The Greens will take a series of 'Robin Hood reforms' to the next election, Greens Leader Adam Bandt will tell the National Press Club tomorrow, where he will announce the first major measure: a 40% tax on the excessive profits of big corporations to fund significant cost of living support.

The share of income going to big corporations has never been higher. The price gouging behind these surging profits is a key driver of inflation and the cost of living crisis. With many Australians at breaking point due to rising rents, mortgages, and prices at the checkout, Mr Bandt will say that Labor's cosying up to big corporations is fuelling the crisis.

The money raised will be given back to everyday people in the form of crucial measures that will address the cost of living and inequality crisis, which the Greens will begin rolling out in the lead-up to the next election. These 'Robin Hood reforms' will help form the basis of the Greens' demands in a likely minority Parliament.

Independently costed by the PBO, the Greens' Big Corporations Tax package will raise $514b over the next decade. It ensures that big corporations who make excessive profits pay a higher share of tax on these excessive profits.

Key details on the proposals

The reforms in the Big Corporations Tax package apply to excessive profits across the economy, but the mechanism differs in each of three different sectors: the Big Corporations Tax (Gas and Oil) reforms the existing PRRT to close the loopholes that Labor has left; the Big Corporations Tax (Coal and Mining) is a 40% tax based on previous proposals for a mining super-profits tax, including the Henry Tax Review; and the Big Corporations Tax (Excessive Profits) is a 40% tax on excessive profits that applies to all other sectors. The Greens' tax changes are structured to ensure that investment is still incentivised (in areas other than fossil fuels), and are designed to be consistent with existing taxation arrangements to simplify compliance and auditing.

Big Corporations Tax (Excessive Profits)

Revenue: Will raise $296 billion

A 40% tax will be imposed on excessive profits. It will apply to profits earned on turnover after the first $100m. The corporate superprofits tax allows a reasonable rate of return (effectively defined as 5% + long term bond rate) on shareholder equity, allows for companies to carry forward credits for years that saw substantial revenue drops, and avoids financial cliffs that some critics say discourage smaller enterprises from expanding.

The policy has been designed to ensure that while it taxes excessive profits, it retains and extends the existing structure of the tax system that ensures the corporate super profits tax will not take a cent from the pockets of Australians who rely upon returns from their investments, like pensioners or the 17 million Australians1 with superannuation balances.

Big Corporations Tax (Gas and Oil)

Revenue: Will raise $111 billion

The revamped tax on offshore oil and gas will close the loopholes in the PRRT that Labor has left open through its failure to take on the big gas corporations. With 56% of gas currently given to big gas corporations for free 2, it will also mandate the payment of royalties.

Big Corporations Tax (Coal and Mining)

Revenue: Will raise $107 billion

A 40% tax is imposed on the super profits of mining projects. The revamped tax on mining profits excludes new and vital sectors, like lithium or nickel mining. It draws on the work of the Henry Tax Review that successive governments have refused to enact, so that everyone benefits from the resources that mining companies are extracting.

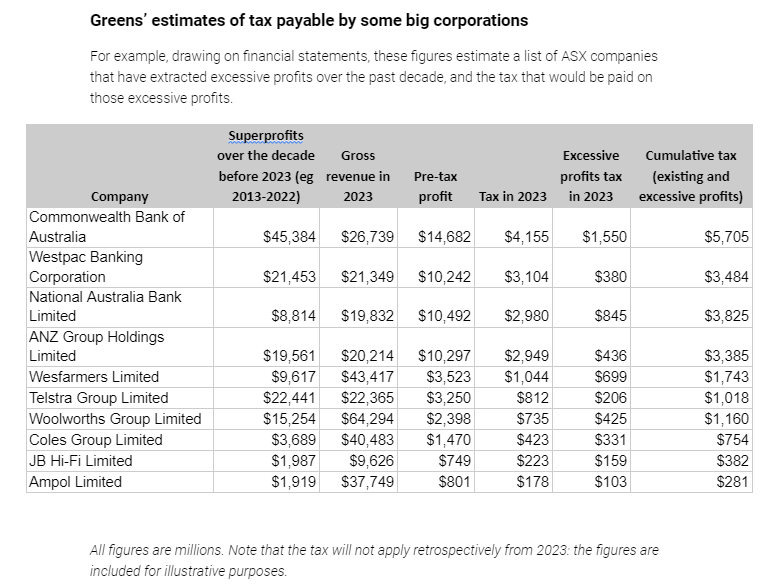

Greens' estimates of tax payable by some big corporations. For example, drawing on financial statements, these figures estimate a list of ASX companies that have extracted excessive profits over the past decade, and the tax that would be paid on those excessive profits.

National Press Club address extracts from Adam Bandt MP, Leader of the Australian Greens:

Enough is enough.

It's time to make the big corporations and billionaires pay their fair share of tax.

This election, the Greens will propose a package of Robin Hood Reforms.

The aim is simple.

To make the big corporations and billionaires pay their fair share of tax to make life better for everyone.

Today, I can announce the first of these Robin Hood Reforms.

We're calling it our Big Corporations Tax and it has a number of components.

The first component is targeted at big corporations who are making excessive profits, beyond a normal return to shareholders. It will apply to companies with an annual turnover of over $100m, taxing the excess profits these companies make.

This new Big Corporations Tax would apply to both Australian corporations, and multinational corporations operating in Australia.

Over the next decade, this tax is expected to raise $296b.

It will provide huge amounts of much needed funding to redirect to everyday people and it will reduce the cost of living.

Two other components are the Big Corporations Tax on the excessive profits of coal and other mining industries, and significant reform to the existing PRRT, so that it actually raises revenue.

The last time the country tried to seriously tax the excess profits of the mining industry, these companies poured millions of dollars into advertising, forcing Labor to sack their own democratically elected Prime Minister.

That doesn't mean it was the wrong thing to do, that is exactly why it needs to be done. We can't have the mining industry determining who is and who isn't running the country and who the country is run for.

If Labor hadn't capitulated so spectacularly, the country would have had an extra $35 billion in revenue between 2012 to 2020.

This money could have built homes, fixed teeth or kept people out of poverty but instead have been hoarded by mining corporations, hidden in offshore havens and handed off to CEOs in mega bonuses.

Big corporations across the economy have squeezed hundreds of billions of dollars out of the public since the end of the pandemic - too much of it tax free.

Because just one of the things we could do through a Robin Hood style Big Corporations Tax is to put dental into Medicare, for everybody, because your teeth should be included as basic healthcare.