Screen Australia has announced an expanded research program to empower the local screen industry and related partners. In addition to publishing drama and documentary trends, a new Screen Currency report will provide insights into the economic and cultural value of Australian screen and games production. A suite of audience research projects, the Viewfinder series, will also deepen our understanding of audience behaviour and attitudes, supporting the industry to respond to the evolving media landscape.

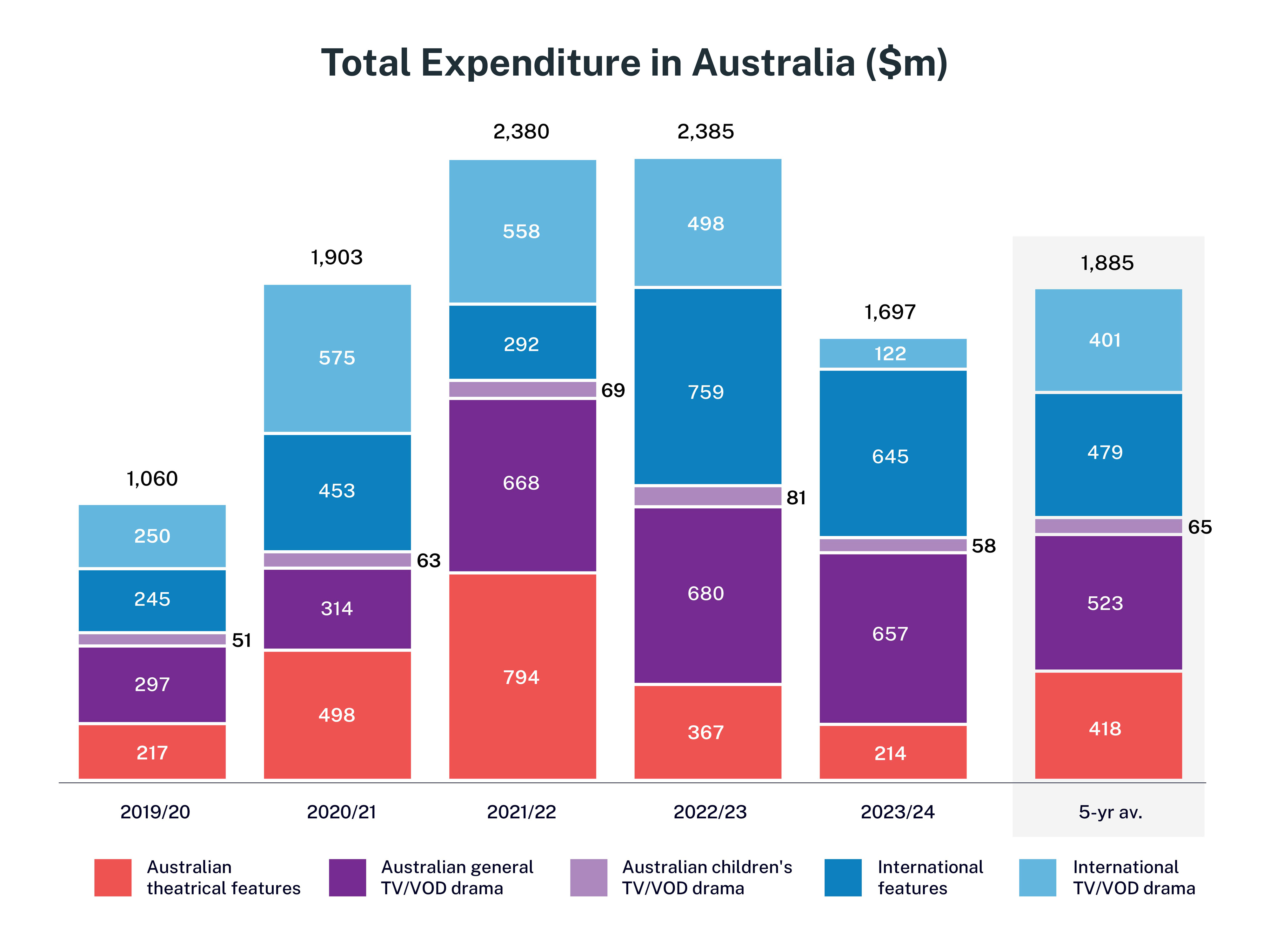

As a first component of this program, a new-look interactive version of the Screen Australia Drama Report was released today. The data shows a total of $1.7 billion spent on drama production in Australia, with $929 million dedicated to Australian stories. This marks a 29% total decline compared to last year, primarily due to a reduction in high-budget production activity across international TV and Australian theatrical features.

Global economic conditions continue to impact screen production, with disruption across distribution platforms, business models and audience shifts influencing the market. The past year also saw US industrial action and uncertainty around changes to the Location Offset incentive, which may have led to international projects being impacted during 2023/24.

Screen Australia CEO Deirdre Brennan says "Expenditure of $1.7 billion on 169 Australian and international drama productions represents a solid result after a three-year peak driven by Australia's status as a COVID-safe filming destination, streaming growth and a number of high-budget theatrical features."

"The Drama Report is one of many resources providing insights into the opportunities and challenges facing the Australian screen sector. This year's results confirm key trends in domestic activity, a contraction of free-to-air commercial TV drama and the increasing role of SVOD commissioning. Children's content continues to face significant pressure and remains reliant on government support, so we're working to broaden the opportunities for development of Australian kids IP. We will also explore the needs of feature filmmakers working in the $1-5 million budget range, dominant again in this year's data."

"We understand how competitive funding is, with Screen Australia supporting 27% of the direct funding applications received for scripted content in 2023/24. In an environment where international financing is also increasingly harder to source, we need to pull together as an industry to ensure the sustainability of the sector. Despite these challenges, we're optimistic about the future and confident that there will be an uplift in production in the year ahead. Screen Australia will continue to collaborate with industry to identify growth opportunities and ensure Australian screen stories thrive."

This year, the Drama Report is presented via an interactive Power BI dashboard, with a user guide available here.

.jpg)

.jpg)

2023/24 Drama Report Key Findings

ABOUT THE DATA

The Drama Report uses industry data to provide an overview of the production of local and international feature, TV/VOD and children's drama titles, as well as PDV activity. All production expenditure is allocated to the year in which principal photography began. PDV employs a secondary method of analysis, which is outlined in the PDV section in the report. 'Drama' refers to scripted narratives of any genre. Titles in the report are categorised according to the platform they were first released on. A full list of titles included is available in the report.