Highlights:

Three (3) drill holes for approximately 1,419 metres (m) have been completed during the Summer 2024 Drill Campaign.

Drill hole CS24-021 encountered five (5) spodumene-pegmatite intervals, with the widest continuous interval of 347.1 m, the longest interval announced by the Company to date.

Drill hole CS24-019 encountered 16 spodumene-pegmatite intervals, with the widest continuous interval of 56.8 m.

Drill hole CS24-020 encountered 17 spodumene-pegmatite intervals, with the widest continuous interval of 22.2 m.

VANCOUVER, BC / ACCESSWIRE / September 11, 2024 / Q2 Metals Corp. (TSX.V:QTWO)(OTCQB:QUEXF)(FSE:458) ("Q2" or the "Company") is pleased to provide an update from its Summer 2024 Drill Program at the Cisco Lithium Property (the "Property" or the "Cisco Property") located within the greater Nemaska traditional territory of the Eeyou Istchee James Bay region of Quebec, Canada.

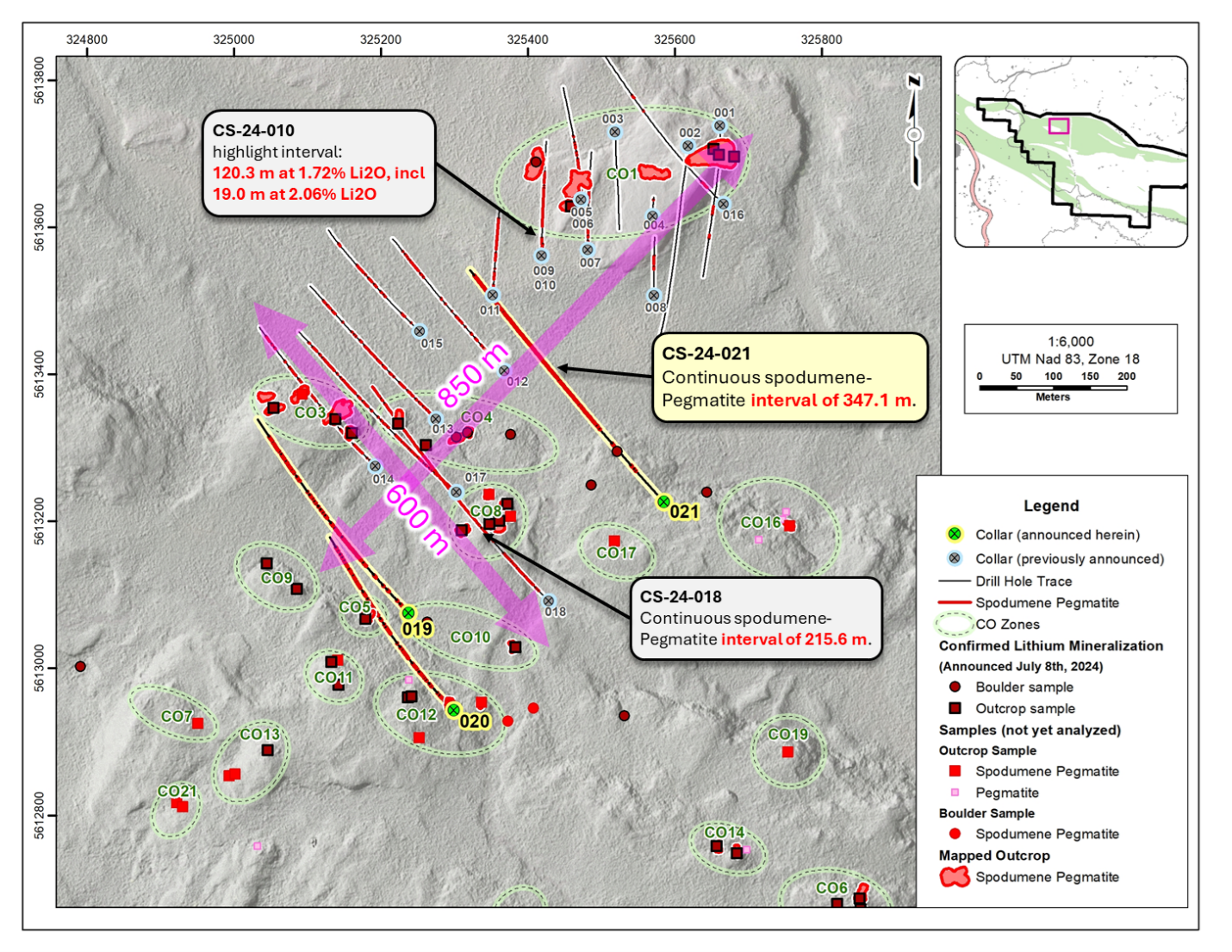

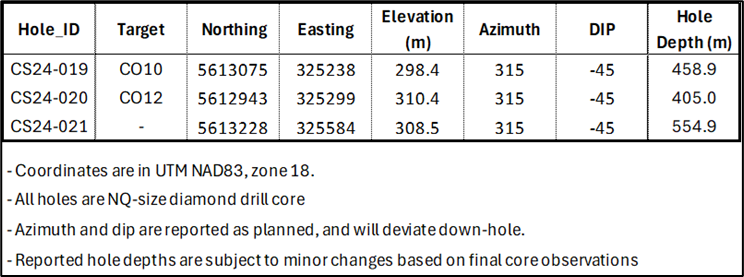

The Summer 2024 Drill Campaign is focused on exploring the connection of the wide, continuous pegmatite zones encountered in holes CS24-010 and CS24-018, located approximately 300 m apart and continuing to drill the large (1.9 by 1.5 kilometres (km)) surface mineralized area in a systematic grid-like manner with wide hole spacing (200 m), and infill drilling in areas with better results. Three (3) drill holes (CS24-019 to 021) have now been completed for approximately 1,419 m and the visual results of each are herein reported on. All holes intercepted pegmatites with visual indications of spodumene mineralization identified.

"The Cisco Property continues to deliver and exceed expectations," said Q2 Metals President and CEO Alicia Milne. "The latest visuals from holes 19 to 21 reveal thick intersections of spodumene-mineralized pegmatite with beautiful white core and large crystals, reaffirming Cisco's immense potential and scale."

"With the verification of a large and continuous mineralized body at the core of our drill-tested area, hole 21 has been an absolute mindset shift for our team," said Q2 VP Exploration Neil McCallum. "Our next steps will be to continue to expand upon our already excellent results."

