Highlights

Russian weapons, including bombs, missiles, and drones, depend on crucial electronic components, such as field programmable gate arrays (FPGA) and microcontrollers, many of which cannot be made by Russia. In many cases, produced only by Western companies, these essential components are being sourced by Russian electronics importers and trading companies in large quantities from, foremost, China. The Russian trading company Elmak LLC, aka Kometa LLC, has imported over $5 million of Western electronic goods, almost entirely via China. Over 90 percent of the items fall under Tier 1 of the Bureau of Industry and Security and European Union List of Common High Priority Items banned for export to Russia and at heightened risk of being diverted to Russia illegally due to "their importance to Russia's war efforts."

China's lack of action to prevent these sales justifies NATO's recent labeling China as a "decisive enabler of Russia's war against Ukraine," [1] adding weight to calls for the application of more sanctions against Chinese suppliers and enabling banks. But U.S. and other Western companies need to do more. They should not ship to China any electronics known to be used in weapons against Ukraine. U.S. companies should show greater due diligence on the final use and end users of their products and simplify supply chains to prevent unauthorized transfers of electronics with restricted Harmonized System (HS) codes. At the very least, companies should agree not to export the most important electronic items to China, which have been identified in Russian weapons downed in Ukraine. Otherwise, as the war continues, with more U.S and other Western manufacturers' electronics found in Russian weapons in Ukraine after causing casualties and destruction, these manufacturers look increasingly insensitive and powerless against their own complicity in supporting Russia's illegal war.

Introduction

Russia's war in Ukraine depends on advanced weapons of numerous different types. Many of these weapons in turn have proven to depend on Western, in particular U.S.-manufactured, integrated electronic circuits, many of which Russia is unable to make. There are many needs for such electronics among civilian Russian industries, but Russia's illegal war against Ukraine demands strong responses, including actions to deny Russia the Western electronic goods required by its drones, missiles, and guided bombs. As a result, many countries have imposed bans on the export of a wide range of electronics to Russia.

In response, Russian companies and trading companies are using intermediary countries to acquire these goods. One of the most egregious intermediaries, or circumvention countries, has been China. It has been unwilling to stop these shipments, despite frequent requests by Western powers.

As a way to illustrate this circumvention via China to Russia, the Institute evaluated 1331 shipments involving HS Chapter 85 goods to a Moscow company called Kometa LLC from early 2022, at the start of the war, through October 2023. [2], [3] Based on the tax number listed in 90 percent of the shipments (the rest had no tax number listed), the actual importer was another little-known company, Elmak LLC. According to commercial documents, it is listed as a wholesale trader of industrial electrical equipment, machines, and materials, whose CEO is Makarov Alexander Mikhailovich. Elmak is listed on Russian trade websites as a small company whose business appears to have benefited from increased sanctions, based on a review of its imports (see Figure 1). Elmak and its CEO have almost no web presence, and no discernible website. Its customers could not be identified, but the timing and amount of purchases are consistent with weapons-production purposes.

The total value of the 1331 shipments imported by Kometa LLC from early 2022 through October 2023 was $5.33 million. None of the shipments have a listed quantity of products contained in them, a highly suspicious finding that points to Kometa's desire to cover up the amount of electronics it imports. Using only shipment costs paints an obscure picture of the true quantity of products contained in the shipments. Ninety-two percent of these shipments have Harmonized System (HS) codes that are in Tier 1 of the U.S. Bureau of Industry and Security (BIS) and EU List of Common High Priority Items (CHPL) that are banned for exports to Russia and at heightened risk of being diverted to Russia illegally due to "their importance to Russia's war efforts." Tier 1 items are defined as "Items of the highest concern due to their critical role in the production of advanced Russian precision-guided weapons systems, Russia's lack of domestic production, and limited global manufacturers."

Figure 1. Frequency of HS Chapter 85 (electrical machinery, equipment, and parts) shipments to Kometa LLC from early 2021 through October 31, 2023. The shipments cluster around certain dates, with more imports in the summer of 2022.

