Key points:

- Beef and lamb exports reached new February export records.

- The US was the largest market for beef, lamb and goat, while China was the largest market for mutton.

- Goatmeat reached an all-time monthly export record in February.

Beef

Beef exports hit a new February record, with exports lifting 25% year-on-year to 117,502 tonnes. This total is 11% above the previous February export volume record set in 2015 of 106,054 tonnes.

The United States (US) remained the largest market, with exports rising 64% year-on-year to 35,092 tonnes. As Australian production has lifted over the past several years, most of the additional beef has gone into the US. In February 2022 – at the peak of the Australian rebuild – Australia exported 9,025 tonnes (one quarter of what was exported in February 2025).

Outside of the US, exports were also strong. Exports to:

- China lifted 36% year-on-year to 21,373 tonnes

- Korea lifted 28% to 17,779 tonnes

- Indonesia lifted 79% year-on-year to 5,012 tonnes.

Of Australia's major beef markets, only exports to Japan eased, falling 15% year-on-year to 20,115 tonnes as a weak yen and high cost of living impacted demand.

Goatmeat

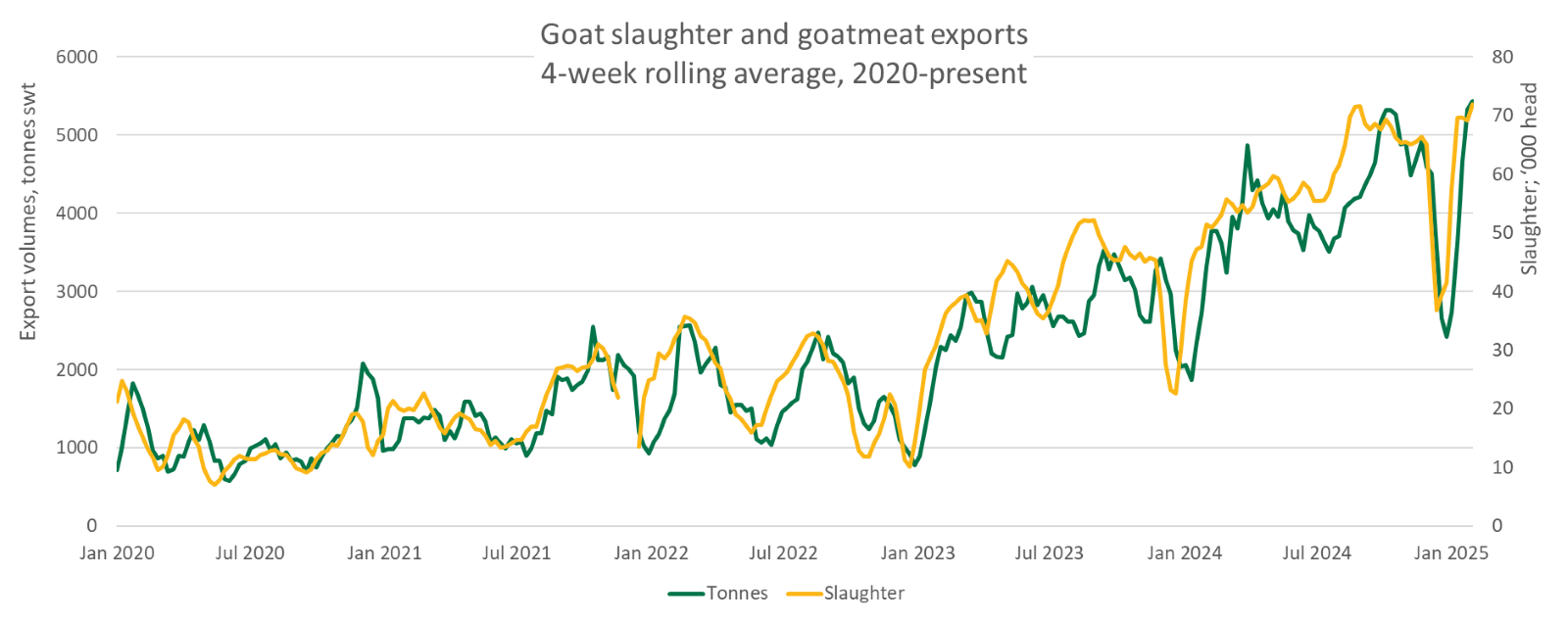

Goat exports hit an all-time high in February at 5,892 tonnes. This is in line with record slaughter; as Australia exports the vast majority of goatmeat production, higher slaughter tends to translate directly into higher exports.

Source: DAFF, MLA's NLRS

The US remained the largest market, with most additional exports going to China. Exports to the US rose 4% year-on-year to 2,245 tonnes, while exports to mainland China rose 301% (a four-fold increase) to 1,255 tonnes. This means that, even as exports to the US reach record levels, the US made up a smaller portion of total exports.

Lamb and mutton

Exports of Australian lamb rose 3% year-on-year to 31,977 tonnes, while mutton exports fell 4% to 20,345 tonnes.

The US remained the largest lamb market, with exports rising 15% year-on-year to 8,657 tonnes. This was largely driven by a 22% increase in chilled lamb exports to 5,928 tonnes.

Across most of Australia's other major markets, a dynamic emerged where importers swapped between lamb and mutton, despite overall export volumes remaining relatively unchanged. For example, in the Middle East and North Africa region, overall sheepmeat exports fell by 8% year-on-year, made up from a 23% decline in lamb exports and a 14% increase in mutton exports. In the same way, lamb exports to China lifted 10% year-on-year to 5,739 tonnes, while mutton exports rose 3% to 6,863 tonnes. Together this totaled 12,602 tonnes, 6% more than February last year.

Attribute content to: Tim Jackson, MLA Global Supply Analyst

MLA makes no representations as to the accuracy, completeness or currency of any information contained in this publication. Your use of, or reliance on, any content is entirely at your own risk and MLA accepts no liability for any losses or damages incurred by you as a result of that use or reliance. No part of this publication may be reproduced without the prior written consent of MLA. All use of MLA publications, reports and information is subject to MLA's Market Report and Information Terms of Use.