Today's inflation figures must prompt the RBA to cut interest rates at its February meeting to ease growing financial distress and keep people in jobs.

"With inflation consistently falling and firmly in the target band, it's hard to justify leaving rates this high," said ACOSS CEO Dr Cassandra Goldie.

"Raising the cash rate has dramatically increased financial stress among people on low and modest incomes. It's time to finally give people some desperately needed relief.

"In recent years incomes have fallen, economic growth has stagnated and almost all jobs growth has been in government funded services. Growth in government spending on services like the NDIS, childcare and health care is not only essential to meet people's needs, it's keeping us out of a recession.

"Failing to lower interest rates will only cause more economic damage and needlessly threaten thousands of jobs.

"Low unemployment is an opportunity, not a problem as some economic commentators suggest. There is no sign that reducing unemployment further would risk a fresh outbreak of inflation.

"Easing financial stress for people and restoring jobs growth beyond publicly funded jobs should now be the RBA's main concerns."

"While the RBA must cut rates, governments must also do more to reduce unemployment, ensure progress on inflation is maintained, and ease financial pressure on those struggling the most.

"Governments must lift income support so people can afford the basic essentials of life, limit rent increases and reduce out of pocket costs for essential public services like health care," said Dr Goldie.

Why interest rates should be cut: what the evidence shows

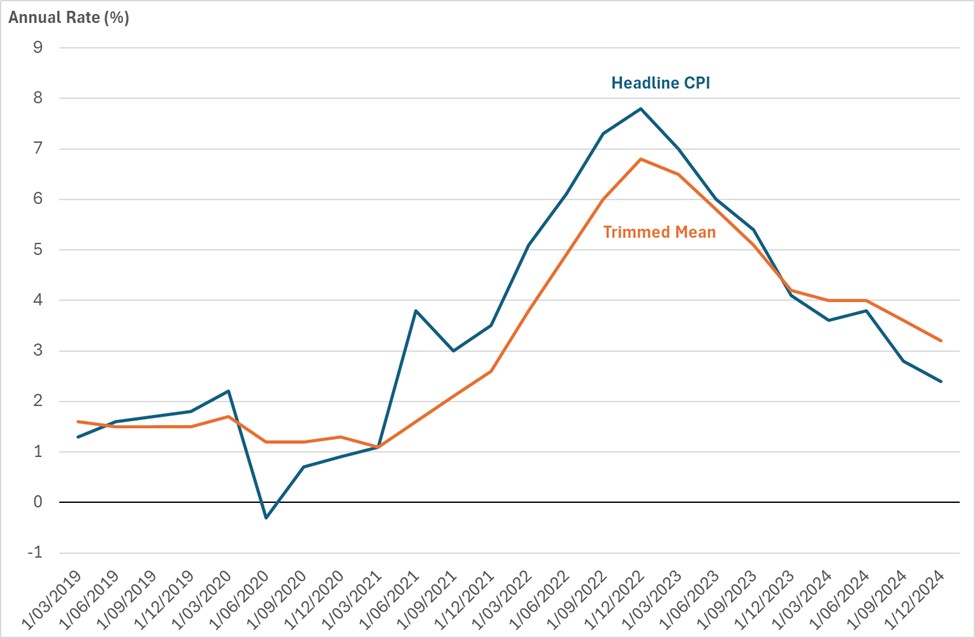

Inflation is falling – if the RBA waits until it's consistently below 3% it will have left it too late to cut rates

Source – ABS CPI

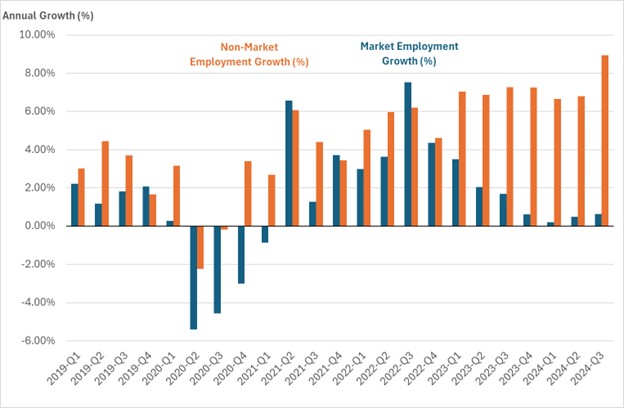

The vast majority of growth in employment has come from the non-market sector – without this growth, unemployment would be much higher

Source – ABS Labour Account

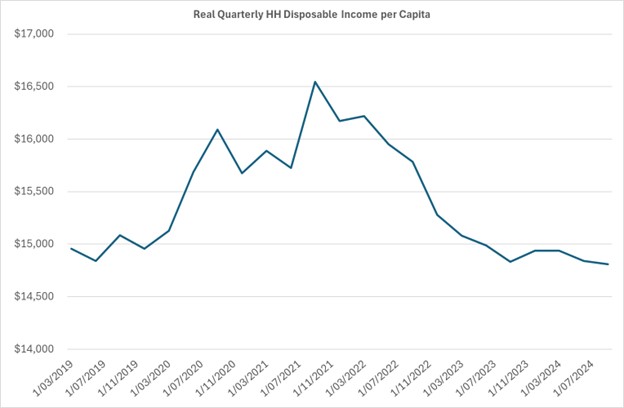

Real incomes have fallen dramatically, under pressure from inflation and excessively high interest rates

Source – ABS National Accounts