Two Russian recipient addresses are listed in the shipments; both are in buildings with several small offices or businesses. The first address is 30A, Okrugvoy, Proezd, Moscow. It received $0.9 million worth of shipments. This building is listed as having contained an electronics store called Kometa, or Comet in English, but available Elmak commercial information does not list it owning a store. The other address is Nikitinskaya 13a Floor 1, POM 1, COM 7, advertised as a business center. This address is also located in Moscow and received $4.4 million worth of goods. Figure 2 shows these buildings' exteriors.

Figure 2. Two addresses which were listed as receiving $5.33 million of almost exclusively CHPL Tier 1 priority goods. Top image shows the building at 30A, Okrugvoy, and the bottom images are Nikitinskaya 13a, where an advertisement's annotations were translated into English.

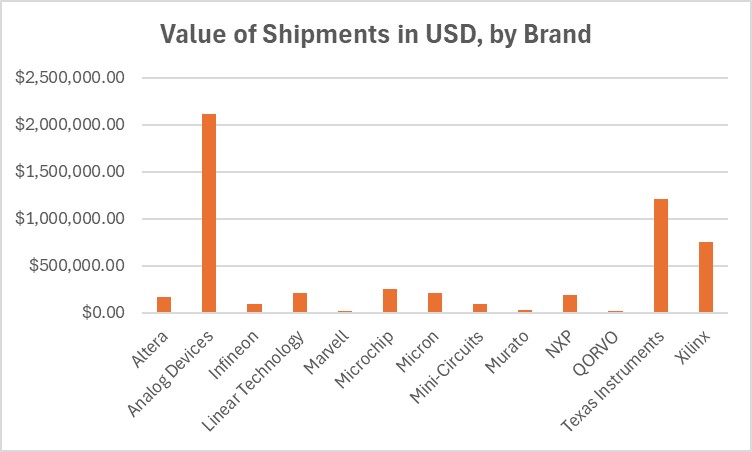

Brands, aka Manufacturers

The available import data identified many brands that Elmak was seeking. Figure 3 shows a frequency distribution of the number of shipments by brand, where Analog Devices and Texas Instruments equipment dominated. Goods included items manufactured by Analog Devices (529), Texas Instruments (404), Microchip (81), Xilinx (37), Altera (18), and Marvell (7). Figure 4 reports the shipments based on their total value in U.S. dollars (USD). As can be seen, Xilinx and Altera, but particularly Xilinx, are more prominent in Figure 4 than in Figure 3. Similarly, Linear Technology and NXP Semiconductors also appear more significant when their shipments are viewed in terms of dollar value ($189 thousand).

Figure 3. Frequency of HS Chapter 85 shipments to Elmak in the time period studied, by major brand.

Figure 4. Value of the shipments in Figure 3 in USD, by brand.

Xilinx

Xilinx and Altera both sell high quality field programmable gate arrays (FPGA), which are at the core of anti-jamming equipment in Russian drones, missiles, and guided bombs, as well as Iranian drones. Xilinx, now owned by AMD, particularly stands out in the data. Leaked internal documents from the Russian manufacturer of Shahed 136 kamikaze drones show the central role of a Xilinx FPGA in the drone's anti-jamming module called Nasir. These anti-jamming units tend to be effective, complicating allied defense efforts.

Since Russia and China do not make these microelectronics, Russian military manufacturers must acquire them from abroad by the thousands. They can be bought individually in bulk or imported in circuits and integrated into, or removed for use in, anti-jamming modules or other electronic military equipment needing them. In addition, Russia would need to buy FPGA-related items required to develop or implement programming on the FPGA.

The number of shipments to Elmak containing Xilinx components totaled 38, with a combined value of $756,088. About 25 of these shipments contained FPGAs in electronic circuits. Of the eighteen shipments with Altera parts, valued in total at $170,502, twelve contained FPGAs in circuits. The relatively high cost of Xilinx and Altera parts can be seen in Figures 3 and 4.

