Westpac New Zealand (Westpac NZ)[i] has reported a 1% increase in underlying profit for the 12 months ended 30 September 2024, as it continues to invest in supporting customers through a challenging period.

Pre-provision profit was up 1% on the prior corresponding period, with net profit rising 10% to $1,055 million, reflecting a significant drop in impairment charges compared to the prior corresponding period.

Net operating income was up 3% on the prior corresponding period, while expenses rose 6%, as a result of ongoing investment in technology, service improvements for customers and regulatory compliance, alongside inflationary pressures.

"We've worked hard to help customers through challenging economic conditions, and are well positioned to support their growth aspirations as the economy improves," Westpac NZ Chief Executive Catherine McGrath says.

"Over the year we grew our home lending by 3% and business lending by 2% in a highly-competitive environment.

"In particular, our business lending was well above system growth in the second half of the year, and we increased our face-to-face interactions with business, corporate and agri customers by 65% to better understand their needs and help them to reach their goals.

"We helped first buyers purchase nearly 5,900 new homes, and have seen a noticeable increase in applications in recent months as consumer confidence grows.

"We have strong momentum and are heading into 2025 energised about helping Kiwi households, businesses and the economy to grow."

Interest rate relief for households, businesses, farmers and growers

Westpac has acted swiftly to pass falling interest rates on to customers. The bank has cut its advertised 1-year fixed home loan rate by a total of 1.15% p.a. since the start of July, and cut floating rates by a combined 0.75% p.a. in line with OCR reductions[ii], with potential interest savings of $58m for its 60,000 floating home loan customers over the next 12 months.

"Our business and agri customers have also seen rates fall over the same period, which will help farmers and growers save an average of around $13,000 a year each in interest costs," Ms McGrath says.

"We estimate by the end of the year that more than a quarter of our fixed home loan customers will have rolled onto lower rates, and nearly three-quarters by this time next year.

"On top of that, our customers have redeemed more than $11m of credit card rewards points with hotpoints Pay, which allows customers to use their points like cash, since it was launched in Westpac One® digital banking in April. Customers tell us they enjoy the flexibility of using their hotpoints wherever they want, including for everyday purchases and bills at a time when living costs are high.

"It adds up to more money in people's pockets to build up savings, pay down debt, or spend to help stimulate the economy."

Keeping customers safe

Customer losses to fraud and scams were down over the year despite a 12% rise in reported cases, thanks to higher prevention and recovery rates.

"Of every $10 of known fraud and scams that touched our systems, we prevented, recovered or reimbursed $9," Ms McGrath says.

"Scammers aren't going away, but we're fighting back with strong investment in monitoring and prevention measures, better industry cooperation and empowering staff to intervene when a customer is trying to make a payment that doesn't seem right.

"However, there's lots of work to do. In particular we want to see social media companies like Meta and big tech platforms like Google act faster to flag and remove scam content, to help stop scams at their source."

Investing for customers and Aotearoa

Westpac is investing heavily to improve customer experience and support the economy:

- A majority of new home loan applicants are now getting an initial decision within 24 hours of their application being loaded;

- Priority technology-related incidents and total outage hours fell by 33% and 87% respectively this year;

- Customers can now start using new debit cards immediately through instant digital issuance;

- Several fintechs are plugged into Westpac's open banking infrastructure to offer seamless and secure customer payment options, with many more API agreements in the pipeline.

"In terms of the wider economy, we've funded important long-term infrastructure projects such as affordable housing developments that will strengthen communities. We've committed to a target of $1bn of new lending to help New Zealanders into affordable homes over the next three years, through options like shared equity and leasehold models, the First Home Loan scheme and lending to community housing providers[iii]," Ms McGrath says.

"We've also financed around three-quarters of all grid scale solar generation capacity either completed to date, or currently in progress across New Zealand.

"While agri lending growth has been subdued due to a decrease in farm sales and lower appetite for new debt, we're helping farmers take steps to improve on-farm sustainability, including climate resilience, through our Sustainable Farm Loan.

"We've provided more than $3.6b over the past 18 months, totalling 43% of our agri term lending, to help farmers and growers take a whole-of-farm approach to sustainability. Our customers are investing in initiatives like growing more efficient crops, choosing renewable energy sources or working to breed stock with higher body weights[iv].

"It was also a strong year for our Westpac KiwiSaver funds, with all funds outperforming benchmarks and our Growth, Balanced, Moderate and Conservative funds ranked 1st in their respective categories in the MJW Investment Survey[v]. Our new High Growth Fund has already attracted more than $200m in funds under management since its launch in late September."

