Australia's aviation sector appears to have recovered from the COVID-19 pandemic as passenger levels and capacity returned to pre-pandemic levels, the ACCC's latest Domestic Airline Competition in Australia report reveals.

Australia's major airlines-Bonza, Jetstar, Qantas, Rex and Virgin Australia -carried 4.9 million domestic passengers in March 2024, which represented 98.8 per cent of passenger figures in March 2019. The airlines also flew around 6.2 million seats in March 2024, which was just below seat capacity recorded in March 2019.

"After four years of instability, the domestic airline industry has returned to more typical seasonal levels that were last seen before the pandemic," ACCC Commissioner Anna Brakey said.

"The increase to airline seat capacity has contributed to lower airfares for consumers on domestic routes. We hope to see this trend continue as the airline industry returns to a more stable market."

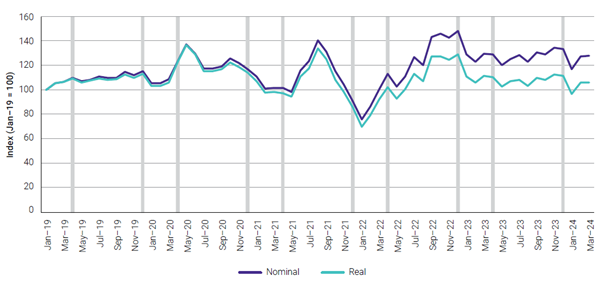

In March 2024, average revenue per domestic passenger decreased in both nominal terms (by 1.4 per cent) and real terms (by 4.8 per cent) compared to March 2023.

The report found that airfares spiked on some routes in February, likely due to the high demand caused by multiple major events.

In February 2024, domestic passenger numbers exceeded 2019 levels for the first time since the pandemic. This surge in demand was driven by several major entertainment events taking place across the country in February which led to large amounts of people traveling domestically. Most notably, this included Taylor Swift's concert tour in Melbourne and Sydney, as well as a World Wrestling Entertainment event in Perth.

Index of average fare revenue per passenger across all routes - January 2019 to March 2024

Source: ACCC calculations using data from the ABS and data collected by the ACCC from Bonza, Jetstar, Qantas, Rex and Virgin Australia.

Note: The average revenue per passenger includes both economy and business fare revenue. It excludes data associated with ancillaries, such as baggage fees, and food and drink sold on board. Data has been adjusted for inflation using ABS Consumer Price Index quarterly data up to March 2024.

Regional connectivity at risk from Bonza collapse

Australian travellers will have less choice for direct flights to regional destinations if low-cost airline Bonza is not able to recommence services after entering voluntary administration.

Bonza had played a key role in connecting regional hubs across the domestic network as it tried to stimulate demand on new routes not offered by other airlines. The number of domestic routes in Australia had increased to 178 in March 2024, a net increase of 22 routes since 2019.

In March 2024, before Bonza entered voluntary administration, the low-cost carrier offered 37 domestic routes. Of these, 35 connected regional locations and 30 were unserved by any other airline.

"Since Bonza began operations, travellers benefited from more affordable airfares and the convenience of direct connections to various regional and holiday destinations otherwise not offered by other airlines," Ms Brakey said.

Direct connections at Maroochydore (Sunshine Coast) and Coolangatta (Gold Coast) airports will suffer the most disruptions following the suspension of Bonza's services. Maroochydore Airport, where Bonza was based, would see direct connections reduce from 14 to three routes and Coolangatta Airport would see the number of direct connections halved.

Due to its small fleet size and exclusion of the busiest domestic routes from its network, Bonza had been unable to capture more than two per cent of the passenger market and competed with other airlines on just seven of its routes.

"While Bonza's impact on competition had been limited to date, its presence represented an opportunity for greater competition to emerge in the highly concentrated domestic aviation sector," Ms Brakey said.

Map of new and cancelled routes on the domestic air passenger network, March 2019 and March 2024

Service reliability still below long-term industry averages, but improving

Service reliability has improved in recent months despite remaining worse than the long-term industry average.

In March 2024, the industry cancelled 2.8 per cent of flights, which represented an improvement from 5.0 per cent in December 2023. Similarly, on-time performance across the industry was 77.2 per cent in March 2024, improving from 63.6 per cent in December 2023.

Note

Where a business enters voluntary administration, consumers' ordinary legal rights can be affected. What happens to consumers' rights with respect to outstanding credits, gift cards, refunds and other reimbursements will depend on what happens in the administration process.