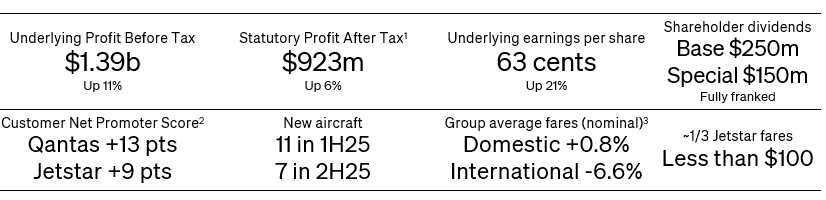

The Qantas Group achieved an Underlying Profit Before Tax of $1.39 billion, an increase of 11 per cent, and a Statutory Profit After Tax of $923 million, an increase of 6 per cent, for the half year ended 31 December 2024.

The performance was driven by the strength of the Group's dual brand strategy with demand for travel remaining strong across all customer segments. Qantas and Jetstar's domestic and international businesses delivered increased profitability carrying almost 10 per cent more customers.

Premium and corporate travel remained strong for Qantas while Jetstar carried a record number of customers[4] in a high cost of living environment, with around one in three flying for less than $100.

The Group continues to invest in renewing its fleet with 11 new aircraft and five mid-life aircraft arriving in the half. A key highlight of the result was the contribution from Jetstar's new Airbus A321LRs and A320neos, which have grown to 21 aircraft providing scale benefits and are now delivering a step change in fuel efficiency, network growth and customer satisfaction.

Qantas' fleet renewal is also underway with five A220s now in operation and performing well. However, as the fleet is still sub-scale, benefits were outweighed in the half by costs associated with transitioning to a new fleet type.

The investment in new aircraft will be complemented by a significant cabin overhaul across existing aircraft to improve the flying experience for customers. New investment announced today will see 42 Qantas Boeing 737 aircraft fitted with new cabins including next generation Business and Economy seats and larger overhead lockers. See separate release.

Qantas Loyalty also performed well, underpinned by active member engagement and cash inflows from partners growing by 11 per cent and 18 per cent respectively, as well as a significant investment in increased reward availability through the roll out of Classic Plus.

While customer satisfaction improved for all segments, there is more progress to be made. The Group is focused on the things that matter most for customers including improved on time performance, inflight service, rewards for frequent flyers and a more seamless travel experience. In recognition of the outstanding contribution our people make every day, the Group made a $1,000 thank you payment to 27,000 non-executive employees in December.

Transformation remains a priority for the Group and has effectively offset the impact of inflation for the half. The Group has seen higher than CPI growth in airport and government charges, a constrained aviation supply chain driving higher engineering costs and the impact of Same Job Same Pay legislation on wages.

For the first time since FY19, the Group will pay dividends to shareholders, with a $250 million base dividend and a $150 million special dividend, which are both fully franked (26.4 cents per share).

Comments from Qantas Group CEO Vanessa Hudson

"The Group's performance highlights the benefits of having both a premium and a low fares airline and a strong loyalty program.

"With a growing fleet of new aircraft, Jetstar went from strength to strength delivering a better experience for customers and an improved financial performance. Importantly, Jetstar was able to help more Australians take a holiday for less.

"Qantas Domestic revenue grew strongly and, like Jetstar, will see significant benefits as its fleet renewal ramps up, starting with the arrival of the A321XLR in the coming months.

"We're seeing progress from the investments we are making for our customers and people but we know there's more work to do to consistently deliver in the moments that matter. This is a key part of rebuilding trust and continues to be our focus.

"Australians have always loved to travel and continue to prioritise it over other spending options. Looking forward, we continue to see intention to travel from leisure and corporate customers remaining high.

"Our financial strength means we are now in a position to pay our shareholders dividends for the first time in almost six years.

"The dedication of our people and the continued loyalty of our customers underpin our success, and I want to sincerely thank them."

Group Domestic

Demand for both corporate and leisure travel continued to grow, driving an Underlying EBIT of $916 million for Group Domestic, with a 5 per cent improvement in unit revenue. This includes a 2 percentage point increase in load factors.

Qantas benefitted from the return of more high-yielding business travel, maintaining its revenue share of both large corporate and small and medium sized Australian businesses. Resources sector flying continued to grow, with a 14 per cent increase in charter revenue driven by adding more A319 aircraft.

Qantas also saw the benefits of its A220 aircraft delivering a boost in customer satisfaction and lower fuel burn per seat. Qantas is expecting an annual up to $9 million EBITDA benefit per A220 compared to the Boeing 717s they are replacing once the fleet reaches scale.[5] The arrival of more mid-life Q400 turboprop aircraft is also ensuring ongoing, reliable air connections for regional Australia. Temporary costs associated with this fleet transition, including costs as a result of aircraft delays, restructuring and fleet write downs were higher in the half.