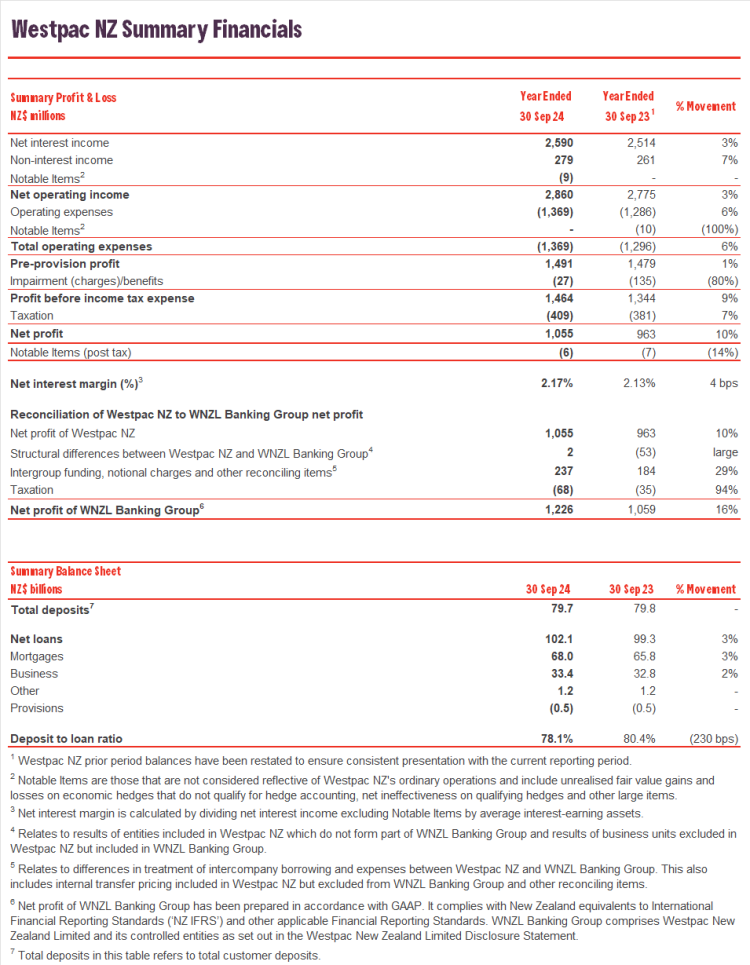

Key financials

(All comparisons are for the 12 months ended 30 September 2024 versus the same period last year)

- Pre-provision profit of $1,491 million, up 1% (up 1% excluding Notable Items).

- Net profit of $1,055 million, up 10% (up 9% excluding Notable Items).

- Net operating income of $2,860 million, up 3% (up 3% excluding Notable Items).

- Operating expenses of $1,369 million, up 6% (up 6% excluding Notable Items).

- Net impairment charge of $27 million, compared with an impairment charge of 135 million in the previous period.

- Net interest margin 2.17%, up 4 basis points excluding Notable Items.

- Home lending up 3% to $68.0 billion, Business lending up 2% to $33.4 billion, Deposits flat at $79.7 billion.

Economic outlook

Westpac's economists are predicting a gradual economic recovery, with GDP growth of 2.3% in 2025 and 2.7% in 2026[vi]. Inflation is tipped to fall towards 2% over the coming year.

"However, the green shoots of recovery we've seen in recent confidence surveys are balanced out by rising unemployment, ongoing geopolitical risks and cost pressures on businesses," Ms McGrath says.

"Overall, we expect the economy and most of our customers will be in a better place 12 months from now, and we'll be standing alongside them to help grow."

[i] Westpac NZ is a segment of the Westpac Banking Corporation Group (Westpac Group). Westpac NZ includes, but is not limited to, Westpac New Zealand Limited, BT Funds Management (NZ) Limited and WBC (New Zealand branch). The financial results of the Westpac New Zealand Limited Banking Group (WNZL Banking Group) will be available in the Westpac New Zealand Limited Disclosure Statement, with a reconciliation between the two results also provided in the Westpac NZ Summary Financials section of this media release.

[ii] https://www.westpac.co.nz/about-us/media/westpac-nz-cuts-popular-fixed-home-loan-rates/

[iii] https://www.westpac.co.nz/about-us/media/shared-ownership-housing-options-could-help-thousands-more-nzers-into-their-own-home/

[iv] https://www.westpac.co.nz/about-us/media/westpac-nz-data-shows-farmers-investing-in-sustainability/

[v] https://mjw.co.nz/wp-content/uploads/2024/10/MJW-Investment-Survey-Sep-2024.pdf

[vi] https://www.westpac.co.nz/assets/Business/tools-rates-fees/documents/economic-updates/2024/Other/Economic-Overview_QEO_report_25Oct24.pdf