The ACCC has today released preliminary observations on the northern Australia insurance market following public consultation and information gathered from insurers.

In July 2017, the ACCC commenced an inquiry into the supply of residential (home), contents and strata insurance in northern Australia, following direction from the Australian Government.

"Our inquiry aims to address concerns about insurance availability and affordability, promote informed and competitive insurance markets, and make a difference for consumers in northern Australia," ACCC Acting Chair Delia Rickard said.

"We have exercised our legislative powers to compel information from insurers about their products and gain unique insights that previous reviews of northern Australia insurance markets have been not been able to consider."

Early analysis shows that while northern Australia makes up only five per cent of the number of policies, it accounts for about 10 per cent of premium revenue. Key initial findings:

- Between 2007-08 and 2016-17, average combined home and contents premiums, adjusted to account for changes in the sum insured, have increased by between 23 and 67 per cent in northern Australia, compared to just 16 per cent in the rest of Australia.

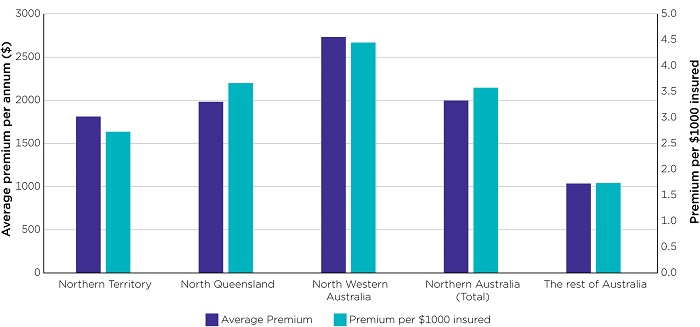

- In 2016-17, the average annual combined home and contents premium in northern Australia was $2000, which is about double the average for the rest of Australia. North Western Australia was the highest at $2700 per year. Strata insurance premiums in northern Australia are more than double premiums in the rest of Australia.

- For home and contents insurance, the highest cost regions appear to be concentrated along the coast of north Queensland, far north Queensland, the Pilbara, Darwin and central Australia.

- The vast majority of home, contents and strata policies in northern Australia are supplied or underwritten by eight insurers through a total of 47 brands. All eight insurers operate in north Queensland, and seven operate in north Western Australia and six in the Northern Territory. Only postcodes for Nullagine and Telfer in Western Australia and Corfield in Queensland have fewer than four insurers supplying insurance.

Last year, the ACCC held public forums in Townsville, Cairns, Rockhampton, Mackay, Darwin, Alice Springs, Broome and Karratha to hear directly from residents. In addition, we received over 280 submissions to our Issues Paper released in October 2017.

"We welcome the effort made by local residents, property owners, consumer groups, local councils, regional development bodies, strata organisations and the insurance industry to contribute to our inquiry," Ms Rickard said.

Submissions raised the need for transparency in how premiums are set, including how insurers estimate risk. Consumer groups continue to advocate for the removal of the exemption of insurance from unfair contract terms laws and better disclosure of information to consumers more generally.

"Some participants highlighted that insurance premiums are rising significantly and people and families are facing increasing financial distress. Many residents consider there is little choice, especially in strata insurance markets and some regional towns," Ms Rickard said.

Reports of renewal notices for home and contents premiums exceeding $10,000 per year were common, especially in the west. Residents living in strata situations questioned the commercial relationships between strata managers, brokers and insurers, particularly regarding percentage-based commissions.

Industry submitted that insurers are now increasingly pricing premiums according to assessed risks at an individual property level. In contrast, many consumers have told us that insurers are not reducing premiums in what locals consider to be low-risk regions or rewarding property owners for their efforts to improve the resilience of their homes.

The ACCC continues to analyse information received from insurers for our next report in November, which will make initial recommendations to government and industry on opportunities for change. Further reports will be released in November 2019 and 2020.

The update report is available at accc.gov.au/insurance

Average annual premium and premium per $1000 sum insured for combined home and contents insurance (2016-17)

Source: ACCC analysis based on data provided by the Insurers

Average premium for combined home and contents insurance in 2016-17

Source: ACCC analysis based on data provided by the Insurers

Average premium per sum insured for combined home and contents insurance products in 2016-17

Source: ACCC analysis based on data provided by the Insurers