Jetstar carried a record number of customers in a high cost of living environment and delivered a 54 per cent increase in domestic earnings compared to the previous year. The airline benefitted from the introduction of eight new aircraft in the half with six A321LRs and two A320neos joining the fleet. This enabled Jetstar's capacity to grow by 8 per cent and offer more flights to a growing network of destinations, and more low fares.

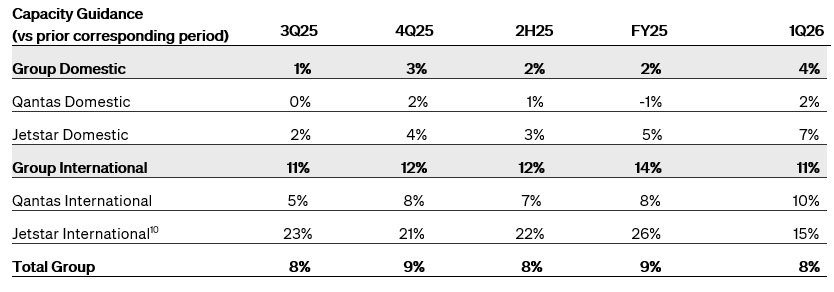

The Group will continue to invest in its fleet with seven new aircraft expected to arrive in the second half of this financial year, including the arrival of Qantas' first A321XLR, which is now expected in June, two A220s and four additional Jetstar aircraft. Looking forward, customers will benefit from a significant upgrade of Qantas' 737 cabins.

The Group has seen higher costs in the half as a result of increases in airport passenger and security charges. Airlines globally are continuing to experience supply chain issues, with QantasLink's regional fleet most affected. This will ease with the retirement of older Q300 and Q200 aircraft.

Average Group domestic fares grew less than inflation.

Group International and Freight

Demand for international travel continued to grow with Group International earnings up 5 per cent with an Underlying EBIT of $497 million.

Qantas experienced an increase in demand for premium cabins across its international network, with a 2.5 percentage point increase in load factors across First, Business and Premium Economy cabins. Qantas' long-haul, direct flights continue to perform well, delivering consistently high customer satisfaction.

The impact of the Same Job Same Pay legislation and supply chain constraint affecting A330 fleet part availability and engineering are the main drivers of cost increases.

Looking forward, the remaining two A380s are expected to return to service later this calendar year. The airline expects its first Project Sunrise A350-1000ULR to enter the final assembly stage in September 2025, which will be followed by flight testing ahead of its delivery in the second half of calendar year 2026.

Jetstar grew its international capacity in and out of Australia by 26 per cent, with the arrival of the new and larger A321LR aircraft enabling the redeployment of existing 787 aircraft to longer routes. The low fares airline added six new international routes in the half: Perth-Singapore/Phuket/Bangkok, Sydney-Vanuatu, Brisbane-Bangkok and Sunshine Coast-Auckland. Routes to Japan and Bali continue to be popular and perform well.

Average Group International fares were down by 6.6 per cent, as Qantas, Jetstar and international carriers added more capacity.

Qantas Freight net revenue grew by 11 per cent with capacity restoration and fleet renewal delivering more freight capacity and unit cost improvements, coinciding with strong market demand and continued e-commerce growth.

Qantas Loyalty

Qantas Loyalty continues to deliver strong results, achieving an Underlying EBIT of $255 million for the half. Membership reached 17 million, with 11 per cent growth in active members compared to the previous period.

There was a 10 per cent increase in points earned, driven by strong performance in financial services, credit cards, retail and insurance. More than two-thirds of all points are now earned on the ground across a coalition of more than 800 partners. The full acquisition of TripADeal has expanded Loyalty's holiday package offering, driving more engagement in the program.

Points redeemed grew by 6 per cent supported by a continued commitment to Classic Flight Rewards, with over 13,000 Classic reward seats booked on average each day and the rollout of Classic Plus, which provided an additional 20 million new reward seats for the calendar year. There have been positive early signs, with double the growth in points earn for members who have redeemed on Classic Plus.

As expected, the launch of Classic Plus had an impact on Underlying EBIT in the first half of FY25. The business expects around 10 per cent Underlying EBIT growth for the full year.

Financial framework and shareholder returns

Net debt remained at $4.1 billion as at 31 December 2024 with the acquisition of new aircraft and return of capital to shareholders through on-market share buy-backs. Net debt is expected to be at or below the middle of the target range for FY25, which is forecast to be $4.7 - $5.8 billion by the end of the financial year, with capex of $3.8 - $3.9 billion for the year weighted to the second half.

The Group ended the half with more than $11.5 billion of liquidity, including $2.3 billion in cash, $1.2 billion in committed undrawn facilities and more than $8 billion in unencumbered fleet and other assets.

With the business generating sufficient franking credits, the Board has approved a fully franked base dividend of $250 million (16.5 cents per share), expected to be sustainable through the cycle[6], and a special dividend[7], also fully franked, of $150 million (9.9 cents per share). The dividends will be paid on 16 April 2025.