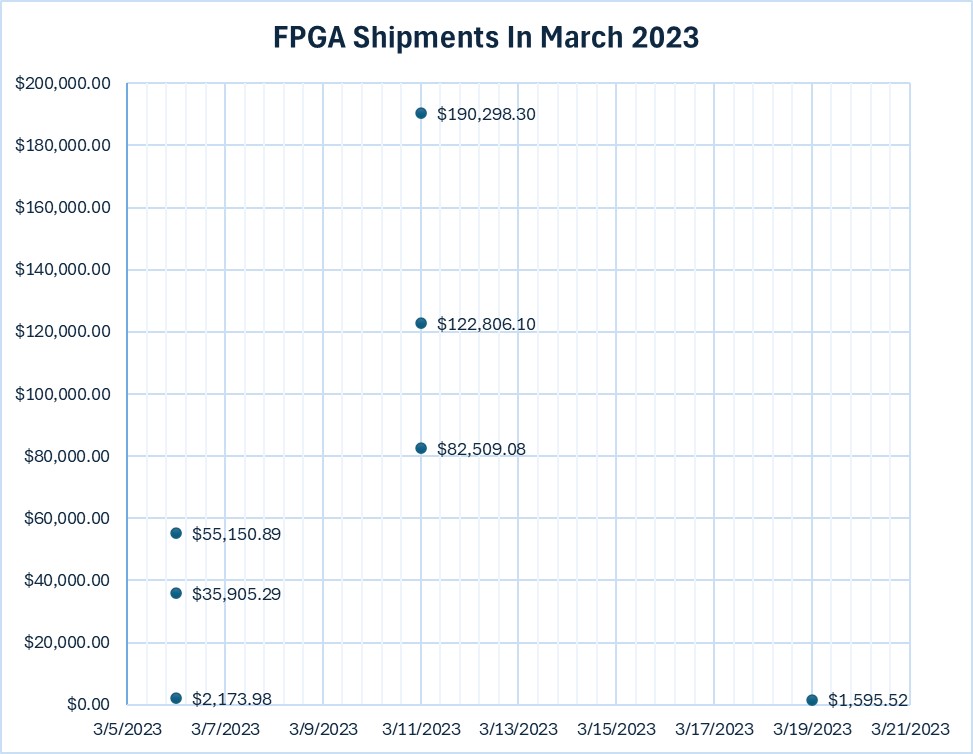

There was a spike in shipments containing Xilinx FPGAs by two suppliers in March 2023, at a time when Russia was focusing more on increasing its own capability to build weapons, in particular Shahed 136 drones. The data list a Chinese company called Chips Resources Limited as making 99 shipments to Elmak, valued in total at $795,982, of which five shipments involved Xilinx FPGAs, valued at a total of $409,803. Of these, Chips Resources Limited made three shipments with FPGAs to Elmak on March 11, 2023, at a combined value of $395,613 (see Figure 5). This was a significant portion of this shipper's sales to Elmak in the period of study. Just a few days earlier, on March 6, 2023, Newsuntech Electronics shipped circuits containing Xilinx FPGAs in four shipments valued at $94,019. So, in less than a week, these two shippers sent Elmak $489,632 of circuit boards containing Xilinx FPGAs. (see Figure 5).

It is not possible to determine the exact Xilinx FPGAs imported by Elmak, or their numbers, since the product descriptions are generic and do not provide any model or part numbers nor quantities. But using other Russian import data, which do contain such information, the price of FPGAs varies greatly and is also affected by their inclusion in circuits of varying complexity. The FPGA that was listed in internal documents as used in the Shahed 136 Nasir anti-jamming unit, a Xilinx Kintex 7 model, has a current retail price on Mouser.com of $627 per unit, although cheaper prices are likely available in China. Other cheaper models may be suitable for Nasir, as well. Additionally, Kometa anti-jamming devices found in Ukraine contain an Altera FPGA that is listed on Microchip.com for $265. Since each anti-jamming unit would need one FPGA, these shipments to Elmak likely contain enough FPGAs for a considerable number of Shahed 136 drones or missiles.

Another sampling of Russian imports of Xilinx products, using commercial trade data covering January 1 to June 30, 2023, partially overlapping the period of this study, resulted in over 350 entries, involving a total quantity of 26,068 Xilinx items valued at $12.5 million. A vast majority of the shipments were sent from addresses in China. Clearly, Russia imported a large number of Xilinx goods and depends on sourcing those products from China.

