The RLC has today released a new report - Removing rightsizing roadblocks - that examines how the removal of financial barriers can encourage older Australians to 'rightsize' and create much-needed housing opportunities for younger families.

This national report showcases how reforms to the Age Pension assets test and Commonwealth Rent Assistance (CRA) eligibility could save almost 100,000 older Australians from being financially penalised for 'rightsizing' into a more manageable home in a close-knit retirement community.

The pre-election proposal sets out to:

- Allow single homeowners who 'rightsize' to own assets of up to $550,000 before their Age Pension income is impacted, with an equivalent increase to the threshold for couples. The current threshold is $314,000 for singles.

- Remove the incoming purchase price threshold for Age Pensioners who 'rightsize' into retirement villages to allow access to CRA payments, consistent with eligibility applicable to residents in other seniors' communities (land lease and manufactured home estates). Currently the threshold is $252,000.

RLC Executive Daniel Gannon said the changes could lead to significant outcomes across the country.

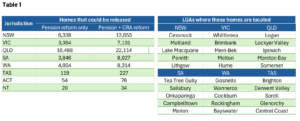

- Release 59,576 homes back into the Australian housing market (see table 1 overleaf).

- Encourage an additional 94,000 seniors to access retirement village housing options.

- Generate $2.95 billion in stamp duty revenue for state governments.

- Reduce costs and demand on public housing, hospital and aged care systems.

- Improve quality of life for older Australians as more move into age-friendly retirement villages.

"Prehistoric policies are locking older Australians in large family homes during a housing crisis when 'rightsizing' initiatives should be front and centre to ease pressure on housing and healthcare systems," Mr Gannon said.

"It's absurd that policies written decades ago are expected to keep up with modern day house prices and cost of living. Older Australians risk losing their pension while younger people are in housing limbo.

"This election is an opportunity for the major parties to prioritise older Australians and fix a broken system to improve outcomes for everyone."

Age Pension reform

Over 30 years from 1994 to 2024, there has been an almost 600 per cent increase in capital city median house prices, but over the same period the allowable assets to receive a full Age Pension have increased by only 178 per cent for a single homeowner and 193 per cent for a couple.

"Seismic shifts in housing markets and skyrocketing prices mean 'asset rich, cash poor' older Australians are actively punished for 'rightsizing' into more suitable housing as they free up equity," Mr Gannon said

"Tens of thousands of older Australians are trapped in big and underutilised homes while young families are stuck in housing limbo. Frankly, it's unconscionable.

"Home Care packages are unattainable with more than 80,000 people currently on a waitlist, meaning older Australians are living in homes no longer suited for ageing bodies and often without the care or conditions they need to safely age in place."

There would be no anticipated cost to government for Age Pension reforms.

Commonwealth Rent Assistance reform

In 1997, the CRA cap covered 55 per cent of the median house price, but today it's just 26 per cent. If it kept pace, it would be $550,000 - incidentally, the national average price of a two-bedroom retirement village unit - and not $252,000.

"Different people receive CRA based on different circumstances, and it even differs between housing types. For example, people who are on the Age Pension and live in land lease communities are eligible for rent assistance from the Commonwealth, regardless of purchase price," Mr Gannon said.

"By contrast, retirement village residents who receive the Age Pension and pay more than $252,000 for their leasehold unit instantly lose their right to access CRA.

"This is another outdated policy that draws a line - and for no reason - between different seniors' housing options that do the same thing in keeping people healthier and happier for longer.

"The evolution of housing markets in recent years is well known, yet CRA eligibility practically remains frozen in time, meaning older Australians are left disadvantaged."

This new report, prepared in conjunction with Ansell Strategic, reveals the average value of homes released across the nation is $825,000. These dwellings are primarily self-contained homes with three or four bedrooms, located in outer metropolitan areas, and ideal for younger families.

The projected cost of CRA reforms - if applied prospectively - would be $244 million pa.

The Local Government Areas (LGAs) highlighted in Table 1 comprise a high concentration of low-middle and middle-wealth seniors - 'asset rich-income poor' Australians - who would gain the most from the proposed policy changes.