Key points:

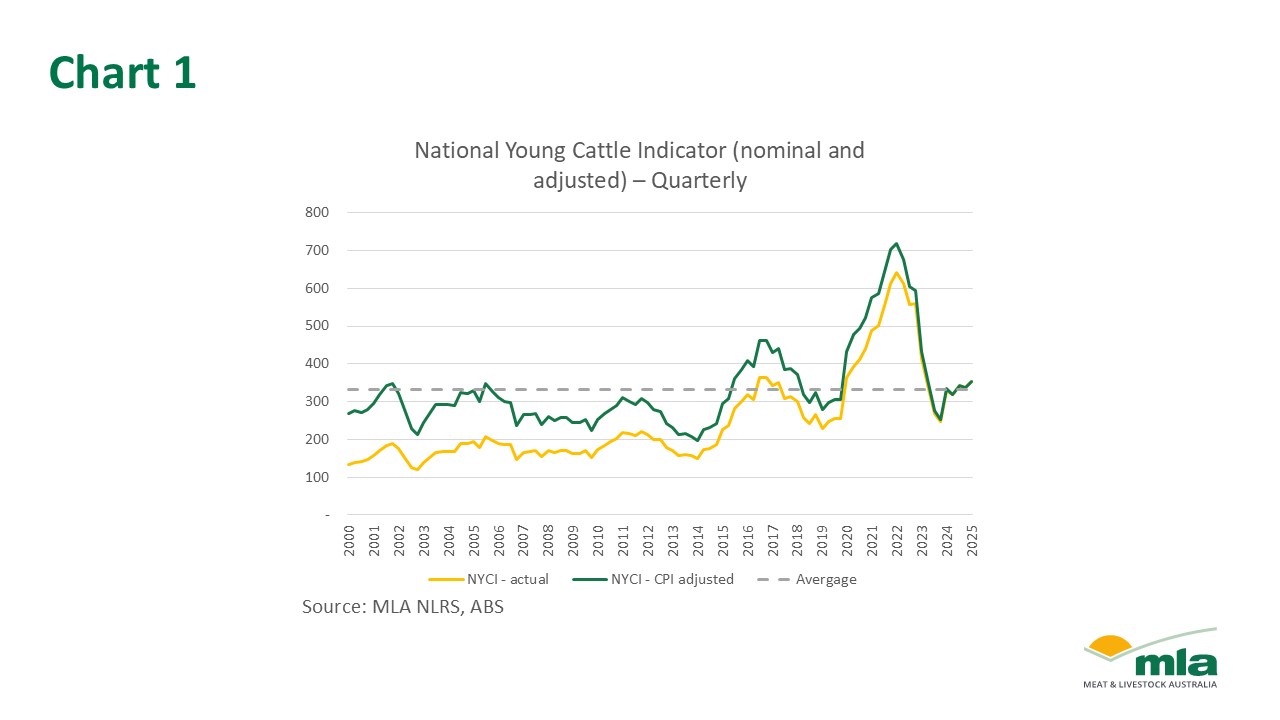

- Adjusting for inflation allows market analysts to get a better understanding of how cattle prices have moved over the past 20 years.

- Intensity of liquidation matches market movements; markets often shift ahead of herd liquidation peaks.

- Despite high turn-off, cattle prices have remained relatively stable over the past decade.

Australia's red meat sector has experienced significant market volatility in recent years. By adjusting for inflation using ABS Consumer Price Index data, it creates a better understanding of how cattle prices have moved over the past two decades.

The current market

The long-term average National Young Cattle Indicator (NYCI) sits at 333¢/kg liveweight (lwt). The March 2025 quarter average sits slightly higher at 376¢/kg lwt, with the previous five quarters holding within 42¢ of the 24-year average. This points to a period of relative price stability, especially when compared to the sharp fluctuations seen over the last decade.

Short-term volatility continues to be driven by rainfall variability and seasonal supply, but quarterly figures offer a more consistent view of medium-term market conditions.

Destocking, rebuilding and the markets response

Cattle markets are cyclical, responding to herd destocking and rebuilding phases. When viewed through an inflation-adjusted lens, it becomes clear that recent cycles have been particularly intense.

During the 2014–16 and 2020–22 rebuilds, prices surged by 135% and 158%, respectively. This contrasts with earlier cycles, where prior rebuilds saw more moderate increases of 62% and 38%.