Figure 5. Several shipments of Xilinx FPGAs to Elmak found in the data set. Only shipments over $1000 are included in the chart.

Types of Shipments Based on Common High Priority List

Ninety-two percent, or 1220, of the shipments involved electronic integrated circuits with HS codes in BIS's Tier 1 of priority-controlled items. These shipments numbered:

63 with HS Code 8542.31, electronic integrated circuits: Processors and controllers, whether or not combined with memories, convertors, logic circuits, amplifiers, clock and timing circuits, or other circuits

91 with HS Code 8542.32, electronic integrated circuits: memories

208 with HS Code 8542.33, electronic integrated circuits: amplifiers

858 with HS Code 8542.39, electronic integrated circuits, not otherwise specified (This code usually includes FPGAs.)

Companies Listed as Suppliers or Shippers (But not Manufacturers, aka Brands)

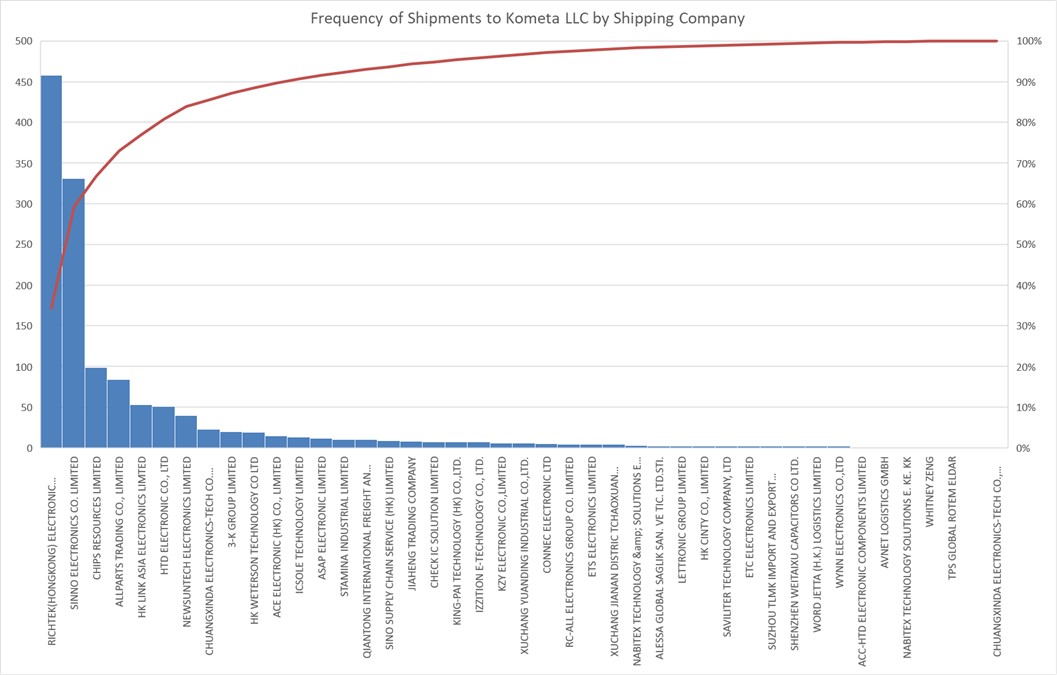

Thirty-nine companies shipped goods to Elmak (see Figure 6). The vast majority of the shipments were sent by Chinese companies with Chinese addresses. Figure 7 shows that 90 percent of the shipments were by ten companies, with two Chinese companies-Richtek (Hong Kong) Electronic [4] and Sinno Electronics-shipping over 60 percent of the shipments.

The company with the most shipments was Richtek (Hong Kong) Electronics, which made 458 shipments, valued at $2,134,459. Most of these shipments were Tier 1 items and spread throughout the time period of the study.

