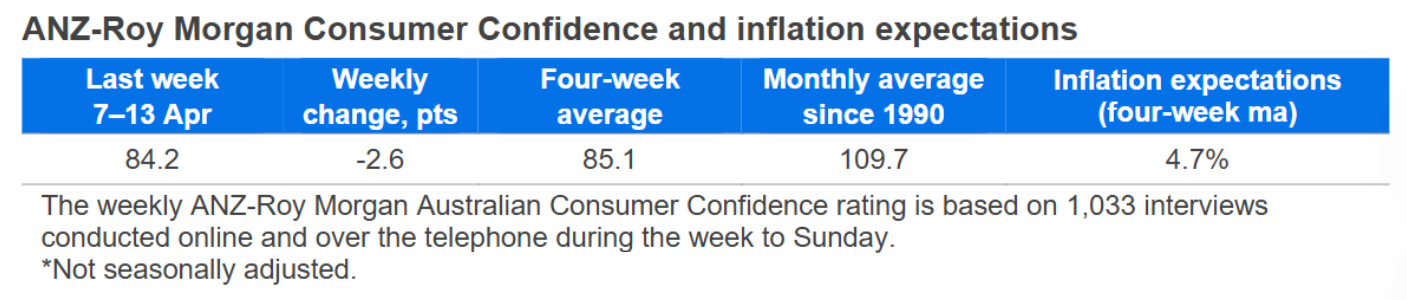

Consumer confidence fell 2.6 points last week to 84.2 points. The four-week moving average ticked up 0.1 points to 85.1 points.

'Weekly inflation expectations'was unchanged at 4 6 per cent ,while the four-week moving average declined 0.1 percentage point to 4.7 per cent.

'Current financial conditions' (over the last year) decreased 1.4 points, while 'future financial conditions' (next 12 months) eased 3.6 points.

'Short-term economic confidence' (next 12 months) lowered 6.4 points, and 'medium-term economic confidence' (next five years) dropped 2.3 points.

The 'time to buy a major household item' subindex lifted 0.6 points.

"Consumer confidence fell 2.6 points last week to 84.2 points. The drop likely reflects the more pessimistic global backdrop following US tariff announcements - the previous week's survey was taken partly before and partly after the initial announcement," ANZ Economist, Sophia Angala said.

"Consumer confidence fell most sharply in subindices that describe the year ahead. Both financial and economic confidence fell below their respective second half 2024 averages. In a speech last week, the Reserve Bank of Australia (RBA) Governor Michele Bullock noted the RBA is focusing on how global uncertainty could impact household and business decisions domestically.

"We expect the RBA to cut the cash rate by 25 basis point at each of its May, July and August meetings this year."

Please note the next ANZ-Roy Morgan Australian Consumer Confidence report will be released on Wednesday 23 April due to the Easter public holidays.