Substantial resource increases at Wharf and Palmarejo

Kensington's reserve-based mine life extended to five years - a doubling in three years

CHICAGO--BUSINESS WIRE--

Coeur Mining, Inc. ("Coeur" or the "Company") (NYSE: CDE) today reported its 2024 year-end mineral reserves and resources, and provided an update on the 2024 exploration program at its Palmarejo operation. Year-end 2024 proven and probable mineral reserves totaled 3.6 million ounces of gold and 270.5 million ounces of silver, which reflects a 22% year-over-year increase in gold reserves at Kensington and the inclusion of silver and gold ounces from the recently-acquired Las Chispas operation.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250218581271/en/

San Juan deposit

- Hole HGDH_159 returned 1.6 feet at 0.42 oz/t gold and 37.6 oz/t silver (0.5 meters at 14.4 g/t gold and 1,290.0 g/t silver)

- Hole HGDH_162 returned 9.1 feet of 0.03 oz/t gold and 2.7 oz.t silver (2.8 meters at 1.2 g/t gold and 253.3 g/t silver)

- Hole HGDH_169 returned 7.5 feet at 0.01 oz/t gold and 9.3 oz/t silver (2.3 meters at 0.4 g/t gold and 318.3 g/t silver)

"Coeur's sustained focus on brownfield exploration investment has been incredibly successful and continues to be a key differentiator. Over the past five years, our gold and silver mineral reserves have increased 40% and 48%, respectively, net of depletion, and our gold and silver mineral resources have grown considerably," said Mitchell J. Krebs, Chairman, President and Chief Executive Officer. "The acquisition of SilverCrest further strengthens the quality of our silver and gold portfolio as evidenced by the 12% increase in our overall reserve grade due to the addition of the high-grade Las Chispas operation.

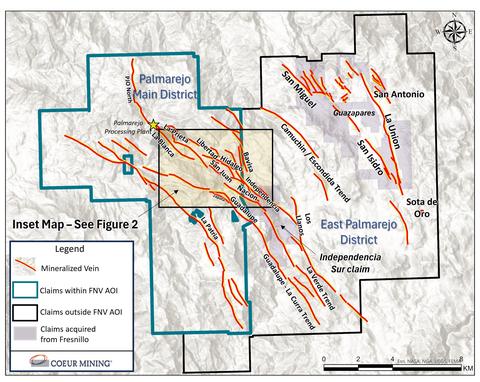

"At Rochester, the exploration team successfully replaced 2024 production. With a 16-year mine life, the focus remains on drilling higher-grade, near mine targets. Coupled with Kensington's impressive reserve growth and the substantial resource growth at Wharf, Coeur's core U.S. operations, where over 70% of our mineral reserves are located, are well-positioned for the future. At Palmarejo in Mexico, the 2024 exploration campaign was also a major success, leading to a 75% increase in its inferred mineral resource base. Overall exploration efforts at Palmarejo continue to trend to the east and outside of the area of the Franco Nevada gold stream, with approximately 60% of total 2025 exploration spending expected in the highly prospective areas in the eastern portion of the Palmarejo district, which we have now fully consolidated."

Coeur's gold and silver price assumptions for year-end 2024 reserves were $1,800 per ounce and $23.50 per ounce, respectively, which represented increases over year-end 2023 gold and silver reserve prices of $1,600 per ounce and $21.00 per ounce, respectively. The gold price assumption for reserves at Kensington increased from $1,850 per ounce at year-end 2023 to $2,000 per ounce at year-end 2024.

The Company increased its gold and silver price assumptions for year-end 2024 resources from $1,800 per ounce to $2,100 per ounce and from $25.00 per ounce to $27.00 per ounce, respectively, except at Kensington which gold price assumption increased from $2,000 per ounce to $2,300 per ounce.

For a complete table of all drill results, please refer to the following link: https://www.coeur.com/files/doc_