In 1H25, the Group completed the return of $431 million[8] to shareholders through previously announced on-market share buy-backs.

The strength in the balance sheet and expected future growth in the business will continue to support the increase in fleet investment, ongoing customer and people initiatives, and future shareholder returns.

Customer and people

Qantas and Jetstar have introduced a suite of improvements over the past 18 months to provide a more reliable, comfortable and seamless customer experience.

In addition to the significant ongoing investment in new aircraft and cabin refurbishments, Qantas has upgraded lounges in Adelaide and Broome, introduced more flexible multi-use flight credits and integrated Apple's 'Share Item Location' feature for AirTags to better track bags throughout the journey. Jetstar has enhanced its digital servicing, including making it faster to check in online and simpler to make payments online and in the air.

These and other improvements are expected to continue the positive momentum on the Group's operational, customer and brand metrics. Qantas' net promoter score improved 13 points in 1H25 compared to 1H24 with Jetstar improving 9 points over the same period.

Qantas' on time performance improved by 2 points in the half compared to 1H24 and Jetstar improved 3 points[9]. With more progress to be made, Qantas has today announced it will expand its Group Boarding process across all regional, domestic and international flights departing Australia. Since Group boarding was introduced in June 2024 on some domestic 737 flights, boarding times have been 3 minutes faster on average.

Additional investment is planned with construction to commence this year on new Auckland and Sydney International Business lounges while improvements are being made to the inflight dining experience for economy customers on Qantas international flights.

The Group is continuing to invest heavily in its people, with employee engagement improving and attrition declining.

More than 1,500 new employees were hired in first half of FY25 to support fleet renewal and growth, along with 1,100 internal promotions and new opportunities. The Group also committed $40 million in new ground training facilities and equipment, doubled the number of 2025 pilot academy scholarships and announced an Australia-first Safety Academy.

Sustainability, community and governance

The Qantas Group continues to make progress towards its 2030 sustainability targets. Through its Climate Fund, Qantas has committed more than $100 million to date into sustainable aviation fuel (SAF) projects and environmental planting projects that generate carbon credits.

In the first half of FY25, the Group expanded its corporate SAF program, supported the expansion of reef restoration projects through its $10 million partnership with the Great Barrier Reef Foundation and diverted more than 130 tonnes of waste through its inflight recycling program.

The Group continues to build its support for Australian communities, including a new four-year partnership with Surf Lifesaving Australia and 750 volunteers to be recruited and trained through the partnership with the Australian Red Cross.

In August 2024, the Qantas Board released a report following a review of key governance matters and committed to implementing actions to address all of the 32 recommendations. The majority of actions have now been completed and the remainder are underway. Ultimately, this will result in stronger governance and better outcomes for stakeholders.

Outlook

The Group expects strong travel demand across the portfolio heading into the second half.

Group Domestic unit revenue is expected to increase by 3-5 per cent in the second half of the financial year compared to the previous year. Group International unit revenue is expected to be flat over the same period.

Net freight revenue in 2H25 is expected to be $10-30 million higher compared to the second half of last year.

The Group is managing the impact of recent USD strength through hedging, natural revenue offsets and network flexibility.

Other key assumptions and expectations are summarised below; please see the full Investor Presentation for more detail.

- FY25 fuel cost approximately $5.22 billion, inclusive of hedging and gross carbon cost of around $70 million.

- FY25 depreciation and amortisation is expected to be approximately $2.03 billion. Net finance costs expected to be $250 million.

- Targeting transformation of approximately $400 million in FY25 to offset CPI, inclusive of cost and revenue initiatives.

- The gross impact of Same Job Same Pay legislation in FY25 is approximately $65 million. Looking to offset through revenue and cost savings.

- Fleet-related EIS costs and inefficiencies for 2H25 vs 2H24 include:

- Entry into service (EIS) costs $22 million ($30 million for FY25).

- QantasLink fleet inefficiencies moderating to $17 million ($41 million for FY25).

Qantas Group Capacity

[1] Statutory Profit After Tax includes $65m increase in legal provision in relation to the ground handling outsourcing Federal Court case

[2]Domestic and International Net Promoter Scores 1H25 compared to 1H24.

[3]1H25 compared to 1H24.

[4] Record for current Jetstar operating airlines.

[5] Excluding Entry Into Service and transition costs

[6]All future distributions remain subject to Board approval.

[7] In line with financial framework and subject to Board approval, surplus capital will be returned to shareholders through special dividends in addition to base dividend.

[8]This includes remaining $31 million of FY24 on-market share buy-backs and excludes $17 million executed and paid in July 2024 due to T+2 settlement.

[9] Percentage of Qantas Domestic and QantasLink and Jetstar domestic flights that departed on time in 1H25 compared to 1H24.