To start and scale-up a business, entrepreneurs need access to capital. In the early growth stages, accessing the necessary capital to make investments in their workforce, cutting-edge technologies, and new offices, labs, or manufacturing facilities can be difficult. While some entrepreneurs rely on venture capital or loans, the government recognizes funding is not available to all entrepreneurs, and even when available, may not be sufficient.

Entrepreneurs need more support to drive Canada's economic growth, increase productivity, patent new innovations, and create good-paying jobs. Providing an additional capital gains incentive for entrepreneurs will enable them to recycle more capital towards their next goal, whether it be a new company, an investment in a promising start-up, or a comfortable retirement.

A Tax Break for Entrepreneurs

In Budget 2024, the government announced a new Canadian Entrepreneurs' Incentive to reduce the inclusion rate to 33.3 per cent on a lifetime maximum of $2 million in eligible capital gains.

When this incentive is fully rolled out, entrepreneurs will have a combined full and partial exemption of at least $3.25 million when selling all or part of a business. The incentive will result in a one-third inclusion rate, and the limit will increase by $200,000 each year, starting in 2025, until it reaches $2 million in 2034.

The Canadian Entrepreneurs' Incentive is designed to encourage innovative entrepreneurs in research and start-up phases to scale-up their businesses, especially in the technology and manufacturing sectors. The additional $2 million incentive is for founding investors in certain sectors who own at least 10 per cent of shares in their business, and where the company has been their principal employment for at least five years. This will encourage innovators to keep innovating in Canada by providing entrepreneurs with more capital from selling their business to invest in their next great idea.

Ultimately, when the Canadian Entrepreneurs' Incentive is fully implemented, and combined with the increased total lifetime capital gains exemption of $1.25 million, entrepreneurs will benefit from at least $3.25 million in total and partial lifetime capital gains exemptions.

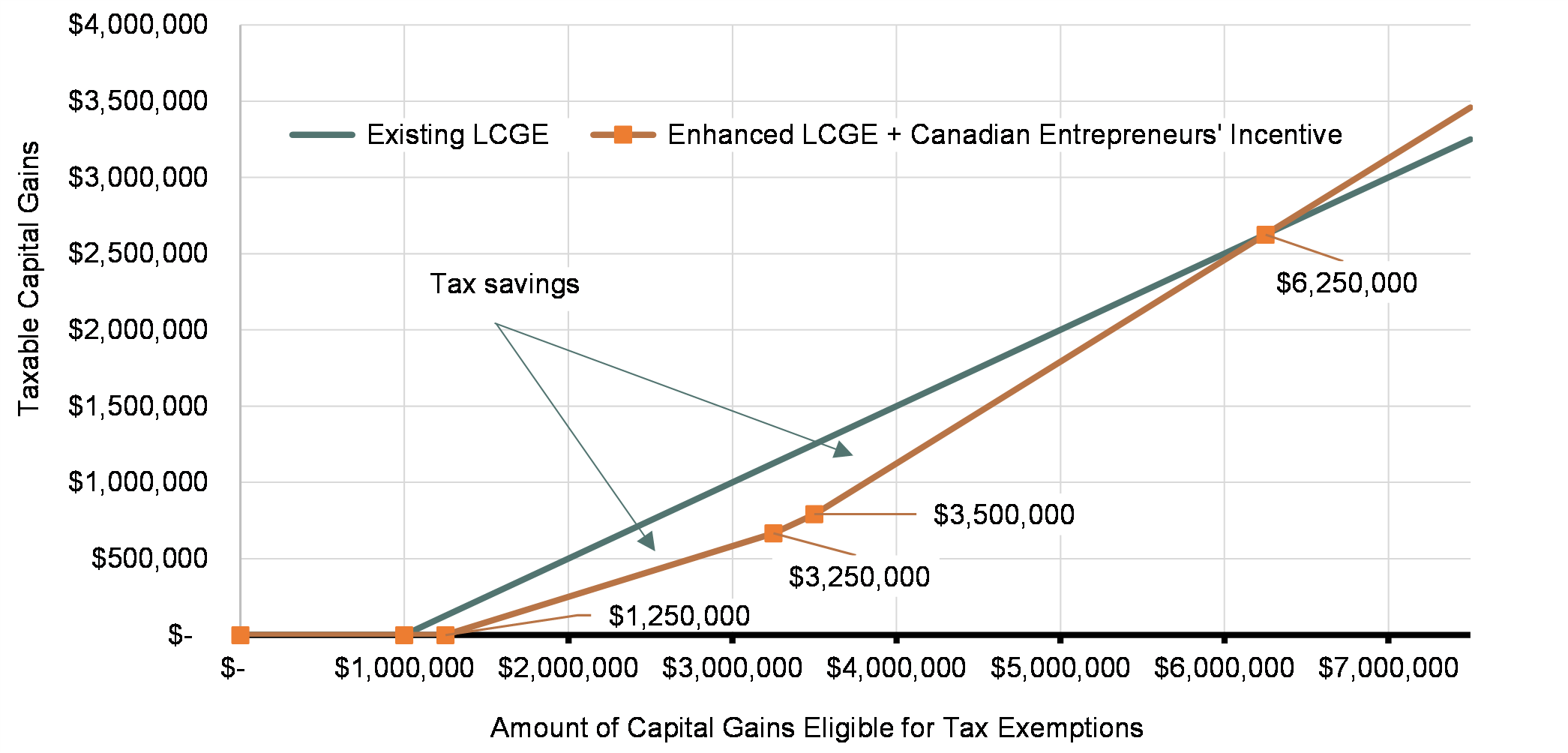

Entrepreneurs with eligible capital gains of up to $6.25 million will be better off under these changes.

The Canadian Entrepreneurs' Incentive Will Reduce Taxes on Capital Gains up to $6.25 million

It takes until an individual reaches $6.25 million in capital gains before all the savings between $1 million and $3.5 million (new Lifetime Capital Gains Exemption, plus $250,000 personal exemption, and plus the new Canadian Entrepreneurs' Incentive) have been recouped. Thus, $6.25 million is the breakeven point. Below $6.25 million someone is better off. Above $6.25 million is when they have more tax owing than under the previous system.

In practice, these tax savings will likely be even higher to reflect the inflation adjustment for the lifetime capital gains exemption and the ability to spread capital gains over multiple years, or to split a capital gain with a partner.

Ensuring entrepreneurs benefit from their innovations

An entrepreneur founded a fintech start-up several years ago, and decides to accept an offer to sell their company to a large fintech company, which will use its resources to scale-up their technology. The entrepreneur earns $2 million in capital gains on this sale.

They have already used the increased lifetime capital gains exemption of $1.25 million when they sold some of their business shares to a business partner.

Currently, they would pay tax on $1 million-or 50 per cent of their $2 million in capital gains.

When the Canadian Entrepreneurs' Incentive is fully implemented, they would only pay tax on 33 per cent of the $2 million-$667,000. The incentive reduces their taxable income by $333,000 when selling a business.