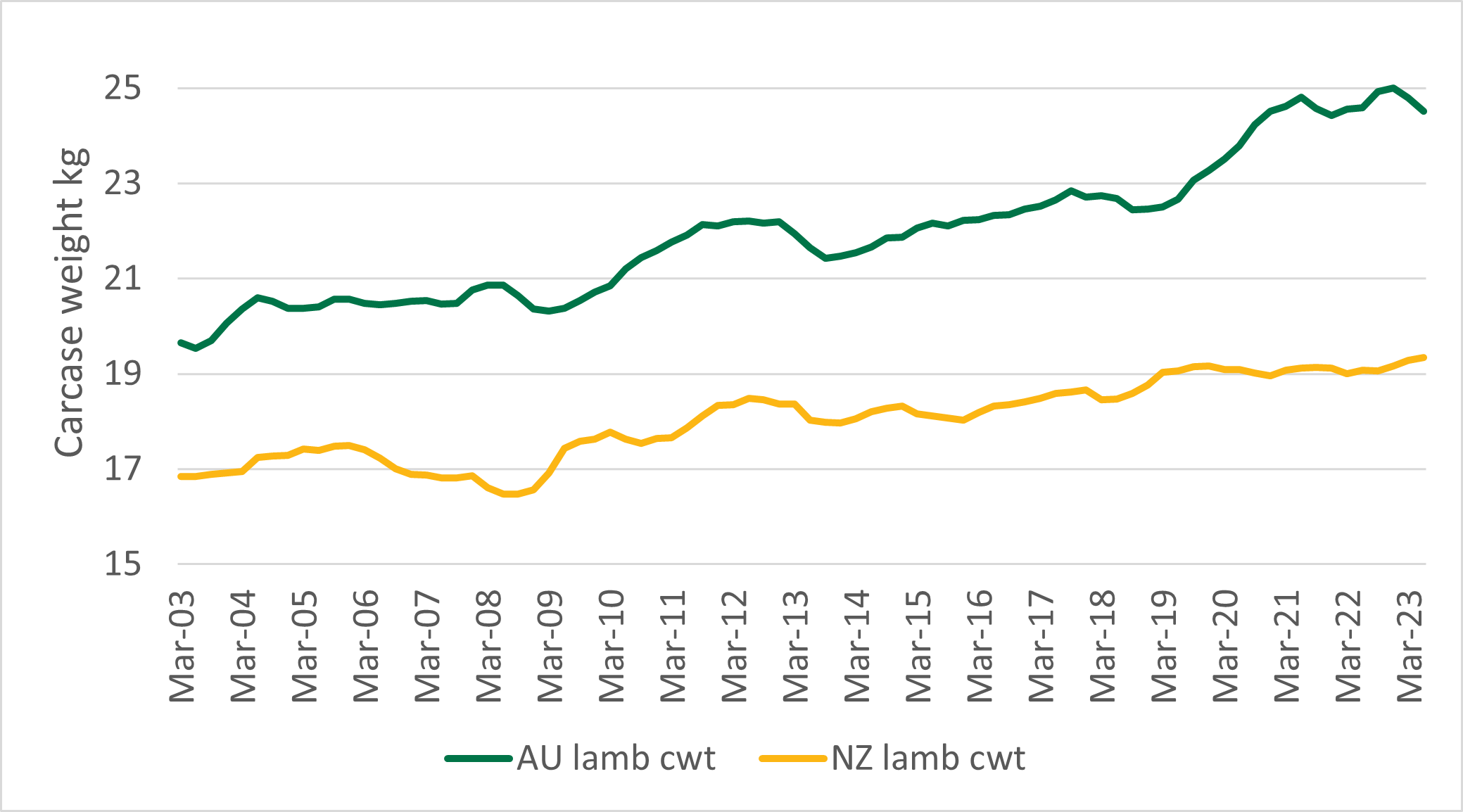

- New Zealand lamb carcase weights have increased by 10% between 2013 and 2023 to 19.5kg/head, while Australian carcase weights have increased by 14% over the same period to 24.6kg/head.

- The pronounced difference in carcase weight reflects the export markets New Zealand and Australia participate in.

New Zealand lamb slaughter has historically tracked above Australian lamb slaughter, but changes in New Zealand's agricultural land use and increased Australian productivity has led to a reverse in this dynamic, with Australian lamb production outpacing New Zealand.

Slaughter

Since September 2022, the gap between Australian slaughter and NZ slaughter has been expanding. Australian slaughter volume rose by 39%, and NZ volumes eased by 1%.

Between 2007 and 2014, New Zealand lamb experienced a decline in slaughter volumes, followed by a gradual downward trend in quarterly slaughter. This shift in lamb production patterns reflects changes in agricultural practices and land use across the country. Over the same period that lamb slaughter eased 25%, the New Zealand dairy cattle herd expanded 27% with milk solids making up a significant proportion of the country's agricultural exports.

This trend continued between 2013–2023 and has arguably intensified in recent years. Between Q1 2013 and Q2 2023, New Zealand lamb slaughter fell by 14% to 4,529,118 head.

In contrast, Australian lamb slaughter volumes rose by 12% from 5,327,800 in June 2013 to 6,058,700 in June 2023.

Carcase weights

Following similar trends in slaughter, Australian lamb carcase weights have increased significantly faster than New Zealand lambs. New Zealand sheep carcase weights have increased by 10% between 2013 and 2023 to 19.5kg/head. Meanwhile Australian sheep carcase weights have increased by 14% over the same period to 24.6kg/head. The stronger increases in the Australian carcase weights and the pronounced difference in size suggests Australian production is considerably more efficient, and reflects changes in on-farm practices and the genetic composition of the flock.

Exports

NZ and Australia are the two-leading global sheepmeat exporters, accounting for over 70% of global trade. Australia makes up the majority of export to the US and Middle East and North Africa (MENA) – two countries that prefer a larger carcase weight lamb product. New Zealand however, takes the market share for lamb exports to the United Kingdom and the European Union, markets which historically have preferred smaller and leaner carcase weights, and where New Zealand has historically held an advantage in market access.

Looking forward

As Australian lamb production reaches record levels, exports have likewise been rising to record highs. As the second largest sheepmeat exporter in the world, lower slaughter in New Zealand means that there is relatively less lamb supply on the global market for Australian exporters to compete with, presenting opportunities for Australia as lamb demand continues to rise around the world.

Attribute to Erin Lukey, Senior Market Information Analyst