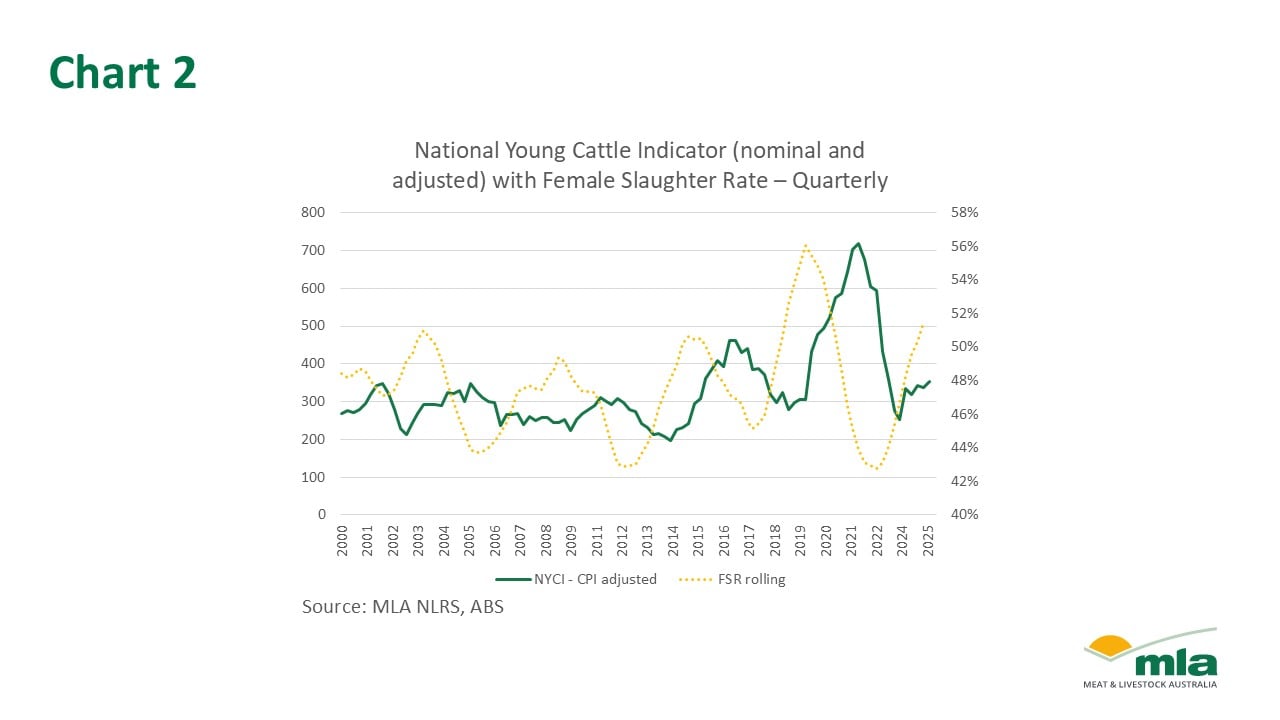

A key indicator of these herd cycles is the Female Slaughter Rate (FSR), which measures the proportion of female cattle in total slaughter. FSR serves as a reliable signal for the phase of the herd. A rising FSR generally indicates liquidation or destocking, while lower levels suggest herd rebuilding.

Historical data shows a clear correlation between FSR price trends in the young cattle market. Destocking periods, where FSR approaches or exceeds 50%, limit future breeding capacity. This eventually drives demand for replacement stock when conditions improve and rebuilding occurs. Prices then flow through to feeder and finished stock markets.

In 2019, the FSR peaked at over 56% – a significant destocking event that reduced rebuilding capability. The result was one of the most intense rebuilds on record starting in 2020, followed by a sharp market rise and, eventually, a correction.

It's worth noting that market shifts and herd cycle peaks don't always align perfectly. In many cases, markets begin to stabilise and lift ahead of peak liquidation and can turn before the rebuild is complete. Recognising this lag is essential when interpreting market signals.

Where we are now

According to Q4 2024 data from the ABS, the rolling FSR is averaging 52% – the second-highest level recorded in two decades. Despite high female turn-off, markets have remained stable due to a relatively strong 30.1 million herd. The herd is currently stable thanks to competing climate conditions across the north and south of the country.

Despite this, herd numbers are forecast to decline in the next two years. If female slaughter remains high, if and when the industry then rebuilds, it could be more intense, likely impacting young cattle availability and pricing. However, if female slaughter rates turn in an already strong herd, how far could a rebuild go?

Attribute to: Erin Lukey, MLA Senior Market Information Analyst

MLA makes no representations as to the accuracy, completeness or currency of any information contained in this publication. Your use of, or reliance on, any content is entirely at your own risk and MLA accepts no liability for any losses or damages incurred by you as a result of that use or reliance. No part of this publication may be reproduced without the prior written consent of MLA. All use of MLA publications, reports and information is subject to MLA's Market Report and Information Terms of Use.