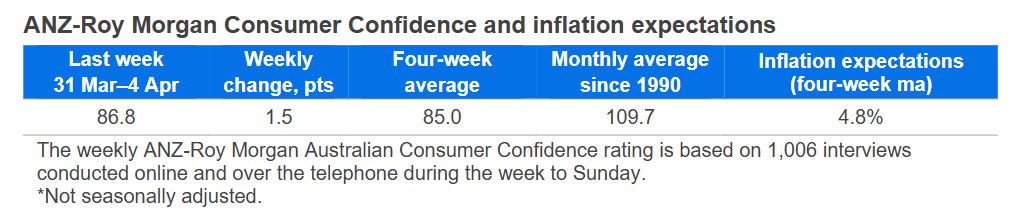

Consumer confidence rose 1.5 points last week to 86.8 points. The four-week moving average was steady at 85.0 points.

'Weekly inflation expectations' ticked down 0.1 percentage point to 4.6 per cent, while the four-week moving average was unchanged at 4.8 per cent.

'Current financial conditions' (over the last year) decreased 2.3 points, while 'future financial conditions' (next 12 months) increased 2.9 points.

'Short-term economic confidence' (next 12 months) lifted 3.6 points, and 'medium-term economic confidence' (next five years) jumped 5.6 points.

The 'time to buy a major household item' subindex declined 2.5 points.

"ANZ-Roy Morgan Australian Consumer Confidence increased 1.5 points last week following the Reserve Bank of Australia (RBA)'s decision to keep the cash rate on hold at 4.10 per cent. The series is just 1.7 point higher than immediately before the RBA's 25 basis points cut six weeks ago," ANZ Economist, Sophia Angala said.

"The lack of material increase in recent weeks may reflect recent global trade uncertainty, which has likely offset some of the upward pressure on confidence from stronger domestic economic conditions. It should be noted that last week's survey period did not capture the weekend (5-6 April) and mostly occurred before the latest US tariff announcements."