Most of Richtek's shipments listed China as their country of origin. However, one exception was on September 29, 2023, when Richtek made 23 shipments valued at $605,892, but only one listed China as the country of origin. The countries of origin of the rest of the shipments were Malaysia, South Korea, and Thailand. Eighteen of these shipments had Tier 1 HS codes and were valued in total at $576,324, or 95 percent of the value.

The second largest number of shipments to Elmak was by Sinno Electronics which is listed as sending 331 shipments, with a total value of $404,062. About 80 percent of the shipments had relatively low value, less than $1000. Almost all of the shipments with individual USD values over $1000 involved Analog Devices' and Texas Instruments' electronic integrated circuits. The largest shipment in terms of value, on January 24, 2022, had Texas Instrument components and had a USD value of $56,798.

Shippers to Kometa LLC, aka Elmak LLC

Figure 6. List of companies sending goods to Kometa LLC, aka Elmak LLC, in the period from early 2022 through October 2023. The companies are nearly all Chinese. Nabitex Technology & Solutions is German, but its two shipments predate the war.

Figure 7. Frequency of HS Chapter 85 shipments from early 2022 through October 2023 to Kometa LLC, aka Elmak LLC, by shipping company.

Shippers Under U.S. Sanctions

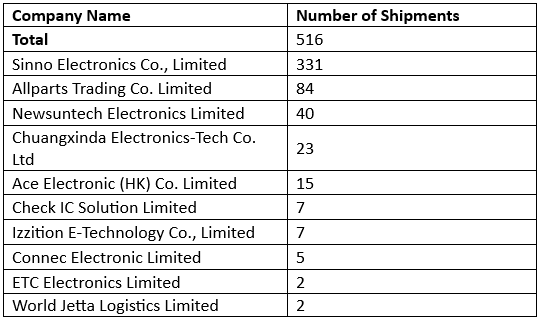

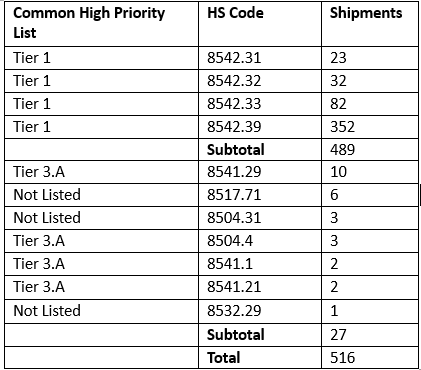

Ten of the 39 companies are subject to U.S. sanctions or are on the BIS entity list (see Figure 8). These ten companies comprise 516 of the 1331 shipments in the data. They all principally provided Tier 1 electronic parts (see Figure 9). Out of 516 shipments, 489 had Tier 1 commodities. Of the remaining 27 shipments, seventeen were in Tier 3; only ten shipments included items not on the priority list.

After the date of their sanctioning or being put on the BIS entity list, however, Allparts Trading, Chuangxinda Electronics Tech, Newsuntech Electronics, and Sinno Electronics registered no shipments to Elmak in the reviewed data. [5] These companies made 478 out of the 516 shipments. (The others were not checked.) For example, Sinno Electronics has been under U.S. sanction since September 30, 2022, for involvement in supplying Russia's military, and all 331 of its shipments predate that sanctioning event.

It is hard to determine whether this shift represents these companies avoiding business with Russia, changing their names, using an intermediary outside of China, or operating clandestinely, or if it represents Elmak avoiding ordering from them out of concern about its orders being discovered and disrupted. Given that over thirty suppliers were not sanctioned and made over 800 shipments, Elmak seems to have had no difficulty finding Chinese suppliers willing to supply Tier 1 goods. Four of the top six shippers are not sanctioned, including Richtek (Hong Kong) Electronics, Chips Resources, HK Link Asia Electronics, and HTD Electronics.

Figure 8. U.S. sanctioned companies shipping HS Chapter 85 goods to Kometa LLC, aka Elmak.

Figure 9. Summary of tiers and HS codes of commodities in shipments from the sanctioned companies.

Conclusion

The current approach is insufficient to address Russia's purchase of vital Western electronics for its key weapons systems. While existing steps are appropriate, they should be supplemented.

