Key points:

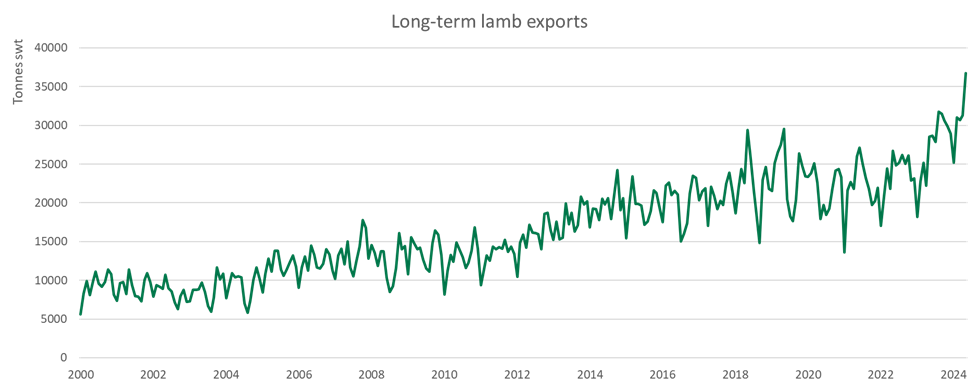

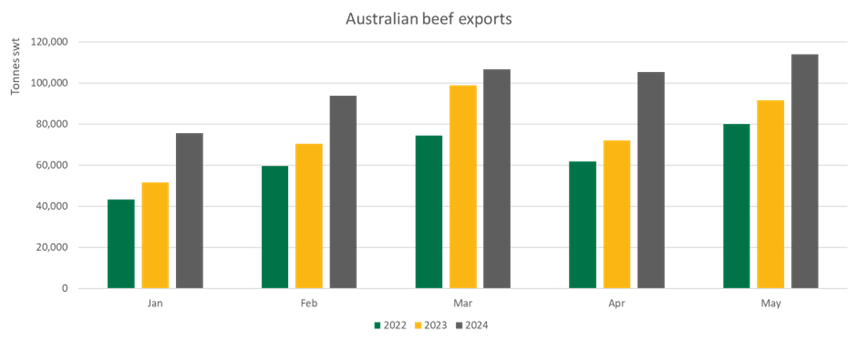

- Lamb exports have reached record highs, and beef exports are the highest since December 2019.

- Strong demand from the United States makes it the largest market for lamb, beef and goatmeat.

Lamb

During May, 36,703 tonnes of lamb were exported, which is the highest lamb export on record for a single month. The United States (US) continues to be the largest market for Australian lamb, followed by China and the Middle East and North Africa (MENA) region.

The increase in total export volume has led to a diversification in markets. For example, exports to Iraq have increased fivefold from last year to 1,386 tonnes, becoming Australia's eighth largest lamb market in May. As Australian exports maintain a strong pace, it will present opportunities to develop market share both in Australia's traditional key markets and emerging markets.

Mutton

Australian exports of mutton rose 11% year-on-year to 21,664 tonnes, the largest single month figure since November 2019.

China was the largest market for the month, though exports fell 38% year-on-year to 5,363 tonnes. Most of the export growth came from markets in MENA; Exports to Saudi Arabia doubled to 1,950 tonnes, exports to Oman rose by 146% to 1,284 tonnes and exports to Qatar lifted eightfold to 1,229 tonnes.

Exports to our other key markets (outside of China and MENA) remained robust; exports to Malaysia rose 26% year-on-year to 2,365 tonnes, exports to the US also rose by 26% to 936 tonnes and exports to Singapore lifted 11% to 889 tonnes.

Beef

There was a rise of 9% from April and 25% (113,923 tonnes) when compared to May 2023 for beef exports. This makes May the biggest month for beef exports since December 2019, and the largest May export figure since 2015.

The export growth was led by strong exports to the US, which lifted by 74% year-on-year to 31,294 tonnes, making up 27% of total exports. US declines in production are now having a noticeable impact on export flows; Australian exports to the US have been consistently high this year, and lower US exports to Japan and Korea have caused increased demand for Australian beef in those markets. Exports to Japan rose by 31% year-on-year to 19,366 tonnes, and exports to Korea lifted 9% year-on-year to 17,096 tonnes.

China was the only major market to see a decline in volumes, with exports falling 22% year-on-year to 15,359 tonnes. Brazil is the major exporter to China, and with Brazilian production currently running at near-record highs, this is impacting the Australian market share.

Goat

After the record export number in April, goat exports reached the second highest ever in May at 4,682 tonnes. This was largely driven by exports to the US, which more than doubled to 2,894 tonnes and made up 62% of trade, as well as exports to South Korea, which lifted by 80% year-on-year to 856 tonnes.

Attribute content to: Tim Jackson, MLA Global Supply Analyst