Brazil self-imposed a suspension on beef exports to China, its largest market, during the first half of June, following the discovery of an atypical case of bovine spongiform encephalopathy (BSE). While the temporary disruption slowed trade to China, it proved more a speed hump than a major barrier, with trade soon up and running again. Moreover, Brazil is expected to continue its drive into Asia, particularly China, in the second half of 2019.

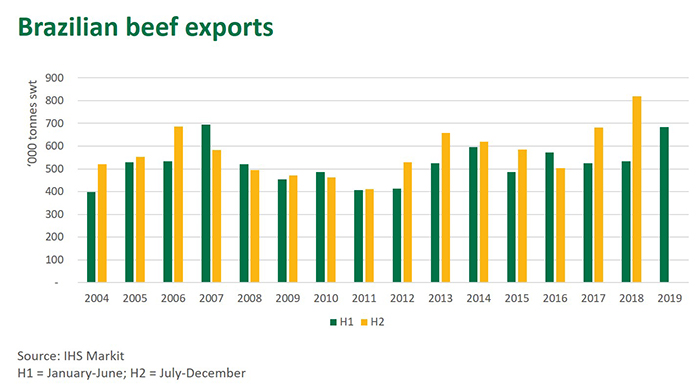

Brazilian beef exports in June declined 10% on the previous month, and shipments to China were back 32%, but still historically high. A year-on-year comparison is more difficult as freight in mid-2018 was heavily disrupted by the nation-wide trucker strike. In the first half of 2019, Brazilian beef exports, at 684,000 tonnes swt, were just shy where they peaked over the same period in 2007. Furthermore, Brazil typically exports a greater volume in the second half of the year - 12% more on average over the last 15 years - and this is expected to remain the case over the coming six months, further ratcheting up competition.

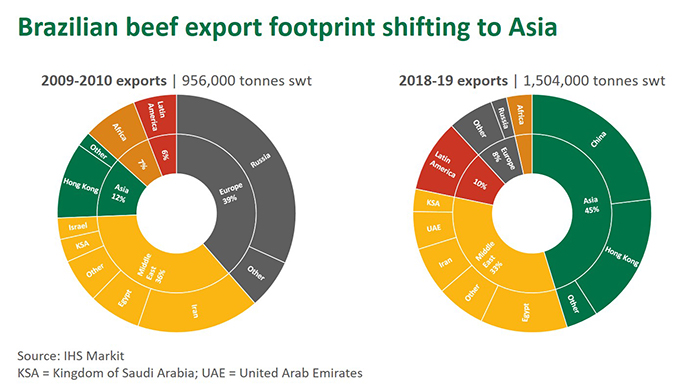

Over the twelve-months to June, Brazil shipped an unprecedented 1.50 million tonnes of beef, up 24% year-on-year and making it the world's largest exporter.

Not only is Brazil ramping up beef exports, it is increasingly focusing its attention on Asia. As highlighted below, Asia has become increasingly important to Brazil's export footprint, increasing from a 12% export share a decade ago to 45% over the last twelve months.

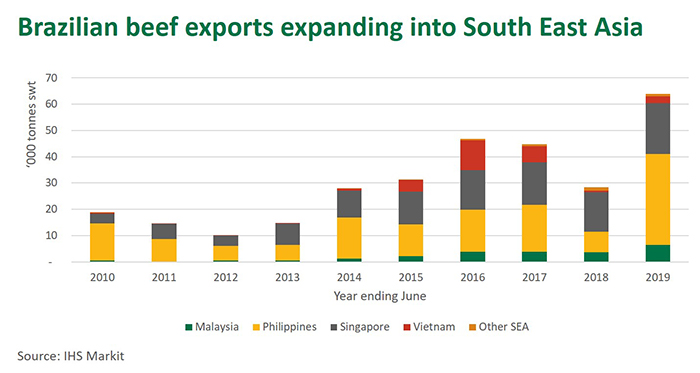

While China and Hong Kong have received the lion's share of this export pivot, other Asian markets have also increased in size. Most notably, exports to the Philippines have increased four-fold ( predominantly frozen manufacturing beef) while shipments to Singapore and Malaysia have expanded 29% and 78% year-on-year, respectively, over the last twelve months.

While Brazilian beef still lacks access to Japan, Korea and the US (three of Australia's four most valuable export markets and representing 61% of Australia's export footprint over the 12 months to May) it is very price competitive in China and South East Asia. As discussed recently, Australian cattle prices are now at a significant premium to Brazil (50% so far in 2019 on a currency adjusted basis), compounding the already high cost base in Australia (a recent AMPC study estimated it costs an extra 74% to process a kilogram of beef in Australia compared to Brazil).

While Brazilian competition in Asia will likely remain and may even increase, Australia alone cannot keep up with demand growth in many of these developing markets. For Australian beef, this means it needs to continue focusing on attracting the dollars of the wealthy and discerning consumer who is happy to pay a premium for high quality and safe Australian beef.

© Meat & Livestock Australia Limited, 2019