Summer 2024 Drilling Update

Drill holes CS24-019 and 020 were drilled approximately 100 m to the southwest of hole CS24-014 at the CO3 outcrop area, extending the drill-defined strike length to 850 m.

Drill hole CS24-021 was designed to test the Company's theory of the continuation of the large pegmatite intervals in drill hole CS24-010 which reported a continuous interval of 120.3 m at 1.72% Li2O including 19.0 m at 2.06% Li2O, and drill hole CS24-018 which included a wide continuous spodumene pegmatite interval of 215.6 m, with analytical results pending.

The continuous interval of 347.1 m in hole CS24-021 is located 100 m to the southwest of drill hole CS24-010 and 200 m northeast of drill hole CS24-018. The definition and expansion of a large, continuous and well-mineralized spodumene pegmatite zone is the priority for the rest of the 2024 season and the upcoming winter drilling season.

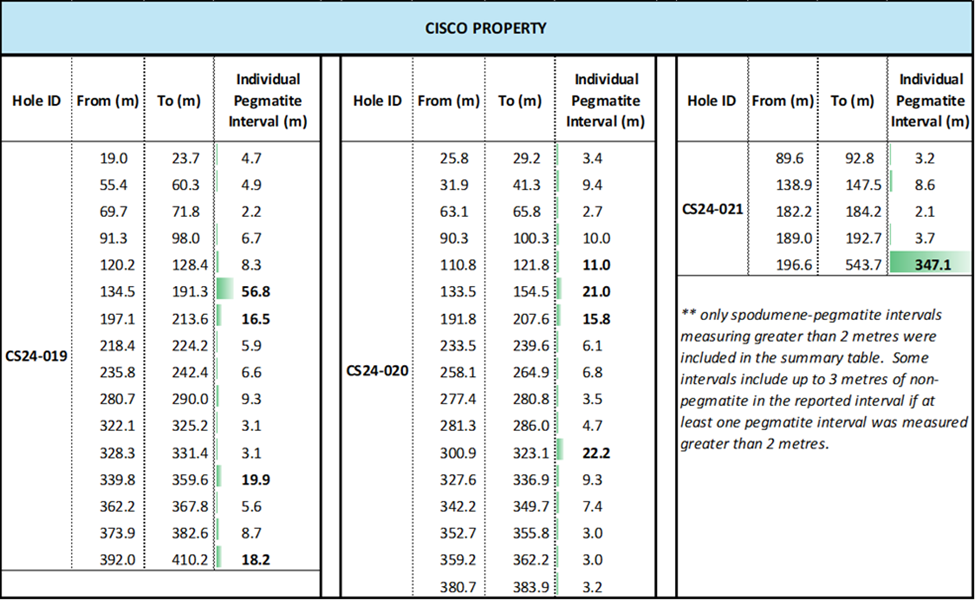

Drill hole CS24-019 encountered 16 individual spodumene pegmatite intervals. Four (4) intervals are greater than 10 m wide, with the widest individual interval measuring 56.8 m.

Drill hole CS24-020 encountered 17 individual spodumene pegmatite intervals. Four (4) intervals are greater than 10 m wide, with the widest individual interval measuring 22.2 m.

Drill hole CS24-021 encountered five (5) individual spodumene pegmatite intervals. One (1) interval is greater than 10 m wide, with the widest individual interval measuring 347.1 m.

The mineralized intervals in all the holes are not necessarily representative of the true width and the modelled pegmatite zones are being refined with every additional hole.

Cautionary Statement: The presence of pegmatites does not confirm the presence of lithium (spodumene or other lithium minerals). Pegmatites are fractionated coarse grained igneous rocks commonly associated with lithium mineralization; however, many pegmatites do not contain mineralization. The presence of any mineralization can only be confirmed with assaying.

