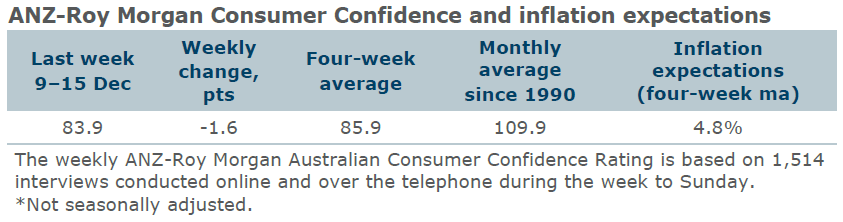

Consumer confidence fell 1.6 points last week to 83.9 points. The four-week moving average decreased 0.7 points to 85.9 points.

'Weekly inflation expectations' rose 0.3 percentage point to 4.8 per cent, while the four-week moving average was unchanged at 4.8 per cent.

'Current financial conditions' (over the last year) increased 0.6 points and 'future financial conditions' (next 12 months) declined by 0.5 points.

'Short-term economic confidence' (next 12 months) jumped 2.2 points, while 'medium-term economic confidence' (next five years) eased 0.5 points.

The 'time to buy a major household item' subindex dropped 7.9 points.

"There are signs the upward trend in ANZ-Roy Morgan Consumer Confidence has stalled, with the series down 4.5 points from the two and a half year peak a fortnight ago," ANZ Economist, Madeline Dunk said.

"Last week, confidence fell 1.6 points, to a nine-week low, despite the Reserve Bank of Australia (RBA) signalling it was more comfortable with the inflation outlook following its December meeting, opening the door for rate cuts early next year. We expect the RBA to begin easing rates in May 2025, but a February cut is possible.

"The decline in confidence was driven by a 7.9 point fall in the 'time to buy a major household item' measure. The subindex has dropped 10.6 points over the past fortnight following the conclusion of Black Friday sales. This may suggest anecdotal reports of stronger November spending reflected a bring-forward in end of year spending."