Although focusing on identifying and sanctioning Chinese suppliers is important, it is not enough, given the sheer number of them and the persistent emergence of new and obscure suppliers. More focus needs to be put on China as a whole, and specific items.

NATO's June 10, 2024, communiqué is a significant step toward acknowledging China's material support of Russia's war effort, stating that China "has become a decisive enabler of Russia's war against Ukraine through its so-called 'no limits' partnership and its large-scale support for Russia's defence industrial base." The Associated Press quoted NATO Secretary-General Jens Stoltenberg as saying that China provides equipment, microelectronics and tools that are "enabling Russia to build the missiles, to build the bombs, to build the aircraft, to build the weapons they use to attack Ukraine." [6] While proposing no specific actions, the communiqué threatens that China "cannot enable the largest war in Europe in recent history without this negatively impacting its interests and reputation."

While more sanctions on Chinese suppliers and facilitating banks is a deserved response, Western suppliers must further intensify their internal end-use controls. They should block key items in their IT internal control systems and centralize order review. They must do a better job of auditing their distributors, particularly those further downstream in the supply chain, to bring them to an appropriate level of control. If a distributor refuses to cooperate and apply adequate end-use controls, the supplier company should terminate its contract, and the matter should be reported to the authorities. To ensure that their internal control systems are adequate, companies should invite their respective governments to conduct reviews to verify that the end-use examination is adequate, and, if it turns out that it is not, implement recommended mitigating measures. As the war continues, with more U.S and other Western manufacturers' electronics found in Russian weapons in Ukraine after causing casualties and destruction, these manufacturers look increasingly insensitive and powerless against their own complicity in supporting Russia's illegal war.

Given the dire situation with respect to China, Western suppliers of key electronic components should institute a ban on sales to Chinese distributors. Since China has, since the start of the Ukraine war, shown its unwillingness to control its exports to Russia against military use, and it hosts a myriad of distributors willing to sell to Russia, responsible Western manufacturers have a moral obligation to restrict sales to China as well as practical incentives to protect the reputation of their companies. Western manufacturers should invest in shifting supply chains to other countries to mitigate economic damage from restricting business in China. Many key items have been identified by Ukrainian and other Western authorities as a result of obtaining internal Russian documents and in analyzing weapons used on the Ukrainian battlefield. U.S. and other Western companies should not ship to China any electronics known to be used in weapons against Ukraine. At the very least, companies should agree not to export the most important electronic items to China. One critical item is Xilinx and Altera FPGAs; other critical items are several types and brands of Western microcontrollers, such as specific ones manufactured by Texas Instruments.

If corporations do not exercise due diligence, control authorities could add specific microelectronics to national control lists in order to force manufacturers to more tightly oversee their distributors and the end user (with license exemptions for countries that are strictly enforcing sanctions). They could also intensify fines for inadequate controls over items that help to kill people in Ukraine and elsewhere. In particular, these higher fines could be applied to inadvertent exports that end up in Russia.

1. NATO, "Washington Summit Declaration," July 10, 2024, https://www.nato.int/cps/en/natohq/official_texts_227678.htm. [↩]

2. The shipments resulted from a search of trade data for Kometa and HS Chapter 85 (electrical machinery, equipment, and parts). These searches do not necessarily obtain all imports to Kometa during this time period, only the ones in this set of trade data. There were likely additional ones. [↩]

3. It is unclear if Kometa LLC is related to Kometa anti-jamming units made by JSC VNIIR PROGRESS. [↩]

4. This company should not be confused with the Taiwanese multinational company Richtek. [↩]

5. The dates of sanctions application or entity listing are Allparts Trading (April 17, 2023), Chuangxinda Electronics Tech (June 28, 2022), Newsuntech Electronics (April 17, 2023), and Sinno Electronics (September 30, 2022). It should be noted that the trade data set does not register every import into Russia or every export from China. [↩]

6. Didi Tang, "NATO allies call China a 'decisive enabler' of Russia's war in Ukraine," Associated Press, July 10, 2024, https://apnews.com/article/nato-china-pacific-washington-59876b88cad3ccf15cc5443912fe3d5b. [↩]