The geological team has completed the core cutting and logging of hole CS24-019 to CS24-021 and the samples have been dispatched to the SGS Canada preparation laboratory located in Val-d'Or, QC for mineral analysis to confirm the presence of lithium.

Private Placement Financing

The Company remains well-funded, having recently completed a non-brokered private placement financing and raised total gross proceeds of $6,878,479.08.

On August 2, 2024, the Company announced that it had completed the first tranche of the private placement, raising a total of $2,529,999.45 by the issuance of 1,142,857 flow-through units at a price of $0.35 per unit and 8,519,998 non flow-through units at a price of $0.25 per unit. On August 9, 2024, the Company announced that it had completed the second and final tranche of the private placement, raising $4,348,479.63 by the issuance of 8,506,315 charity flow-through units at a price of $0.475 per unit, 22,800 flow-through units at a price of $0.35 per share and 1,200,000 non flow-through units at a price of $0.25 per unit.

Each flow-through unit and each charity flow-through unit consisted of one flow-through common share of the Company (a "FT Share") and one half of one share purchase warrant (each whole warrant, a "Warrant"). Each Warrant will entitle the holder to acquire one additional non- flow-through common share of the Company at a price of $0.50 per share for a period of two years. Each non flow-through unit consisted of one non-flow-through common share of the Company and one half of one Warrant.

Gross proceeds from the issuance of the charity flow-through units and the flow-through units will be used to incur "Canadian exploration expenses" that qualify as "flow-through critical mineral mining expenditures", as such terms are defined in the Income Tax Act (Canada) (the "Tax Act"), on the Company's lithium projects in Quebec that the Company will renounce to the subscribers pursuant to the Tax Act with an effective date not later than December 31, 2024. Where applicable, gross proceeds from the sale of the FT Shares from purchasers in Québec will also qualify as "Canadian exploration expense" under the Taxation Act (Québec) and qualify for inclusion in the "exploration base relating to certain Québec exploration expenses" and the "exploration base relating to certain Québec surface mining exploration expenses", under the Taxation Act (Québec). Proceeds from the sale of the NFT Units will be used for general working capital.

Aggregate finders' fees totaling $85,425.02 and 306,600 broker warrants were paid to arm's length finders in connection with the private placement, with each such broker warrant bearing the same terms as the Warrants. The Offering remains subject to receipt of acceptance by the TSX Venture Exchange.

About the Cisco Property

The Cisco Property is comprised of 222 mineral claims and is 11,374 hectares in size. It is located less than 10 km east of the Billy Diamond Highway, and is approximately 150 km north of Matagami, a small town that contains the closest rail link to much of James Bay. The Property lies within the greater Nemaska Community lands of the Eeyou Istchee Territory, James Bay, Quebec.

The Property is situated along the Frotet Evans Greenstone Belt, comprised of a volcanic package dominated by mafic to felsic metavolcanic rocks, of the southern James Bay Lithium District, the same belt that hosts the Sirmac and Moblan lithium deposits, located 130 km and 180 km away, respectively.

Sampling, Analytical Methods and QA/QC Protocols

All drill core samples were shipped to SGS Canada's preparation facility in Val D'Or, Quebec, for standard sample preparation (code PRP92) which includes drying at 105°C, crushing to 90% passing 2 mm, riffle split 500 g, and pulverize 85% passing 75 microns. The pulps are then shipped by air to SGS Canada's laboratory in Burnaby, BC, where the samples are homogenized and subsequently analyzed for multi-element (including Li and Ta) using sodium peroxide fusion with ICP-AES/MS finish (code GE_ICM91A50). The reported Li grade will be multiplied by the standard conversion factor of 2.153 which results in an equivalent Li2O grade. Drill core was saw-cut with half-core sent for geochemical analysis and half-core remaining in the box for reference. The same side of the core was sampled to maintain representativeness.

A Quality Assurance / Quality Control (QA/QC) protocol following industry best practices was incorporated into the sampling program. Measures include the systematic insertion of quartz blanks and certified reference materials (CRMs) into sample batches at a rate of approximately 5% each. Additionally, analysis of pulp-split and reject-split duplicates was completed to assess analytical precision. The QP has verified the QA/QC results of the analytical work.

Qualified Person

Neil McCallum, B.Sc., P.Geol, is a registered permit holder with the Ordre des Géologues du Québec and Qualified Person as defined by NI 43-101 and has reviewed and approved the technical information in this news release. Mr. McCallum is a director and VP Exploration for Q2.

About Q2 Metals Corp

Q2 Metals is a Canadian mineral exploration company focused on unlocking its portfolio of lithium projects in the Eeyou Istchee James Bay region of Quebec, Canada, that includes both its 100-per-cent-owned Mia Lithium Property and the Cisco Lithium Property.

The Cisco lithium property is located approximately 150 km north of Matagami, Que., and comprises 222 mineral claims and is 11,374 ha in size. The property has district-scale potential with an already identified mineralized zone and a discovery drill result that included 120.3 metres at 1.72% lithium oxide (hole CS-23-010).