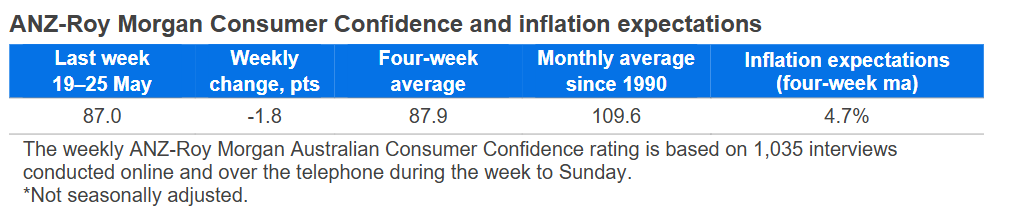

Consumer confidence fell 1.8 points last week to 87.0 points. The four-week moving average increased 0.9 points to 87.9 points.

'Weekly inflation expectations' lifted 0.2 percentage point to 4.7 per cent, while the four-week moving average ticked down 0.1 percentage point to 4.7 per cent.

'Current financial conditions' (over the last year) decreased 1.5 points, while 'future financial conditions' (next 12 months) declined 1.4 points.

'Short-term economic confidence' (next 12 months) lowered 4.9 points, and 'medium-term economic confidence' (next five years) eased 2.7 points.

The 'time to buy a major household item' subindex rose 1.7 points.

"ANZ-Roy Morgan Australian Consumer Confidence fell 1.8 points last week to 87.0 points. There was a broad-based fall across the subindices despite the Reserve Bank of Australia (RBA)'s 25 basis point rate cut last week," ANZ Economist, Sophia Angala said.

"This may have been influenced by the RBA's post-meeting commentary being more dovish than anticipated and the weaker outlook for growth, employment and inflation it expects from global trade uncertainty.

"We continue to expect progress to be made in negotiations between the US and its trading partners. This combined with Australia's expected resilience, particularly with regards to the labour market, will likely lead to a relatively shallow easing cycle. We expect a 25 basis point rate cut in August and another in the first quarter of 2026."