The last time Canada's political parties campaigned during a tax season was more than a decade ago . This year, taxes are a hot topic, and for good reason. Shortly after the federal election was called, the political parties began rolling out promises of tax cuts to win over voters .

Author

- Esteban Vallejo Toledo

PhD Student in Law and Society, University of Victoria

At the same time, although Canada's consumer carbon tax was scapped last month, debates about the industrial carbon tax are likely to continue .

As the election campaign continues and political parties make more tax-related promises , approximately 3,520 tax clinics and 18,090 volunteers are doing their best to help people file their taxes until April 30. Some of the volunteers are struggling to help as many people as possible .

No candidate has talked about a tax issue that is essential for life in free and democratic societies: tax literacy. If Canada is to maintain an informed, financially responsible and democratic society, tax literacy must become part of the national conversation.

A longstanding idea with modern relevance

The notion of tax literacy has been gaining traction in recent years, but it's far from a new idea.

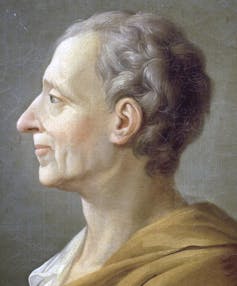

One of the earliest advocates for tax literacy and education was Charles Montesquieu, a French judge and political philosopher of the Enlightenment.

In his 1748 book The Spirit of Laws , Montesquieu argued for tax literacy and education for two key reasons.

First, he was convinced that knowledge about taxation was necessary to defend oneself against the corruption and abuse that characterized private tax collectors, known at the time as tax farmers.

Second, he believed education in democratic societies could enhance people's sense of responsibility for public affairs and help hold authorities accountable for their actions. In his view, tax literacy and education were instrumental in how societies organized themselves for the common good.

More than 275 years later, Montesquieu's argument remains just as relevant.

Tax literacy is neglected in Canada

In Canada, tax literacy continues to be neglected despite efforts by tax agencies like Canada Revenue Agency (CRA) and Revenu Québec to promote it.

There are important reasons to treat tax literacy as a national priority. It helps people understand and navigate federal, provincial and municipal taxes, recognize the social importance of taxation and responsibly exercise their rights. It also allows people to manage their financial affairs according to the law.

Tax literacy is also instrumental in contesting economic populism , a political approach that claims to represent the interests of "ordinary people" against perceived elites, often by oversimplifying complex issues like taxation.

It also helps counter the spread of of disinformation, misinformation and malinformation about taxes in the media , online and on social networks .

In Canada, recent examples include misleading claims that Canada has the highest taxes in the world , mischaracterizations of climate tax policies , flawed analyses of the carbon rebate's cost and other misconceptions about the carbon rebate .

Tax literacy vs. financial literacy

While Canada has done considerable work to further financial literacy since 2001, tax literacy has received far less attention from both authorities and scholars.

In fact, only two peer-reviewed studies have examined tax literacy in Canada. Published in 2016 and 2020 , these studies analyze tax literacy within the context of financial literacy and mostly in relation to the income tax.

Similar to financial literacy , the authors of these studies define tax literacy as "having the knowledge, skills and confidence to make responsible tax decisions."

Canada's federal and provincial governments, as well as non-profit organizations and tax preparers , tend to use a benefit-based narrative to promote tax literacy and encourage tax compliance.

This narrative frames filing income taxes as positive because it allows people to receive direct payments from the government. In Canada, the income tax system is closely linked to the social support system that benefits everyone, particularly low-income people for whom filing taxes is the primary way to access benefits such as the Canada Child Benefit, the GST/HST Credit and the Canada Workers Benefit.

The missing fiscal dimension

While the benefit-based approach aligns with international standards and has clear advantages, it also has drawbacks.

Most notably, it overlooks the fiscal dimension of tax literacy. This dimension highlights the role taxes play in raising revenue to support government programs , promoting collective well-being, regulating economic activity, addressing social inequalities, strengthening democratic institutions and advancing social goals like environmental protection .

Taxes are far more than mandatory payments to government. Recognizing this enables citizens to actively participate in decision-making processes and hold governments accountable.

The fiscal dimension also broadens public understanding beyond the income tax. On one hand, it helps people interact with tax authorities beyond the CRA, including those administered by provinces , municipalities and First Nations .

On the other hand, it helps citizens better understand public budgets and recognize that while income tax is an important source of revenue, it is not the only one .

The fiscal dimension also challenges harmful narratives that attempt to create social divisions by using the terms " taxpayer " and " taxpayer money ." It also counters the spread of wrongful stereotypes of Indigenous people . These narratives are often used in populist rhetoric to undermine democracy by excluding marginalized groups.

What needs to happen now

Tax literacy must become a national priority in Canada, and public institutions must lead this process. To move in this direction, Canada's public institutions should:

1) Adopt a holistic approach to tax literacy that includes both the fiscal and financial dimensions.

2) Address misinformation and discrimination experienced by Indigenous people regarding tax exemptions. This is essential to honouring the Truth and Reconciliation Commission's Calls to Action .

3) Offer long-term partnerships and support to teachers and educational institutions to integrate tax literacy into schools.

4) Lead the production of education resources to ensure a holistic approach. Education resources produced or sponsored by the private sector tend to focus on individual responsibility and frame financial choices in moral terms without considering broader social contexts.

5) Ensure tax literacy initiatives serve not only children and youth but adults as well, in line with UNESCO's vision of education as a lifelong right .

6) Ensure adult tax literacy resources follow the recommendations of the OECD (Organisation for Economic Co-operation and Development) . They should be thorough but easy to understand, offered in multiple formats, concise and supplemented by additional resources. Public authorites should expand podcasts , learning platforms and tax initiatives .

The history of taxes in Canada has been one of important developments but also of social and economic conflicts , wrongful discrimination and colonial racism . It must not also become a history of populism and missed opportunities.

Now is the time for Canada to write a different chapter. By advancing tax literacy, both authorities and society as a whole can strengthen democracy and build a more informed public.

![]()

Esteban Vallejo Toledo receives funding from the Law Commission of Canada Emerging Scholars Program. He has previously received funding from SSHRC, LFBC, and UVic.