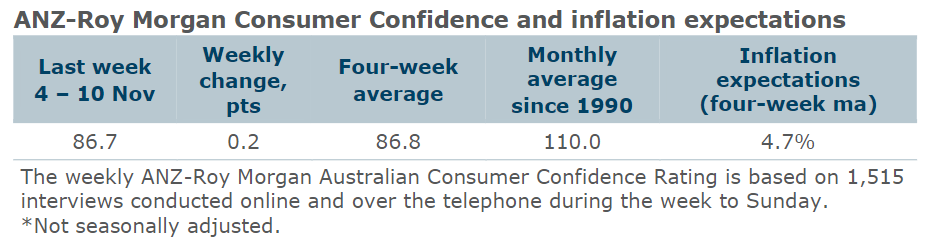

Consumer confidence rose 0.2 points last week to 86.7 points. The four-week moving average increased 0.8 points to 86.8 points.

'Weekly inflation expectations' rose to 4.9 per cent, while the four-week moving average increased 0.1 percentage point to 4.7 per cent.

'Current financial conditions' (over the last year) eased 1.8 points and 'future financial conditions' (next 12 months) declined 0.6 points.

'Short-term economic confidence' (next 12 months) fell 1.9 points, while 'medium-term economic confidence' (next five years) rose 0.2 points.

The 'time to buy a major household item' subindex increased 4.9 points.

"Consumer Confidence was steady last week after the Reserve Bank of Australia (RBA) kept rates on hold," ANZ Economist, Madeline Dunk said.

"Confidence continues to trend upwards, with the four-week average now at its highest level since January 2023.

"The four-week average of consumer confidence amongst outright homeowners and those paying off a mortgage reached its highest level since June 2022, which was just one month after the RBA started lifting the cash rate. Those paying off their mortgage are now more confident, on average, than renters.

"The 'time to buy a major household item' rose 4.9 points to its highest level since January 2023. This may be linked to the beginning of a range of pre-Black Friday sales events".